Tesla Inc. has broken four quarterly car delivery records in a row, but over the past three months something has been threatening its winning streak: factory downtime.

The electric-vehicle maker shut down some of its facilities over the summer to make upgrades, which Chief Executive Officer Elon Musk warned would slow production. Additionally, as inflation continues to hit household budgets, consumers are having a harder time making big purchases.

Analysts surveyed by Bloomberg estimate Tesla will report as soon as Monday it delivered 456,722 cars in the third quarter. That’s below the 466,140 units delivered in the second quarter, and would be the first decline since early 2022. In recent days, some analysts have lowered their expectations.

“Planned factory downtime and questions regarding demand have created confusion on the Street regarding Q3 deliveries,” wrote Robert W. Baird analyst Ben Kallo in a note to clients this week. Kallo, who has an outperform rating on the stock, estimates 439,200 deliveries for the quarter.

After telling investors in January that there was potential for the company to produce 2 million cars in 2023, Musk said in July that the company would stick with an earlier target of 1.8 million cars.

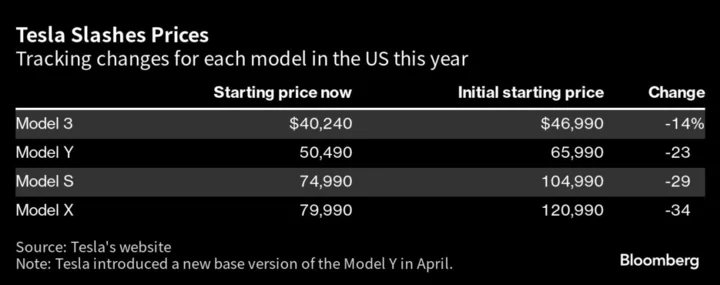

However, even with output slowing, the Austin-based EV maker is still taking steps to keep sales high. It’s been slashing prices all year in response to inflation and high interest rates.

Tesla’s best-selling Model Y now starts at $50,490 in the US, compared to $65,990 at the start of 2023. And it’s a major beneficiary of the Inflation Reduction Act, passed about a year ago. Each version of Tesla’s high-volume vehicles, the Model 3 sedan and Model Y SUV, qualify for a $7,500 federal tax credit for eligible buyers.

Tesla’s delivery figures come as all eyes are on Detroit, where the United Auto Workers union is embroiled in a strike against General Motors Co., Ford Motor Co. and Stellantis NV, maker of the Jeep, Chrysler and Dodge vans. The simultaneous strike against Detroit’s Big Three automakers comes as they are navigating a costly transformation from the era of the internal combustion engine to EVs.

The Tesla delivery announcement is all but certain to mean the US has crossed 1 million electric car sales this year, the first time it’s reached that threshold.

The quarter also included a long-awaited refresh of Tesla’s Model 3. The automaker slimmed down the front end of its entry sedan in the first major face lift of the Model 3 since it went into production six years ago.

It’s not yet available in the US, and Tesla has said very little about when buyers here may see the refreshed version. Tesla makes the Model 3 at its factories in Fremont, California, and Shanghai. Deliveries of the revamped Model 3 are expected to begin in the fourth quarter with exports to customers in Europe.

Investors and Musk fans are eagerly awaiting the next Tesla model, its Blade Runner-inspired steel Cybertruck. Social media, especially the Musk-owned platform X, have been littered with images of the car. However, volume production is still a long way off. Musk said at some point it will have a debut party in Austin, where the first Cybertruck will be handed off to a customer, but hasn’t clarified when.

Analysts don’t expect the Cybertruck to account for a significant portion of Tesla deliveries anytime soon. It’s a complex vehicle to make, and they anticipate output will ramp up slowly.

Meanwhile, when factory upgrades are complete, Tesla is likely to continue churning out an increasing volume of cars. Analysts expect production to top 2 million in 2024.

“Our base case now is for Tesla to guide to about 2.1 million deliveries next year, versus current consensus of 2.3 million units,” wrote Deutsche Bank analyst Emmanuel Rosner. “On the bright side, with the company not trying to push as much volume, there could potentially be less pricing pressure next year.”

--With assistance from Keith Laing.