Inflation is showing early signs of picking up again in the US, and if it accelerates from here, US high-yield issuers could see a surge in defaults, according to Bank of America Corp. credit strategist Oleg Melentyev.

Persistently rising price levels could weigh on companies’ earnings, even before accounting for rising interest costs. A 3% inflation rate is easily manageable for most junk-rated corporations, but 4% would pressure them, while 5% inflation “could cause a full-scale default wave,” Melentyev wrote in a note Friday.

That wave could bring cumulative high-yield defaults to 15%, according to Melentyev, a jump from current levels. In the last 12 months, about 2.5% of US high-yield debt defaulted, according to Fitch Ratings. A persistent 4% inflation rate could bring cumulative defaults to 10%, Melentyev wrote.

Overall inflation was 3.7% last month compared with August 2022, but the core consumer price index, which excludes food and energy costs, rose 0.3% last month from July. That marked the first month-over-month acceleration since February, Bureau of Labor Statistics data showed Wednesday.

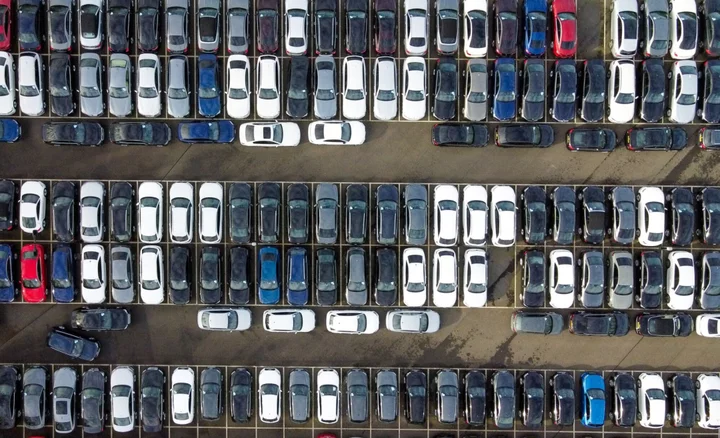

“The CPI report this week reinforced our view that the easy part of the inflation fight is behind us,” Melentyev wrote. The auto workers’ strike is likely to boost wages, while higher oil prices and a re-acceleration in rental prices means that bringing inflation under 3% “is going to be a struggle.”

The Federal Reserve is continuing its fight against rising prices, with the central bank expected to meet next week. Rates traders are betting that the Fed will pause on rate cuts this meeting but may hike at the November meeting.

Inflation staying at 4% would lead to 10% of junk-rated companies generating insufficient earnings to cover their interest costs over the next two years, according to Melentyev’s estimates. He forecasts that metric, known as an interest coverage ratio or ICR, falling below 1 for these companies.

Debt in the CCC tier faces particular pressure now, according to the strategist.

“In CCCs, the ICRs start at barely sustainable 1.3x today and get destroyed in every scenario we consider,” Melentyev wrote.

(Updates with graphic)