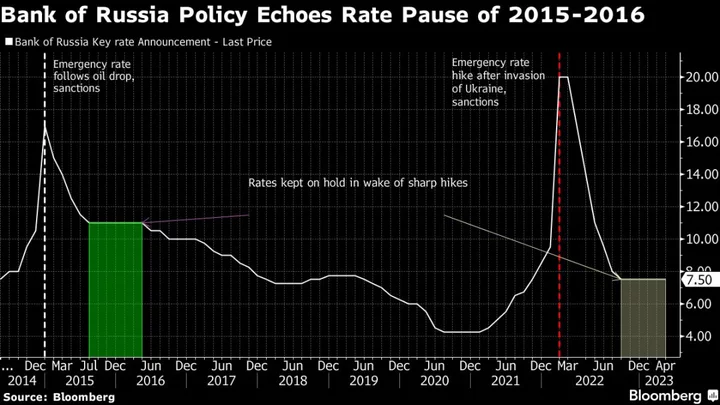

Russia is poised to extend its interest-rate pause to the longest in more than seven years as the central bank remains alert to inflation risks at a time of heavy government spending on the war in Ukraine.

The option of raising rates for the first time since the immediate aftermath of the invasion will still likely be on the agenda when policymakers meet on Friday. But only two of the 14 economists surveyed by Bloomberg predict a hike of a quarter percentage point, with the rest saying the benchmark will stay at 7.5% for the sixth straight time.

Inflation is close to ending an uninterrupted decline that started a year ago and brought it well below the central bank’s target of 4%. But despite long warning of severe labor shortages and the threat posed to prices by surging budget expenditure, Governor Elvira Nabiullina can probably afford to wait as inflation just starts to show signs of acceleration.

“While we think inflation troughed in annual terms in April, sequential price growth has been weaker than we had thought and hence it will likely take into the late third quarter for inflation to exceed the target,” Goldman Sachs Group Inc. economists including Clemens Grafe said in a report. “We therefore now forecast the hiking cycle to start in September rather than in June.”

Official borrowing costs haven’t changed since the central bank ended its steep monetary easing cycle that more than reversed an emergency hike after the invasion of Ukraine more than 15 months ago.

The turns of policy over the past year echo the experience in 2015-2016, when the Bank of Russia paused for six meetings after unwinding the rate increases it delivered in response to a crash in oil prices and the first rounds of sanctions following the annexation of Crimea from Ukraine.

What Bloomberg Economics Says...

“While sounding hawkish, the central bank is unlikely to act for now. It historically has tended to wait until inflation’s run rate exceeded its target for three-four months before raising rates.”

—Alexander Isakov, Russia economist. For more, click here

Evidence is starting to emerge that inflation is picking up. On a weekly basis, price growth jumped from near zero to 0.2% in the seven days ended June 5. Inflation expectations for a year ahead, a key factor for policymakers, rose in May for the first time in three months.

Analysts at the Bank of Russia have continued to warn that price pressures could be on the rise, pointing to factors ranging from faster wage growth and worker shortages to a revival in consumer lending.

With the economic outlook turning more upbeat, Nabiullina said after the last policy decision in late April that a rate increase remained “more likely.”

The tone may grow even more hawkish at this week’s meeting, according to Raiffeisenbank analysts Stanislav Murashov and Grigory Chepkov, especially with budget spending on track to be higher than planned.

“The acceleration of inflation in the first days of summer may prompt the central bank to toughen its rhetoric,” they said.