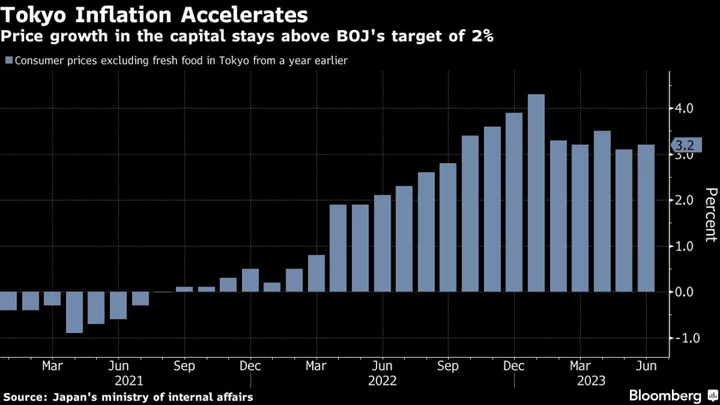

Inflation in Tokyo re-accelerated for the second time in three months in June, an outcome that supports expectations the central bank will raise its inflation forecast next month amid lingering speculation of possible policy adjustments.

Consumer prices excluding fresh food increased 3.2% in the capital from a year earlier, rising at a faster pace than a revised 3.1% last month, according to the ministry of internal affairs Friday.

Economists had expected a gain of 3.4% given a government decision to allow utilities to raise their electricity charges from this month. Some economists were unaware of the revision to 3.1%.

Separate data showed factory output declined in May from the previous month for the first fall since January, as recovery momentum sputtered more than expected. The labor market remained relatively tight, with the jobless rate unchanged at 2.6%.

The slightly faster pace of price gains supports the view that the Bank of Japan may revise up its inflation projections when it meets at the end of July. Around a third of economists surveyed by Bloomberg forecast policy change at the meeting largely because of expectations that the BOJ will have to bump up its price forecasts.

While Tokyo prices, a leading indicator of the national trend, show that businesses are continuing to pass their costs onto consumers, it’s unclear if Japan’s cost-push inflation has turned into price growth led by demand.

What Bloomberg Economics Says...

“Looking ahead, we expect inflation to ease from July. We see national core inflation dropping below the BOJ’s 2% target in 4Q23.”

— Taro Kimura, economist

For the full report, click here.

A deeper measure of the inflation trend that strips out fresh food and energy prices unexpectedly decelerated, slowing to 3.8%. The gauge is free from the impact of government measures for energy prices.

For overall prices, the drag from energy shrank from May, according to the government data, showing the impact of the price increases from electricity companies. The impact of government subsidies still lowered electricity prices from a year earlier.

Dai-Ichi Life Research Institute estimated that this would lift up nationwide core consumer prices by around 0.25 percentage points.

The factory data showed a 1.6% drop in output from the previous month, although production levels were still 4.7% higher than a year earlier.

The number of jobs available for every applicant slightly decreased to 1.31 in May, down from 1.32 in the prior month.

(Updates with more data, details from reports)