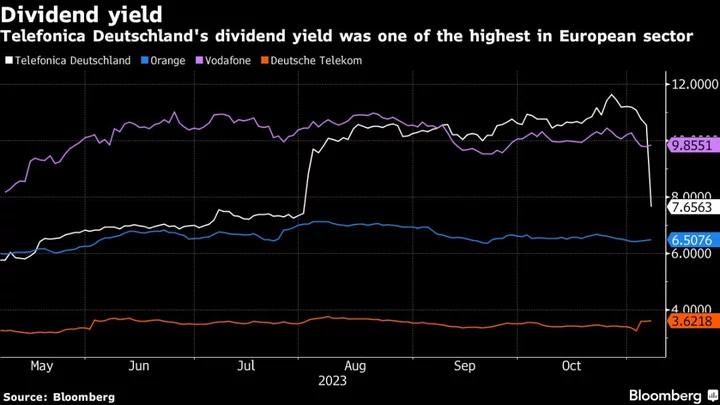

Spain’s Telefonica SA is seeking to buy up the outstanding shares in its German unit for as much as €2 billion ($2.2 billion) in a bid to take the company private.

The move to acquire 28.2% of Telefonica Deutschland Holding AG comes three months after the loss of a wholesale contract caused shares of the German carrier to plummet. Telefonica already owns the remainder of the company, directly or indirectly.

Telefonica shares fell as much as 3% on Tuesday in Madrid, where the company is based; shares in the German unit rose as much as 42%.

Still, analysts welcomed the long-term outlook for the deal.

“The transaction makes a lot of sense for Telefonica,” ING telecommunications strategist Jan Frederik Slijkerman wrote in a note. “Adding leverage to Telefonica Deutschland or asset sales could be a means to pay for the transaction, while Telefonica gets better control over the asset and dividend leakage will be reduced.”

The deal could also help the Spanish group maintain its dividend policy, Berenberg analyst Carl Murdock-Smith said, writing in a note that it could offer Telefonica a way to take more cash out of its German unit.

The Spanish carrier said Tuesday it will pay Telefonica Deutschland shareholders €2.35 per share, a 37.6% premium to Monday’s closing, saying “the offer reinforces Telefonica’s strategy to focus on its core geographies and its strong commitment to the German market.”

The company also said it planned to work with management on revising the unit’s dividend policy to align with its business plan.

Telefonica Deutschland in August lost a contract to rival 1&1 AG that secured a deal with Vodafone Group Plc. The German unit, which relies on 1&1 for an estimated 40% of its free cash flow, is set to lose about €340 million of free cash flow by 2025, according to estimates by Bloomberg Intelligence.

Read More: 1&1 Shares Soar After German Roaming Deal With Vodafone

The move to buy out the German unit comes as Telefonica prepares to lay out a three-year strategic plan on Wednesday, at its first capital markets day in over a decade. Investors are expected to query management about the impact of the 1&1 decision, and about how Telefonica plans to pay for the German-unit deal.

Bloomberg Intelligence telecoms analyst Erhan Gurses estimates that the offer could add up to 0.2x leverage to the company on an after-lease basis. Telefonica’s debt stood at €27.5 billion in June as per the company’s calculations.

--With assistance from Agatha Cantrill and Thomas Seal.

(Updates with analyst in sixth paragraph. A previous version of this story corrected the full name of the German unit.)