UK consumer confidence rebounded in August as inflation showed signs of cooling and strong wage growth buoyed household finances.

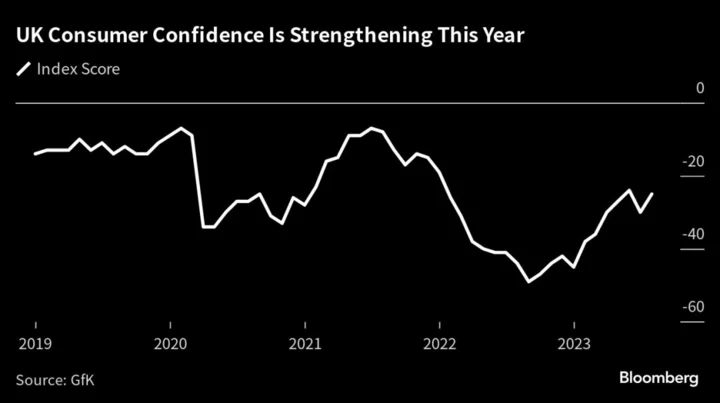

The market research company GfK said its reading of sentiment rose 5 points to minus 25 this month, recouping almost all of the downturn in July. Consumers’ outlook for their own finances in the next year is now 28 points higher than a year ago.

The figures mark a strong contrast with a sharp drop in retail sales in July, with industry surveys showing that decline is likely to continue. Except for July, consumer confidence has risen steadily this year as the economy grew marginally instead of slipping into a deep recession that many had expected last year.

To be sure, confidence numbers remain in negative territory as they recover from a sharp drop in September last year, which took the index to its lowest level since records began.

“While the financial pulse of the nation is still weak, these signs of optimism are welcome during this challenging time for consumers across the UK,” Joe Staton, GfK’s client strategy director, said in a report released Friday.

The improvement may reflect a decline in the inflation rate, which has ratcheted back expectations for how long the Bank of England will keep raising interest rates.

“Consumer price inflation is slowing, but costs remain elevated and will continue to test many household budgets for months to come,” said Linda Ellett, UK head of consumer markets, retail and leisure at KPMG. “Consumers still face far more significant price hikes in the likes of mortgage or rent — which are far harder to manage and will inevitably impact consumer spending further.”

On the spending front, GfK’s major purchase index rose 8 points to minus 24, reflecting increasing confidence about large purchases among consumers. This comes despite warnings from the CBI that year-on-year retail sales in August fell at their fastest rate since March 2021.

- GfK’s overall index score of minus 25 was 19 points higher than last August’s reading.

- The savings index rose 1 point, suggesting that strong wage growth and high interest rates are yet to spark a major change in consumer attitudes toward saving.

- Consumers’ outlook for the general economic situation over the next 12 months increased 3 points from July to minus 30.

(Adds detail on longer-term trend in consumer confidence, in fourth paragraph.)