Credit-rating companies are facing a pivotal moment as Turkish President Recep Tayyip Erdogan takes on a new, more orthodox approach to economic policy.

Money managers and analysts alike have praised the addition of two former Wall Street bankers at the helm of Turkey’s economy administration. Now, it’s up to major debt-scoring companies to weigh in on whether it’s enough to change the nation’s overall credit picture.

Read more: Ex-NY Fed Economist Among Three Central Bankers Named by Erdogan

“The key questions remain,” said Frank Gill, head EMEA sovereign specialist at S&P Global Ratings. “How much time [does] the president give the new economic team to reset previously unsustainable policy settings?”

In the wake of his reelection, Erdogan has opted for a series of measures meant to reassure investors — including the appointments of Hafize Gaye Erkan as central bank governor and Mehmet Simsek as finance minister.

Since then, the extra yield investors demand to hold the nation’s sovereign bonds over comparable US Treasuries has fallen to just 367 basis points, according to JPMorgan Chase & Co. data, the lowest since Covid-19 shocked the nation in early 2020.

To S&P’s Gill, an uptick in investor sentiment and the changes in leadership are “encouraging” — even if there’s still uncertainty about the path ahead. The firm last year downgraded Turkey’s foreign-currency rating deeper into junk rating, to B.

That risk was echoed by Fitch Ratings in a report last month. The scoring firm places Turkey at B, five notches below investment grade.

“Turkey’s record of policy reversals and premature policy easing, and repeated changes in central bank leadership, mean it will take time to lastingly reduce uncertainty regarding the durability and effectiveness of the policy shift,” Fitch analysts Erich Arispe and Paul Gamble wrote in a note.

Thomas Gillet, lead analyst on Turkey at Scope Ratings, also said the post-elections policy pivot is a positive ahead of the company’s next scoring announcement on Friday. The risk, however, is that it’s still unclear whether this policy will be continued over the medium-to-long term.

“One of the biggest challenges ahead for the new economic administration is to unwind previous policy measures,” he said. Another will be trying to “consistently sustain monetary tightening to effectively tame high inflation and regain market credibility, while mitigating potential implications for financial stability.”

The central bank has been at the heart of the overhaul started by Erdogan after winning reelection to extend his rule into a third decade. Turkish policymakers embarked on the nation’s first monetary tightening cycle in more than two years with increases of interest rates by a cumulative 900 basis points at two straight meetings.

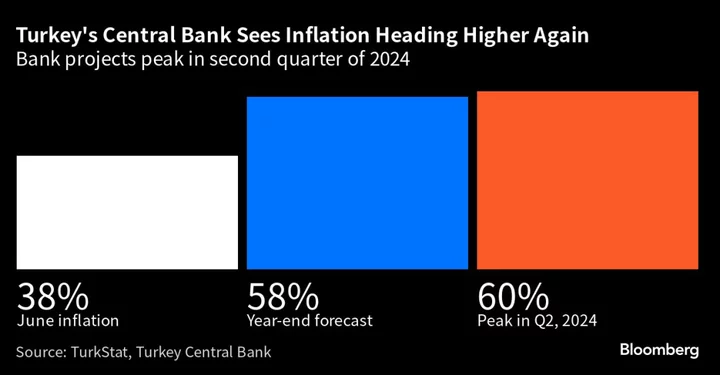

Even so, real rates remain well below zero when adjusted for inflation and the central bank has more than doubled its year-end inflation projection to 58%.

For Moody’s Investors Service, the very gradual pace of monetary tightening stands to have negative implication for the lira’s stability, as well as the nation’s current-account balance. Moody’s lowered Turkey to B3 last year as foreign-currency reserves slipped.

“The central bank has just acknowledged that its very gradual pace will not bring inflation down any time soon,” Moody’s wrote in an emailed statement to Bloomberg. “This raises the risk that savers will again turn to dollars or increase their gold buying.”