Treasury yields surged Thursday, most to the highest levels since March, as strong economic growth data prompted traders to wager that the Federal Reserve will raise rates two more times this year.

Short-maturity yields, more sensitive to changes in the Fed’s policy rate, climbed the most in a day since March. The two-year rose as much as 18 basis points to 4.89%. It peaked this year at 5.08% on March 8, before collapsing toward 3.50% amid a rout in US regional bank shares after several failed.

Rates on swap contracts referencing future Fed policy meetings repriced to levels that suggest the US central bank will raise its target range for the federal funds rate by a quarter percentage point by September. They priced in about half of an additional quarter-point hike, down from more than half earlier in the session. As recently as early April, the contracts anticipated about three quarter-point rate cuts by year end.

“Today’s data showed that rates will be higher for longer,” said Tracy Chen, a portfolio manager at Brandywine Global Investment Management. In looking for rate cuts, the outlook for Fed policy changes “has been mispriced.”

Yields on Treasury inflation-protected securities, which provide a clearer view of the outlook for Fed policy, also rose, with the five-year rate exceeding 2% for the first time since 2008.

US economic data released Thursday showed that first-quarter economic growth was faster than previously estimated, while new claims for unemployment benefits unexpectedly dropped, a sign of labor-market strength.

Commenting at events in Madrid Thursday and Portugal Wednesday, Fed Chair Jerome Powell said he wouldn’t take off the table additional interest-rate increases at consecutive policy meetings.

Swaps for the November Fed meeting showed a new cycle peak of about 5.44% versus the current effective rate of 5.07%.

The Fed left its policy rate unchanged at 5%-5.25% on June 14 after 10 consecutive increases, as most forecasters expected. However, revised quarterly forecasts for the economy and monetary policy showed officials expect to raise rates twice more by year-end.

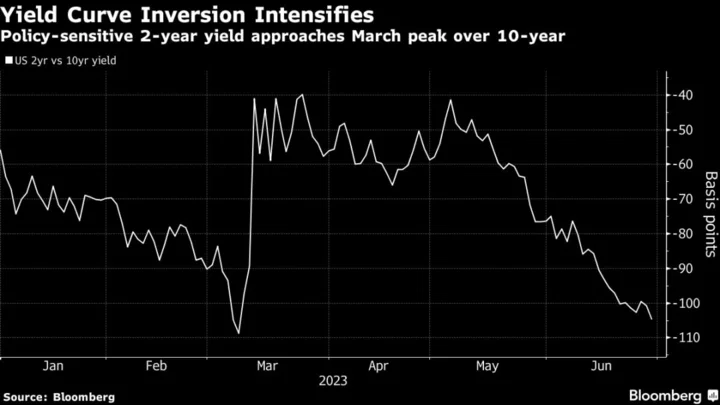

Longer-dated Treasury yields rose less, deepening the inversion of the curve. The two-year rate exceeded the 10-year by nearly 107 basis points, within 5 basis points of levels reached in March that were the most extreme in decades. The inversion signifies investors expect the Fed’s rate increases to curb future growth, possibly to the point of recession.

The 10-year, which rose as much as 16 basis points to 3.866%, is “at the risk of a breakout” to 3.9% and higher, said George Goncalves, head of US macro strategy at MUFG. It has scope to 4%, last seen in March, “if second-rate-hike expectations move to September.”

As the second quarter draws to a close this week, banks have been anticipating calendar-based demand to buy bonds based on their relative performance vs stocks.

--With assistance from Ye Xie.

(Updates yields. A previous version corrected the effective policy rate.)