Turkish President Recep Tayyip Erdogan failed to carve out a lead large enough to avoid a runoff in an election that left the incumbent with momentum headed into a decisive showdown.

Boasting a lead of over 2 million votes, Erdogan will go head to head on May 28 against Kemal Kilicdaroglu, who has the backing of the nation’s broadest-ever grouping of opposition parties. The president’s People’s Alliance also was on track to maintain its parliamentary majority, according to the initial tally by state broadcaster TRT.

Early results on Monday showed Erdogan winning 49.3% of the votes, while Kilicdaroglu secured 45% support, short of the 50% threshold needed to avoid a runoff. Another contender, Sinan Ogan, received 5.2% and was eliminated from the race. While it’s still possible for Erdogan to declare victory in the first round, a runoff contest is the most likely outcome, with more than 98% of ballot boxes having been counted.

After a polarizing campaign that’s whipsawed markets, Erdogan powered through to the next round after doing better than many polls predicted ahead of the toughest election battle of his political life.

“We have no doubt that the preference of our nation — which has given a parliamentary majority to People’s Alliance — will favor confidence and stability in presidential elections,” Erdogan said during his traditional victory speech from the balcony of his party headquarters in Ankara.

Currency Woes

The prospect of two more weeks of uncertainty will weigh on a market that’s recently grown more confident of an Erdogan defeat after presidential contender Muharrem Ince dropped out of the race and potentially left the opposition vote less divided.

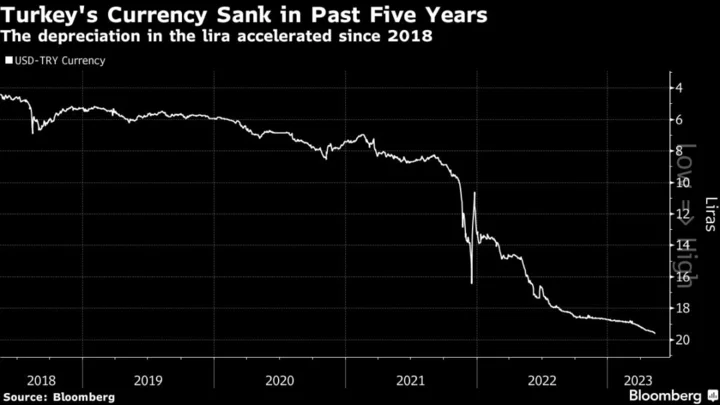

Investors have been betting on the Turkish currency to weaken following the election, regardless of the result.

The lira was slightly weaker in light trading in Asia hours as state banks intervened to hold the exchange rate at around 19.65 per dollar, according to people familiar with the matter. The lira closed at 19.58 on Friday.

“Two weeks of uncertainty is a scenario that markets dislike the most,” said Cagri Kutman, Turkish markets specialist at KNG Securities.

Erdogan, the country’s longest-serving leader, has molded the NATO member into a regional power that plays a growing role from Ukraine to Syria. He even maintained strong support in much of the area hit by the devastating February earthquakes that left more than 50,000 people dead. Survivors and opposition parties have accused the government of not responding to the disaster adequately.

But increasingly erratic economic policies have left the 69-year-old incumbent vulnerable after an inflation crisis last year gutted household budgets.

Kilicdaroglu, 74, was running on a promise to restore the rule of law, mend strained ties with the West and return to economic orthodoxy. Ahead of Sunday’s election, many opinion surveys showed Kilicdaroglu had the edge over Erdogan.

“If our nation says second round, we respect that,” he said after the release of initial results on Monday. “Erdogan could not get the results he desired.”

‘Distinct Advantage’

Erdogan’s parliamentary majority will give him “a distinct advantage” in the runoff, allowing him to campaign with the promise of a leadership in unity, said Wolfango Piccoli, co-president of Teneo Intelligence in London.

A surprise showing by Ogan, the third candidate in Sunday’s race who ran on anti-immigrant platform, was a key factor in keeping the front-runners from securing an outright majority.

Backed by a nationalist party, Ogan — a former academic with a doctorate from a Moscow university — exceeded his poll numbers going into the vote, possibly benefiting from the last-minute withdrawal of another candidate.

How Ogan’s electorate might behave in the second round could swing the vote in either direction. In remarks late on Sunday, Ogan, 55, criticized Erdogan’s unconventional economic views and refrained from endorsing any of the top two contenders, accusing them of being too close to groups he described as “terrorists.”

Erdogan’s electoral ally, Huda Par, was founded by people linked to the pro-Kurdish militant group Hezbollah, which isn’t related to the Lebanese group of the same name.

In the case of Kilicdaroglu, his alliance won crucial support from Kurdish politicians — including a party that the government accuses of ties to separatist militants, a charge it denies.

“In comparison to his opponent, Erdogan is better positioned to win the votes that went to ultra-nationalist candidate Ogan in the first round,” Piccoli said.

Lira Risks

Though the president’s open-door policies have left Turkey with the world’s largest refugee population, it’s his approach to the economy that will dominate the final stretch of campaigning.

The Turkish currency has been under pressure since Erdogan ramped up a slew of unorthodox policies starting in 2018, including state interventions in FX markets and interest-rate cuts even as inflation surged.

Stealth interventions in the market by the central bank have totaled nearly $177 billion since December 2021, according to an estimate by Bloomberg Economics. It will be under pressure to double down to hold the lira stable in the coming weeks.

Turkey’s Stealth Interventions Hit $177 Billion Before Vote

“I would expect Erdogan and his government to maintain market stability at all costs going into the second round,” said Nick Stadtmiller, head of product at Medley Global Advisors in New York.

The effort has already been costly to its reserves. To pad out its holdings, it’s been borrowing foreign currency from commercial lenders via swap transactions — allowing them to park funds with the central bank, which in return lends liras.

The central bank’s reserves remain deeply negative when swaps are taken into account.

Ahead of Sunday’s vote, the monetary authority also cracked down on lenders’ sales of hard currency, telling them to slow sales to firms and focus on increasing inflows to foreign-exchange-protected lira deposits.

The central bank will hold its next rate-setting meeting on May 25, three days before the runoff vote.

“The current government cannot show weakness as we head to the final stretch of the electoral cycle,” Stadtmiller said. “A dip in Turkish markets would suggest a chink in the armor of Erdogan’s policies.”

--With assistance from Taylan Bilgic, Inci Ozbek, Tugce Ozsoy, Firat Kozok, Baris Balci and Kerim Karakaya.