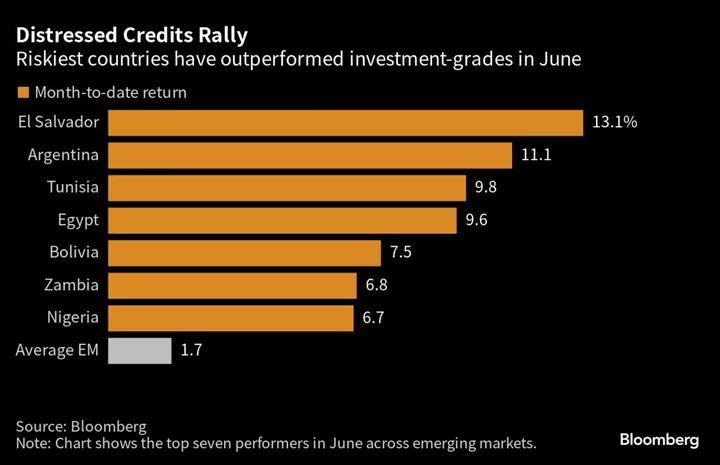

The world’s riskiest sovereign bonds are having a moment as Wall Street investors seek out high yields from countries showing early signs of market-friendly pivots.

Junk-rated government dollar bonds from El Salvador to Nigeria and Turkey are outperforming this month as money managers take on risky bets in exchange for out-sized returns. The question now is whether orthodox policies can keep luring capital as major central banks reiterate their commitment to bring down inflation.

“There is still significant scope for these assets to rally,” said Thys Louw, portfolio manager at Ninety One UK Ltd., referring to sovereign high-yielders. “But the next leg of the rally is likely to be tougher as there’s still uncertainty with regards to how risk assets will handle continued tightening in global liquidity.”

Developing-market assets have struggled to embark on the type of rally analysts forecast for 2023 as China’s economic recovery lost steam and major policymakers kept interest rates high. The number of emerging government defaults, meantime, has risen to a record — resulting in frantic efforts to accelerate the sovereign-debt restructuring process.

That’s what makes this month’s outperformace among high-risk bonds stand out. High-yielding debt from emerging markets has returned almost 3% in June so far, with the biggest gains coming from deeply-speculative CCC rated countries. Investment-grade nations, meanwhile, are little changed this month.

“Shifts to more orthodox and market friendly policies have fueled the recent outperformance of sovereign bonds” in nations from Turkey to Nigeria, said Brendan McKenna, strategist at Wells Fargo & Co. in New York. “This is a trend that could continue across emerging markets going forward.”

Nigeria’s sovereign notes have soared as President Bola Tinubu embarked on a series of bold fiscal moves, unshackling the country’s currency and dismantling a costly decades-old system of fuel subsidies.

A bond rally has ensued in Turkey, too, as newly reelected Turkish President Recep Tayyip Erdogan brought on two former Wall Street bankers to run the country’s finances, fueling optimism for a more orthodox approach.

Even serial defaulter Argentina has seen its dollar bonds advance in June as investors position for the nation’s upcoming presidential elections. President Alberto Fernandez has ruled out running for reelection with inflation running above 100% and government coffers running dry, opening the door for a new administration with market-friendly priorities.

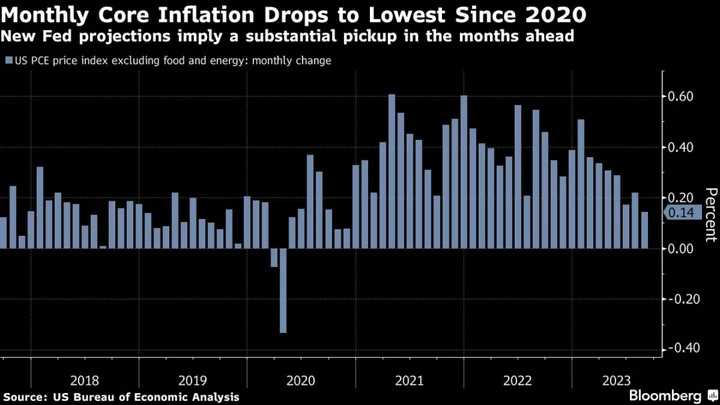

At the same time, the debate on Wall Street is growing louder about how to trade risky emerging markets as major central banks maintain their hawkish tone. The Federal Reserve and European Central Bank both signaled the need for further interest-rate hikes to quell inflation, rekindling concern about risk to the world’s economy.

To Ninety One’s Louw, investors in high-yielding emerging-market assets will likely be on the lookout for evidence that a deep, painful recession can be avoided.

Read: Global Rate-Hike Endgame Is Now Haunted by Recession Worries

But there’s also still potential for a so-called soft landing in the US and global economy, which stands to lure investor capital flows into emerging markets, according to economists Robin Brooks and Jonathan Fortun at the Institute of International Finance.

El Salvador, for example, benefitted from the broader shift in external risk sentiment over the past few weeks, according to Siobhan Morden, managing director of Latin America fixed-income strategy at Santander US Capital Markets LLC.

Weighing Risks

Of course, risk is inherent in these credits. Many of these bonds still trade at or near levels that investors consider distressed — and therefore at greater risk of an eventual default.

Dollar bonds from 16 emerging markets still trade at distressed levels of at least 10 percentage points over US Treasuries, according to data compiled from a Bloomberg index.

Egypt’s dollar notes are still down roughly 10% this year, even after a June rally. The nation’s economy has struggled to recover from the pandemic and fallout of Russia’s war in Ukraine, even after cinching a deal with the International Monetary Fund and devaluing the local pound.

But that’s not deterring Sonal Desai, the chief investment officer for Franklin Templeton Fixed Income, who cited value in the bonds.

“I would note that frontier markets are always gonna come with risk,” she said. “But we still find attractive opportunities in part because some of the valuations are so extreme.”

What to Watch

- Traders will be closely watching Turkey’s central bank. Bloomberg Economics expects its main policy rate to jump to 15% from the current 8.5%. A 650-basis-point increase would mark the start of a pivot away from its loose stance.

- China’s commercial banks are expected to lower prime lending rates to counter May’s weak economic data. But economists surveyed by Bloomberg say more stimulus is needed to put recovery back on track.

- Central banks in Philippines and Indonesia are likely to hold their key rates steady. Singapore and Malaysia will report inflation data.

- In Brazil, traders will watch the central bank’s monetary policy decision and analysts anticipate policymakers to tone down the hawkishness of the post-meeting statement.

- Mexico’s and Chile’s central bankers are expected to hold the benchmark rates at their June meetings as inflation extends a downtrend.

--With assistance from Netty Ismail.