The rebound in Adyen NV and its European fintech peers this month has been notable, but investors should brace for a bumpy road ahead.

After a string of profit warnings knocked off €30 billion in combined market value this year, the three European payment processors — Adyen, Nexi SpA and Worldline SA — have been on a recovery path. In just a month, their combined market capitalization increased by more than 50%, helped by reassuring company updates and private equity firms’ interest in the sector.

But risks are growing. Global economic uncertainty adds to the pressure on payment processing companies, which are highly sensitive to consumer spending. Fierce competition to win over merchants in the US is weighing on Adyen’s growth, while a tougher regulatory stance in Europe adds to concerns.

“It’s not like we’ve turned the page immediately,” Jefferies analyst Hannes Leitner said in an interview. Consumer spending trends have held up in the past quarter, but retailers’ expectations are “very cautious” for the fourth quarter, he said.

A set of more realistic medium-term goals was taken well by Adyen investors earlier this month, after a sharp growth slowdown triggered a historic meltdown in the Dutch company’s shares in August. Both Worldline and Nexi are rebounding from their record lows, following an outlook reset at the former.

The three stocks are still a shadow of their former selves, though. Their combined market value remains 22% below the end-2022 level. With a 64% decline year-to-date, Worldline sits rock bottom among members of the Stoxx Europe 600 Index, compared to a 7.3% gain for the benchmark.

Buying the dip isn’t without risks. Consumer spending appears sluggish, evidenced by a continued contraction in the Euro area’s retail sales. Company insolvencies in both the UK and Europe hit multiyear highs, and that bodes ill for Nexi and Worldline, whose merchant portfolios are more exposed to smaller businesses.

For Adyen, the challenge is on multiple fronts. Its key customer eBay offered a bleak sales outlook for the all-important holiday quarter in a sign of e-commerce market weakness. Winning processing volume from major merchants has become more difficult, as rivals from PayPal Holdings Inc. to Stripe Inc. lure clients with cheaper prices or offerings with more functionalities.

And even after this year’s drop, Adyen appears expensive versus peers. The Dutch company trades at 44 times forward earnings, compared with PayPal at 10 times, and a Bloomberg Intelligence basket of global fintech stocks at 19 times. Its stock price is 6% above the average analyst target.

Adyen “still trades at a premium valuation to peers in an increasingly competitive environment, and management’s outlook doesn’t appear to bake in any buffer for the said competitive environment, nor for any macro deterioration,” KBW analysts led by Sanjay Sakhrani wrote in a note.

Regulatory scrutiny offers another cause for concern. Germany’s financial watchdog Bafin has taken a hardball approach over the past year, issuing sanctions on a dozen firms, including a Worldline subsidiary. The French company said it decided to cut ties with thousands of higher-risk merchants, leading to a €130 million sales hit.

Still, depressed valuations lend support to both Worldline and Nexi. Both stocks’ forward price-to-earnings ratios are well below their five-year averages. Private equity firms’ interest in Nexi may also help defy concerns over the sector’s near-term earnings, according to Bloomberg Intelligence.

Tech Chart of the Day

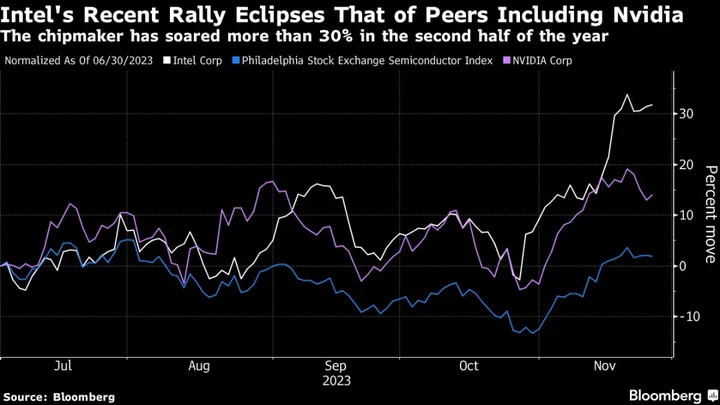

Intel Corp. has rallied nearly 32% in the second half of the year, fueled by an improving personal computer market and a more competitive product line. Last month, the chipmaker predicted a return to sales growth in the fourth quarter. The gains have helped the stock outperform peers in the Philadelphia Semiconductor Index, including Nvidia Corp. in the same period.

Top Tech Stories

- Amazon.com Inc.’s $1.4 billion deal for Roomba maker iRobot Corp. risks being derailed unless the firms fix a list of competition concerns highlighted by the European Union’s antitrust arm.

- Amazon.com is looking for office space in Miami as founder Jeff Bezos plans his move from the Seattle area.

- Reddit Inc. is again holding talks with potential investors for an initial public offering for the social media company, according to people familiar with the matter, as hopefuls prepare for a long-awaited reopening of the market for new listings.

- Fast-fashion retailer Shein has filed confidentially with US regulators for an initial public offering that could take place next year, according to a person familiar with the matter.

- Tesla Inc. has fought off allegations it illegally terminated dozens of New York employees in response to a unionization campaign, a setback for organizing efforts at the Elon Musk-led carmaker.

- SenseTime Group Inc. shares plummeted their most since April after short-seller Grizzly Research released a report accusing the Chinese AI company of inflating its revenues.

Earnings Due Tuesday

- Premarket

- PDD

- Postmarket

- Intuit

- Workday

- CrowdStrike

- Splunk

- HP Enterprise

- NetApp Inc

- Tuya

--With assistance from Subrat Patnaik.