The Bank of England is facing a stormy gilts market while Turkey's new governor is expected to ramp up rates sharply at central bank meetings in the week to come.

There's a fresh read on the health of the world economy in the offing, while key policy makers are hitting the road, with U.S. Secretary of State Antony Blinken headed for Beijing and London and Paris hosting some big summits.

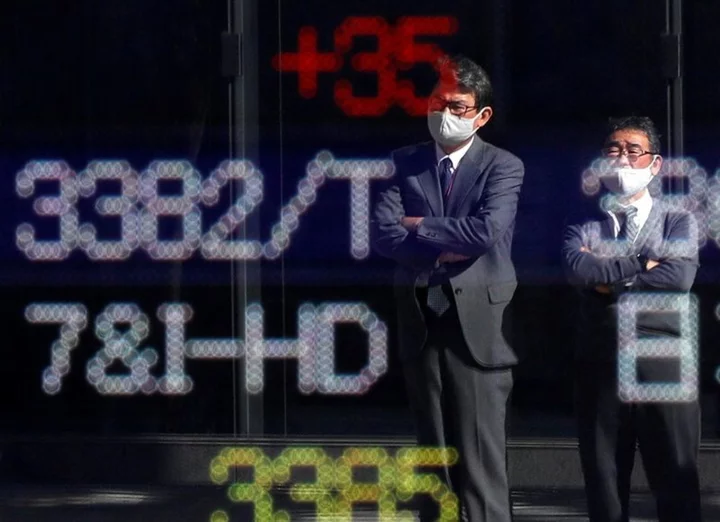

Here's a look at the week ahead in markets from Kevin Buckland in Tokyo, Lewis Krauskopf in New York, Amanda Cooper and Karin Strohecker in London.

1/THE NIGHTMARE ON THREADNEEDLE STREET

The Bank of England could be facing its worst nightmare - an economy that's barely growing and the shadow of a 1970s-style wage price spiral. Earnings are growing at their fastest clip on record - excluding the pandemic. The jobs market is tight, the cost of living is high and workers, both in the public and private sectors, are pushing for better pay to make ends meet.

Add to that a surge in the government's borrowing costs to their highest since 2008 and the pressure that is putting on an already-struggling mortgage market and the central bank's position is looking unenviable.

Markets show traders are placing an almost one-in-five chance the BoE will raise rates by half a point next week, up from near zero at the start of June. Even if the bank raises by this much, will it do the trick?

2/ECONOMIC CHECK UP

A raft of decidedly hawkish noises from big central banks - including the Fed - has once again raised questions about how much central bank tightening is accelerating a global slowdown.

Cue Purchasing Managers' Indexes (PMIs) from around the world that will offer a fresh look into demand trends and evidence of the health of the manufacturing sector in the United States, Europe and Japan so far in June.

May reports showed bad news in many key regions. U.S. manufacturing contracted for a seventh straight month, as new orders continued to plummet amid higher interest rates. PMIs for the euro zone in May moved further into contraction zone - another gloomy sign for the region that tipped into a technical recession in the first quarter of 2023.

3/AN UNWELCOME SURPRISE

After back-to-back hawkish surprises at the Reserve Bank of Australia's past two policy meetings, investors will be keen to parse minutes from June's confab on Tuesday to gauge the risks of a third.

Right now, money markets put the odds of a hike, or a hold, at a coin toss for July, but either way, by November at the latest traders are certain rates will be 50 basis points higher than now.

With the cash rate already at a decade high, and RBA Governor Philip Lowe prioritizing reining in stubborn inflation over preserving jobs, recession risks are rising. May's blockbuster employment report could also provide more leeway for the RBA to tighten rates further.

Investors in Australia need to keep a close eye on key trading partner China as well, where a post-COVID recovery is already spluttering and Sino-U.S. tensions are simmering.

4/HITTING THE ROAD

Expectations the first trip to Beijing in five years for a U.S. Secretary of State could yield a breakthrough between the world's top two economies have been downplayed by the team for top diplomat Antony Blinken, who is expected - according to Chinese state media - to visit on June 18-19.

Cautious optimism is in the air in London as well, where Western policy makers are gathering on June 21-22 for the Ukraine Recovery Conference to tackle issues from short-term financing, to long-term reconstruction costs. The event is held after the breach of the huge Soviet-era dam on the Dnipro river, which experts warn will have a huge impact not only on Ukraine but also on global food security.

Meanwhile in Paris, the New Global Financing Pact on June 22-23 is the summit debut for newly appointed World Bank chief Ajay Banga, who will be joined by heads of state from around the globe to discuss how financing, especially related to climate issues, can be structured for some of the poorest nations.

5/THE ONLY WAY IS UP

Another debut is on the agenda for Hafize Gaye Erkan - Turkey's newly appointed central bank governor, who hosts her first rate-setting meeting on Thursday.

Analysts at leading investment banks expect her to start ramping up interest rates - currently at 8.5% - to anywhere up to 25% as part of a major reset of the country's economic policies. That is still some way short of the inflation rate, which dipped just below 40% in May.

Investors are keen to see how deep and lasting those changes will be after President Tayyip Erdogan clinched an election victory in late May. Erdogan said his newly appointed Finance Minister Mehmet Simsek would take unspecified steps swiftly with the central bank, but that it was a mistake to suggest that he himself had changed his views on interest rates.

(Compiled by Karin Strohecker; Editing by Philippa Fletcher)