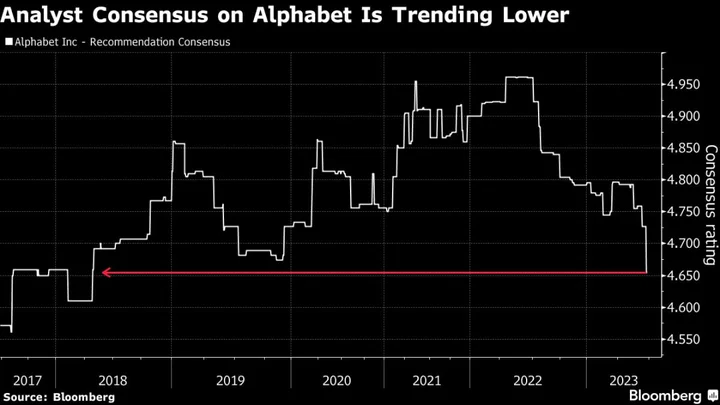

Once one of the highest-rated stocks on Wall Street, Alphabet Inc. is getting a cooler reception from analysts after rallying 35% this year.

The Internet search giant has 47 buy ratings, the lowest in at least three years, among the 55 analysts tracked by Bloomberg that cover it. While that still reflects more optimism than many other companies in the Nasdaq 100, it’s well below the unanimous approval Alphabet had a year ago, showing that some analysts believe its rebound from a November low is running out of steam.

“I see some short-term headwinds here after the most recent price movement,” David Wagner, portfolio manager at Aptus Capital Advisors LLC, said in an interview. He sees Microsoft Corp. increasingly threatening Google’s dominant market share in search.

Investors growing cautious on Alphabet may also be wary of the potential impact of an economic slowdown on cyclical advertising sales, or that ongoing antitrust investigations will weigh on the stock.

“Generally, tech is going to be sensitive to corporate profits,” Jordan Stuart, client portfolio manager at Federated Hermes, said in an interview, adding that conditions are becoming more difficult in areas including consumer spending and company investment in growth.

Racking up Downgrades

Recent months have seen a few rare downgrades for the company. In May, Loop Capital reduced Alphabet to hold from buy on concerns that it will struggle to maintain dominance in search, as people increasingly turn to artificial intelligence.

Bernstein followed in late June, moving the company to market perform from outperform. Analyst Mark Shmulik wrote that the stock appeared fairly valued, citing a “narrative that has quickly caught up to fundamentals.”

UBS downgraded shares of Alphabet last week to neutral from buy, but boosted its price target. Citing medium-term revenue risk from new search displacing ad inventory with generative artificial intelligence responses, analyst Lloyd Walmsley wrote that he saw better opportunities in Amazon.com Inc. and Meta Platforms Inc.

An AI-Paved Path Forward

While some analysts worry that Alphabet is behind the curve in artificial intelligence or that the trend will hinder future growth, the stock has both benefited and faced more volatility as a result of the broad-based tech rally fueled by AI in the first half of the year.

In February, Alphabet erased about $170 billion in market value on growing concerns about Bard, Google’s ChatGPT competitor. The shares regained the lost value in May, when the company started rolling out plans to integrate the technology into its search engine. In June, it was the worst performer of the top seven megacap tech stocks.

In terms of valuation, it lags its megacap rivals. The stock sells for about 19 times estimated earnings, compared to Nvidia Corp. at 49 times and Amazon at about 42.

To be sure, some on Wall Street still see its valuation as compelling and think it could continue its run higher. Piper Sandler analysts this week boosted their price target, noting that there was room for the shares to grow.

Others remain hesitant to move to the sidelines entirely given Alphabet’s solid positioning and long-term growth potential. Jason Benowitz, senior portfolio manager at CI Roosevelt, who owns the stock, believes the company will overcome the near-term headwinds to climb higher.

For Aptus’ Wagner, it remains a good longer-term bet. “It’s such a wonderful stock for the long run, if I had a chance to own it as a set-it-and-forget-it name for the next three to five years I would,” he said.

Tech Chart of the Day

Rivian Automotive Inc. has rallied 52% over the last six sessions as the company said it built more battery-electric vehicles last quarter than Wall Street had anticipated and also shipped its first commercial shipments outside the US. The winning streak might come to an end on Thursday however, as it edges lower along with US stock futures.

Top Tech Stories

- Meta Platforms Inc.’s Instagram officially unveiled Threads, an app designed as a direct rival to Twitter, launching the most serious threat yet to Elon Musk’s struggling social-media site.

- Mark Zuckerberg posted his first tweet in more than a decade, a playful jab at Musk on the day the Meta founder rolled out a much-anticipated Twitter substitute.

- Artificial intelligence-driven gains can propel Microsoft Corp. to join Apple Inc. in the elite category of stocks with a market capitalization of more than $3 trillion.

- A rise in cyberattacks poses a vital risk to India’s economic ambitions, with industries from manufacturing to pharmaceuticals becoming more vulnerable as they digitize operations, according to a Google subsidiary.

- Tesla Inc. and China’s top automakers pledged to maintain fair competition and avoid “abnormal pricing” in the world’s biggest EV market, signaling a possible end to a price war that’s rattled the industry this year.

- Tesla chief executive Elon Musk reaffirmed his vision of a robot-fueled future, calling for more regulatory oversight of artificial intelligence at a high-profile Chinese government-backed conference Thursday.

--With assistance from Subrat Patnaik and Dawn McCarty.

(Updates with stock move at market open.)