Serbia is likely to hold borrowing costs unchanged as easing inflation allows policymakers to take a step back and assess the impact of their steepest monetary tightening drive on record.

The National Bank of Serbia will leave its one-week repurchase rate at 6.5% on Friday, keeping it at the highest level in over eight years for a third meeting, according to 13 out of 15 analysts in a Bloomberg survey. Two expect a 25 basis-point increase.

Slowing inflation, a weak economy and an expected euro-area slowdown in the second half are reasons for holding rates steady, according to Ljiljana Grubic, chief economist at Raiffeisen Banka AD in Belgrade.

“We expect the NBS to continue using auxiliary monetary instruments, rather than hiking rates,” she said by email.

The central bank last month increased mandatory reserve requirements for lenders, estimating that the move will withdraw liquidity totaling about 115 billion dinars ($1 billion) and reduce the banking sector’s local currency surplus by about 20%.

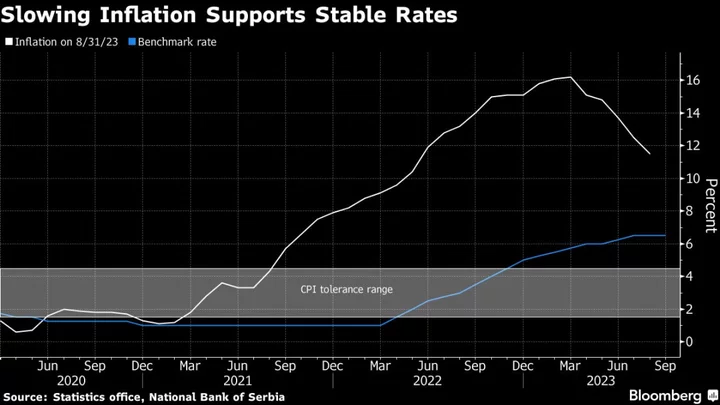

The annual inflation rate fell to 11.5% in August, compared with the March peak of 16.2%. The survey indicates a drop to single-digits this month. The central bank sees price growth returning to the 1.5%-4.5% tolerance band in the second quarter of next year, while economic growth remains on track for an expected expansion of about 2.5% in 2023.

Some price pressures remain, stemming from government decisions to raise pensions and public sector wages, combined with an increase in regulated power and gas prices taking effect this fall.

After initially lagging its peers in raising rates, Serbia is the only country in the region to lift borrowing costs more than once this year.

Alongside neighboring Romania, the two Balkan economies stand out in central and eastern Europe as Poland and Hungary are already lowering borrowing costs and policymakers in the Czech Republic haven’t ruled out a first rate cut by the year-end.

Raiffeisen’s Grubic expects rate cuts in Serbia may start in the second quarter of next year, although the pace of monetary easing will be slower than the hiking cycle because inflation will stay above pre-pandemic levels.

--With assistance from Harumi Ichikura and Mark Sweetman.