Brendan Murphy is shorting 10-year Japanese government bond futures on a wager that it’s only a matter of time before the nation’s central bank tightens monetary policy.

Murphy, a money manager at Insight Investment, which oversees more than $880 billion in assets, is bearish on those JGBs whose yields are capped by the Bank of Japan’s rigid policy as price pressures mount. He’s bullish on 30-year Japanese debt, which isn’t subject to the BOJ’s control.

“We do think that you see yield curve control lifted,” Murphy said in an interview last week. “They’re going to move incrementally toward normalization,” he said, adding that the BOJ “don’t want to be accused of tightening too quickly and going back into a disinflationary environment.”

10-year JGB yields climbed to a 0.485% on Friday, the highest since March 10. Similar-tenored bond futures fell to a four-month low.

Market action shows many echo Murphy’s view: 10-year JGB yields climbed to a near-three month high of 0.48% on Friday. Similar-tenored bond futures fell to a four-month low.

Bond bears are likely to be further emboldened by a report that BOJ officials will likely raise their inflation forecast above 2% for this fiscal year at their July meeting. Adding to this, former BOJ official Hideo Hayakawa said the central bank will probably loosen its grip on yields this month.

“Inflation is elevated,” Murphy said. The BOJ may tighten “not necessarily in the next month but in the next two quarters.”

Here are other investment views by Murphy:

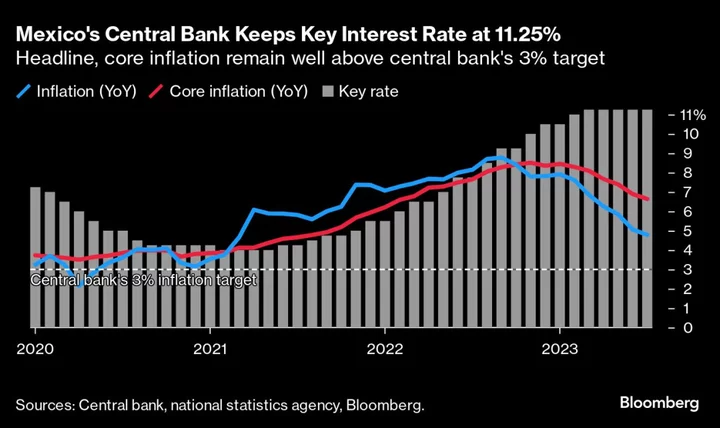

- He favors local currency emerging-market government bonds, including those of South Korea, South Africa and Mexico

- In developed markets, his fund likes debt of nations that are closer to easing policy, such as New Zealand

- The Federal Reserve is likely to hike interest rates once more and then maintain an extended pause