By Cynthia Kim and Jihoon Lee

SEOUL South Korea's economy fared better than expected in the third quarter with the expansion underpinned by exports, backing the case for the central bank to keep rates on hold for the months ahead.

Gross domestic product (GDP) grew 0.6% in the July-September quarter from three months earlier, data from the Bank of Korea showed on Thursday, the same pace as the prior quarter and beating a median 0.5% increase forecast in a Reuters survey.

The report points to an economy that is still in a soft patch and undergoing an exports-based recovery after a cumulative 300 basis points of interest rate hikes since August 2021 weighed on indebted households and restrained spending.

In the third quarter, exports expanded 3.5% after declining 0.9% in the preceding three months, while private consumption grew 0.3% after contracting 0.1% in the second quarter.

Government spending grew 0.1%, and construction investment expanded 2.2% after contracting 0.8% in the second quarter.

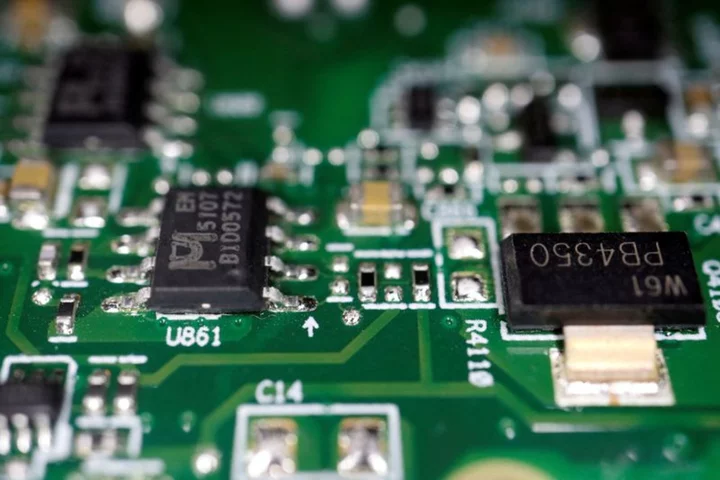

Facility investment has been a drag, contracting 2.7% on-quarter.

On an annual basis, Asia's fourth-largest economy grew 1.4% in the third quarter, after a 0.9% gain in the second quarter and beating a 1.1% rise expected by economists.

South Korea's central bank held interest rates steady for a sixth straight meeting last week, retaining a tightening bias on monetary policy as it warned of inflationary risks from the Israel-Hamas conflict and global oil prices.

In a separate Reuters survey conducted early this month, South Korea's economic growth was forecast to slow to 1.2% in 2023 from 2.6% in 2022. That is lower than the government and the central bank's projection for 1.4%.

(Editing by Ed Davies and Sam Holmes)