SAN FRANCISCO & NEW YORK & TEL AVIV, Israel--(BUSINESS WIRE)--Aug 15, 2023--

YL Ventures, the early-stage, cybersecurity-focused venture capital firm, has been ranked eighth among venture capital firms worldwide in PitchBook's 2022 Global Manager Performance Score League Tables (dated July 31, 2023), based on its performance. The PitchBook report examined 1,557 fund families across 4,520 funds managed by 1,105 GPs across all strategies.

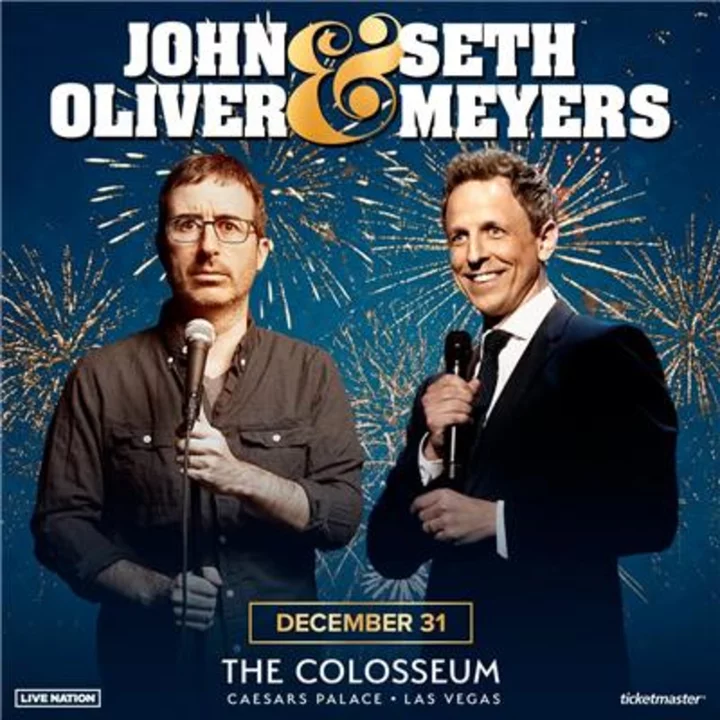

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20230815813274/en/

YL Ventures Ranked 8th Among VCs Worldwide in PitchBook’s New Report (Photo: Business Wire)

YL Ventures, the seed and follow-on investor of unicorns Axonius and Orca Security, is the only venture capital firm in the PitchBook top 10 that is solely focused on investing in cybersecurity startups. “This recognition demonstrates YL Ventures’ position as the prominent VC bolstering Israeli cybersecurity innovation on the global stage,” says Yoav Leitersdorf, managing partner at YL Ventures. “Our commitment to funding and guiding brilliant entrepreneurs is strengthened by the continued trust and support of our Limited Partners, and the acknowledgment of market leaders such as PitchBook.”

According to the report, “The PitchBook Manager Performance Scores are built to go beyond the limitations of traditional benchmarking techniques, such as internal rate of return (IRR) quartiles, to provide a more robust measure of relative performance that considers the dispersion of returns and their finality, which quartile ranking largely ignores … The Scores consider multiple funds across a strategy to provide a more holistic performance measure than benchmarking a single fund.”

Commenting on YL Ventures’ ranking in the report, the firm’s CFO, Dave Reed, states that “PitchBook's novel methodology places a heavier emphasis on results that are realized, calculating fund scores based on normalized deviations from the mean and adjusting for confidence in the finality of results. PitchBook blocks out the noise and boils it down to what matters, culminating in a more holistic result than single fund metrics or quartile rankings. The ranking highlights firms that provide consistent results and distribute capital faster than the peer group. These two traits exemplify the value YL Ventures promises and delivers to its investors.”

YL Ventures employs a unique value-add strategy to support its portfolio companies in each stage of their journey and across all strategic company-building areas, including go-to-market, product-market fit, marketing, HR and others. The firm is bullish on the cybersecurity industry and focuses on helping its entrepreneurs build their company foundations while positioning them to become future category leaders in the global market.

Over the years, YL Ventures’ funds have achieved significant success and considerable returns for their investors, proving the value of the firm’s consistent and focused strategy. For example, YL Ventures’ 2017 fund, YLV III, invested over $130M in seven portfolio companies. Within only six years of the fund’s launch, its impressive interim results place it among the top-performing VCs worldwide, and at the top decile for IRR, TVPI and DPI return for its vintage year, according to PitchBook’s Benchmarks. YL Ventures’ performance metrics are significantly above the baseline top decile figures, implying that the firm is amongst the highest-performing funds, even within the top 10% of all performers.

Out of a total of 30 investments since the firm’s inception, 12 companies were acquired by leading global enterprises including Twistlock (acquired by Palo Alto Networks), Hexadite (acquired by Microsoft), Medigate (acquired by Softbank-backed Claroty) and FireLayers (acquired by Proofpoint). In 2022, YL Ventures announced the launch of its $400M Fund V, bringing its total capital under management to $800M. At its launch, it was the largest seed-stage cybersecurity-focused fund ever raised, bridging Israeli innovation and the U.S. market.

About YL Ventures

YL Ventures funds and supports brilliant Israeli cybersecurity entrepreneurs from seed to lead. Based in Silicon Valley, New York and Tel Aviv, YL Ventures manages five funds with $800M in total assets under management. The firm accelerates the evolution of portfolio companies via a powerful network of Chief Information Security Officers, global industry leaders and a dedicated team of experts, providing tailored guidance and hands-on support on all critical company-building domains. The firm's track record includes investments in Israeli cybersecurity unicorns such as Axonius and Orca Security, as well as successful, high-profile portfolio company acquisitions by major corporations including Palo Alto Networks, Microsoft, CA and Proofpoint. YL Ventures was ranked 8th out of over 250 venture capital firms in PitchBook’s prestigious 2022 Global Manager Performance Score League Tables, and was the only cybersecurity-focused VC to secure a top 10 spot on the list.

View source version on businesswire.com:https://www.businesswire.com/news/home/20230815813274/en/

CONTACT: Media:

Montner Tech PR

Deb Montner

dmontner@montner.com

KEYWORD: UNITED STATES NORTH AMERICA ISRAEL MIDDLE EAST CALIFORNIA NEW YORK

INDUSTRY KEYWORD: PROFESSIONAL SERVICES SECURITY TECHNOLOGY OTHER TECHNOLOGY FINANCE VENTURE CAPITAL ASSET MANAGEMENT

SOURCE: YL Ventures

Copyright Business Wire 2023.

PUB: 08/15/2023 04:05 PM/DISC: 08/15/2023 04:05 PM

http://www.businesswire.com/news/home/20230815813274/en