South Africa is strapped for cash and the country’s central bank has a stern warning for the ruling African National Congress: You can’t spend your way out of trouble.

“Deteriorating fiscal risks lead to higher interest rates,” Reserve Bank Governor Lesetja Kganyago said on Thursday after holding interest rates at 8.25%. “Foreigners will want to be compensated.”

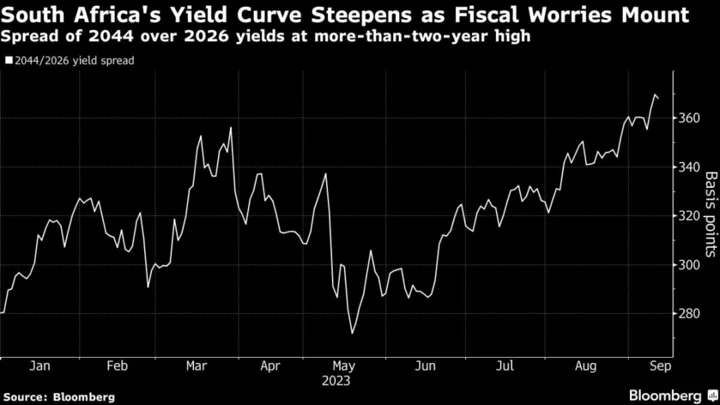

South African government bond yields have climbed above 12% in recent months even as the country’s inflation rate has declined to 4.8% from above 7%, as investors weigh threats to the public purse. The central bank aims for inflation at the mid-point of its 3% to 6% target range.

Tax revenues fall short of spending and debt issuance to make up the gap has boosted yields. The National Treasury wants austerity measures but faces opposition from others worried about public unrest ahead of next year’s election, in which the ANC risks losing its majority.

Unsustainable

“Government spends more than it earns from taxes. We spend as a nation more than we produce. We import more than we export,” said André Roux, head of the Futures Studies program at Stellenbosch Business School. “These kinds of deficits cannot be sustained for a long period.”

Party leaders meet in October to hammer things out and Finance Minister Enoch Godogwana, who presents a budget update on Nov. 1, will be under intense pressure to go easy from other ministers. The fallout over proposed cost containment measures is believed to be a contributing factor in the delay of the budget, which ordinarily happens in late October.

Some in the ANC fear a repeat of the deadly violence of 2021 if social spending programs are axe, in a country where millions live in chronic poverty alongside conspicuous wealth and the unemployment rate is above 30%.

Kganyago, who under the constitution is granted operational independence from the government in setting rates, made it plain that being fiscally reckless will cost South Africa higher debt-service payments, leaving even less money to go around.

Likening investor appetite to eating a slice of bread, he said they’ll want a spread “whether it’s butter, jam or whatever” and it will get pricey if the fiscal picture darkens.

“Foreigners are not prepared to eat the bread on its own. They would want to have the spread added and that spread had better be sufficient for them to buy it,” he told a press briefing following the interest-rate decision.

His colleague, Deputy Governor Kuben Naidoo, offered a less colorful but more direct explanation of the trade-offs being faced by the government as it tries to balance competing demands.

“In the normal course of events in the business cycle, weaker fiscal does lead to tighter monetary policy,” he told the reporters. “A looser fiscal stance makes the work of monetary authorities more difficult.”

ANC spokeswoman Mahlengi Bhengu-Motsiri said the government was working on how best to balance the demands of keeping the country working while cushioning those at risk in the community.

“The governing party has got to be able to explain to South Africans about how we are using cost containment to protect investment and consumption to secure jobs, to make sure that social assistance doesn’t suffer,” she said.

The spokeswoman’s comments are a climb down from the party’s economic boss, Mmamoloko Kubayi, who told local newspaper Mail and Guardian that the National Treasury had sought to usurp powers from the president and his executive.

“We were shocked when we saw the letter; we just believe that consultation would have helped the matter,” Kubayi said of the earlier proposed austerity measures.

“If you look at the official letter, it took away the constitutional power of the president and took it into the National Treasury, which was unfortunate and illegal.”

Tension over spending is nothing new in South Africa, but sharpening the debate this time around is anxiety over what’s shaping up to be a very tough election next year for the ruling party.

Public frustration is simmering over rolling power cuts and the ANC’s repeated failure to deliver on basic public services. Opinion polls see them dipping below 50% control of parliament, which would force them to forge a coalition alliance with one or more of the smaller parties.

“There is a big concern about the erosion of the ANC’s electoral power at national level,” said Sithembile Mbete, who lectures in political science at the University of Pretoria. “The stakes I think are higher for the party than they have ever been.”