The UK’s National Grid Plc is preparing for a possible power crunch in January as several planned nuclear outages coincide with peak winter demand.

Electricity consumption is projected to climb to a high during the first two weeks of January, just as nuclear availability is forecast to drop, according to National Grid’s winter outlook report published Thursday. Blackouts are a less likely than last winter but can’t be ruled out, the grid’s Electricity Supply Operator said.

“There’s a risk of small blackouts,” Craig Dyke, head of national control at the ESO, said in an interview. However, the probability of that happening this winter is low, he said.

Although Russia is still waging war on Ukraine, Europe is much better supplied ahead of winter after largely replacing lost flows of pipeline gas with liquefied natural gas supplies. In addition, energy security has been bolstered by near full gas storages on the continent and the higher projected availability of French nuclear reactors during the coming heating season.

Units at Electricite de France SA’s Hartlepool and Torness nuclear stations are scheduled to be offline for work in January, company data show.

National Grid expects it will need to use “operational tools” like market warnings to help balance supply and demand this winter. The network operator has been stress-testing tens of thousands of weather scenarios this winter to ensure it can manage margins, Dyke said.

Overall National Grid’s supply buffer has narrowed to 7.4% compared with 8% in an early outlook in June.

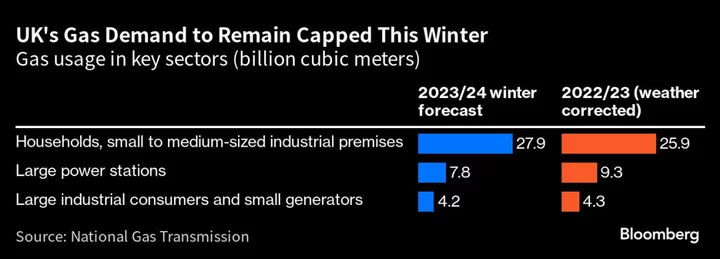

Gas demand this winter is expected to be close to last year’s levels, according to a separate outlook from National Gas Transmission Plc. There could be an uptick in gas consumption from households and businesses, spurred by lower prices, but that would be offset by weaker demand in the power sector.

The market is in much better shape than a year ago, and gas-supply margins are expected higher this winter, National Gas Transmission said. It would take a combination of events — a very cold winter coinciding with a major interruption to one of the UK’s gas supply sources — “for there to be a material risk to our energy security,” the operator said.

For the time being, that’s considered as an unlikely scenario, but both National Gas Transmission and National Grid continue emergency exercises and other measures ahead of the heating season.

Still, high volatility in prices is here to stay, according to National Gas Transmission. The global market for the fuel, including LNG, “remains finely balanced for the winter ahead,” it said. “Any sudden changes to LNG supply or demand in Asia or the Americas could easily have a domino effect into Britain and Europe.”

That’s already been the case in the past few months with prices extremely sensitive even to brief supply interruptions — from outages in Norway and the US to strike threats in Australia.