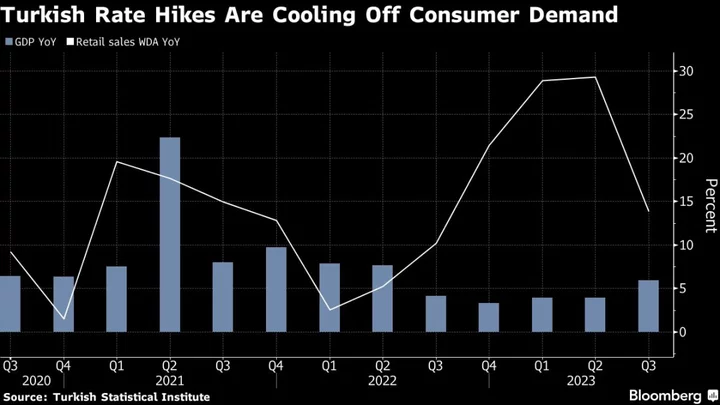

Turkey’s economy cooled last quarter as the central bank moved to tighten monetary policy after May elections, a pivot that’s turning around sentiment among investors without crashing growth.

Gross domestic product expanded 0.3% from the second quarter in seasonally and working-day adjusted terms, according to data published on Thursday. That’s down from a revised 3.3% in the previous three months and worse than every estimate in a Bloomberg survey of economists, whose median was for 1%.

Some momentum carried over on an annual basis, with GDP growth reaching 5.9% in the third quarter from a year earlier, compared with a revised 3.9% in the preceding period.

The sharp turn away from accommodative policies had an immediate effect on the economy, Selva Demiralp, a professor of economics at Istanbul’s Koc University, said before the data release. Another “important factor that suppressed the growth rate in third quarter is the low demand for Turkish exports due to the slowdown in Europe,” she said.

Turkey’s ability to eke out growth is important as it enters the final stretch before municipal ballots in March that could soften the resolve of policymakers while inflation accelerates past 60%. President Recep Tayyip Erdogan’s reelection in May set the stage for a shift in priorities with the appointment of a new team of technocrats anchored by Finance Minister Mehmet Simsek and central bank Governor Hafize Gaye Erkan.

The economy is “moving toward a more balanced composition in growth,” Simsek said in a statement after the data report.

“We will continue our predictable and rule-based policies until inflation and the current-account deficit are permanently reduced and macro-financial stability is achieved,” Simsek said. “We will thus strengthen the foundation for sustainable high growth.”

The prospect of a soft landing for Turkey’s $1 trillion economy would be a vindication for Erkan, who’s argued that price stability is critical to sustainable growth. Prior to her appointment in June, Erdogan for years leaned on policies that pumped up the economy at the expense of inflation and the lira.

“In a situation when inflation and volatility are high, the disinflation process can be started with minimal compromise on growth until inflation falls back to certain levels,” Erkan said in a speech on Wednesday. “At this point the aim should be to maintain the disinflation process decisively.”

Monthly hikes since June have nearly quintupled the key rate to 40% in November, with a cumulative 15 percentage points of tightening delivered in the third quarter alone. The central bank anticipates price growth will peak next May at as high as 75%, finishing 2024 at 36% from 65% at end-2023.

Still, a prolonged economic slump probably isn’t in the cards for Turkey, given the central bank initially took a gradual approach to tightening policy and with the country’s output gap remaining positive. A model developed by Demiralp together with fellow researchers at Koc University showed the probability of recession is at less than 20%.

Behind the economy’s weak quarterly performance was a “domestic demand slowdown, said QNB Finansbank’s chief economist, Erkin Isik, whose forecasts were among the most accurate in predicting the latest GDP figures.

“Preliminary indicators suggest a moderate slowdown will continue in the fourth quarter,” he said. But “a more notable slowdown may be needed for an inflation outlook that’s compatible with the central bank’s predicted path.”

--With assistance from Joel Rinneby.