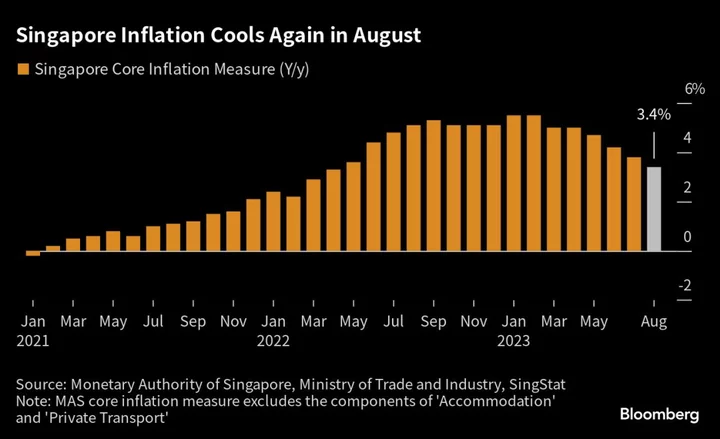

Singapore’s core inflation moderated further in August from a year ago, reflecting improvements to supply chains and lower import costs that allow the central bank room to extend its pause on monetary tightening.

Core inflation, tracked by the Monetary Authority of Singapore to determine policy settings, came in at 3.4% last month, official data showed Monday. The measure, which excludes housing and private transportation costs, was lower than the median forecast of 3.5% in a Bloomberg survey of analysts.

All-items inflation eased to 4% in August. That matched the forecast by economists in a Bloomberg survey and was slower than the 4.1% reading in July.

The figures, the final price print before MAS’s next policy review in October, confirm a deflationary trend in the city-state. That boosts the case for policymakers in the island nation to stand pat for a second straight meeting, although globally the rate outlook differs for individual economies based on local developments.

In the US, the Federal Reserve is on course for a hike in November after a surprise spike in its August inflation print, while an unexpectedly low print in the UK allowed the Bank of England to pause.

What Bloomberg Economics Says...

CPI gains are still elevated and food and energy prices are ticking up again. That suggests households in this city-state still can benefit from a strong currency to lean against rising import costs.

— Tamara Mast Henderson, Asean economist

For the full note, click here

The MAS — which manages the currency rate, rather than the interest rate, to adjust monetary conditions — expects inflation to moderate further over the next few months as imported inflation remains low compared to year-ago levels and the current tightness in the domestic labor market eases.

--With assistance from Tomoko Sato.

(Updates with details throughout.)