TORONTO--(BUSINESS WIRE)--Aug 16, 2023--

Rupert Resources (“Rupert” or “The Company”) is pleased to report drill results from its 2022/23 exploration program at its multi-million ounce Ikkari gold discovery at the 100% owned Rupert Lapland Project in Northern Finland. In November 2022, the company published a mineral resource estimate (“MRE”) and preliminary economic assessment (“PEA”) for the project demonstrating the potential for a high margin, low impact mine with a life of over 20 years (see November 28, 2022 press release and footnotes 1&2 ).

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20230816303158/en/

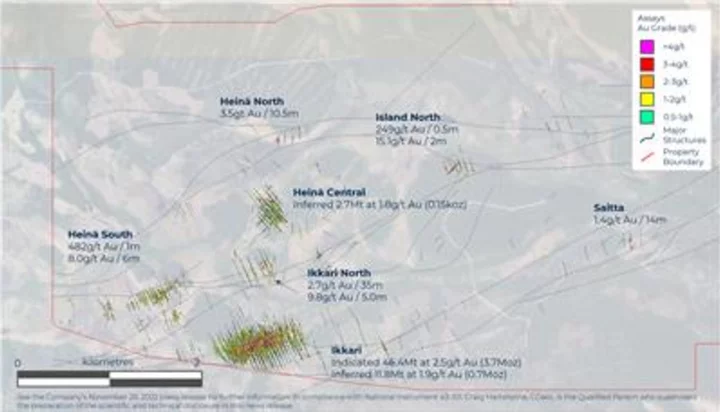

Figure 1. Overview of relative locations of Ikkari and Ikkari North (plan view) (Photo: Business Wire)

HIGHLIGHTS

Ikkari -Further results from Infill and extension program

- #123027 intersected 2.1 grams per tonne gold (“g/t Au”) over 52m from 228m including 4.4g/t Au over 10.0m from 249m highlighting higher grade mineralisation within the felsic unit in the northern part of the deposit.

- #123047 intersected 4.2 grams per tonne gold (“g/t Au”) over 72m from 235m including 6g/t gold over 10.3m from 247m and 13.1 g/t over 4m from 277m confirming the high-grade core in the central portion of Ikkari (see figure 3).

- #123055 intersected 1.7g/t Au over 52m from 108m confirm the continuity of mineralisation in an area of Inferred Mineral Resources within the felsic sediment unit to the west of the deposit . The hole also intersected 1.9g/t Au over 24m at depth from 424m including 8.4g/t Au over 1.0m and 8.8g/t Au over 2.0m up-dip from previously reported mineralisation at depth in the west of Ikkari.

- #123063 intersected 5.9 g/t over 9m from 540m (420m vertical) including 49.6 g/t Au over 1m extending the western plunging mineralisation at depth with a step out from hole #123026 (1.3g/t Au over 88.7m from 487.3m including 3.1g/t Au over 13.0m from 495m) reported earlier in the spring (see May 23, 2023 press release).

- #123080 intersected 1.3g/t Au over 43m from 565m (445m vertical) confirming the presence of wide zones of mineralisation beyond 450m vertical depth in the eastern parts of the deposit.

Ikkari North (0.5km north of Ikkari)

New drilling at Ikkari North successfully targeted the Eastern continuation of mineralisation hosted within an E-W structural corridor. Within this trend multiple intense breccia zones host gold and pyrite mineralisation. Drilling during the winter 2023 has extended the footprint of the mineralisation 200m to the east from previous drilling during the winter 2022 (see previous press release dated August 17, 2022).

- #123059 intersected 2.7g/t Au over 35.1m from 233.1m (165m vertical) including 56.6g/t Au over 1.0m

- #123069 intersected 1.1g/t Au over 14.6m from 291.4m including 4.3g/t Au over 0.5m

James Withall, CEO of Rupert Resources commented “Diamond drilling for the 2023/24 season has commenced on several targets with the base of till program set to resume in September after the summer break. The results published today highlight the potential of the mineralising system in Area 1 to yield more discoveries. A significant portion of the drilling in 2022/23 was allocated to infill drilling to upgrade the confidence level of Ikkari resource ahead of the upcoming pre-feasibility study; with this work behind us, the focus can switch back to exploration, both in Area 1 and along the 15km structural corridor extending eastwards from the multi-million ounce Ikkari discovery where new base of till and geophysical anomalies have been identified.”

Ikkari deposit drilling

The 2022/23 infill and exploration drill program at Ikkari successfully extended the mineralised envelope at depth to the west and across the strike extent of the deposit (see figures 2 & 3). Infill drilling successfully targeted areas of Inferred resource present within the open pit defined in the PEA and down to approximately 450m vertical depth. The database for assays to be included in an updated NI 43-101 MRE, the basis of a pre-feasibility study to be completed in H1 2024, was closed at the end of June 2023 and the aim is to complete the update in Q4 2023.

Ikkari North

The Ikkari North target was identified from the MT-IP survey conducted in spring 2022 and was the first discovery made in Area 1 that was not identified using Base of Till (“BoT”) sampling. The survey identified a strong north-dipping chargeability anomaly that projects towards surface approximately 500m to the north of the Ikkari deposit. The recent drilling has expanded the footprint of this discovery a further 200m to the east. Drilling at Ikkari North is constrained to the winter season and further follow-up drilling is restricted at this time.

2023/24 exploration campaign

The 2023/24 exploration drilling program has now commenced. Following a further update to our geological model and structural interpretation of Area 1, and the completion of the immediate requirements for Ikkari infill drilling, the focus of the drilling is returning to exploration. Figure 1 shows the drilling to date in the immediate area encompassing Ikkari, Ikkari North, Heina South and Heina Central.

Drilling to date outside of the Ikkari deposit has been limited and focused on testing surface anomalies identified through base of till drilling. The aim for the upcoming season is to systematically explore the potential extensions to the key mineralising structures identified from the updated geological model at Ikkari. The work in this area will include: extension testing of the Ikkari deposit to the west and along the contact with black shale to the east; potential for continuity between Ikkari North and Heina South and extensions of the Heina Central system southwards – See Figure 5.

Further exploration is also underway at a number of targets that have been identified along the original 20km domain boundary, the initial regional target structure identified in 2019. Base of till was completed on these targets as part of the 2022/23 programme and systematic drilling of these has now begun where access is possible in the summer and will be continued during the winter – See Figure 6.

Ikkari Project Update

The pre-feasibility study (“PFS”) for the Ikkari project has now begun and is being led by Rupert’s owner’s team and consultancy firm WSP. The PFS metallurgical test work is now underway and the mineral resource update for the Ikkari deposit should be concluded by the end of Q4 2023. In conjunction with the PFS our environmental impact assessment (“EIA”) programme work is also underway and feedback from stakeholders has recently been received allowing evaluation of additional work required to be incorporated into the preparation of the EIA report in mid-2024.

The Company has continued to add to the strength of the Ikkari development team with the recruitment of Tuula Roimaa as Principal Process Engineer. Tuula previously held the roles of Chief Metallurgist for Boliden’s Kevitsa base metals operation and Chief Metallurgist at Agnico Eagle’s Kittila mine and has extensive experience in both gold and base metals recovery.

Figures & tables

Figures and tables featured in the release include:

- Figure 1. Overview of relative locations of Ikkari and Ikkari North (plan view)

- Figure 2. Location of new drilling at Ikkari, plan map

- Figure 3a & 3b. Cross sections through Central Ikkari

- Figure 4. Location of new drilling at Ikkari North, plan map

- Figure 5. Rupert’s Area 1 2023/24 exploration plans.

- Figure 6. Rupert’s regional licence holding and 2023/24 exploration plans.

- Table 1. Collar locations of new drill holes in Ikkari

- Table 2. New Intercepts from drilling in Ikkari

- Table 3. Collar Location of new drill holes in Ikkari North

- Table 4. New Intercepts from drilling in Ikkari North

Geological interpretation

Ikkari was discovered using systematic regional exploration that initially focused on geochemical sampling of the bedrock/till interface through glacial till deposits of 5m to 40m thickness. No outcrop is present, and topography is dominated by low-lying swamp areas.

The Ikkari deposit occurs within rocks that have been regionally mapped as 2.05-2.15 billion years (“Ga”) old Savukoski group greenschist-metamorphosed mafic-ultramafic volcanic rocks, part of the Central Lapland Greenstone Belt (“CLGB”). Gold mineralisation is largely confined to the structurally modified unconformity at a significant domain boundary. Younger sedimentary lithologies are complexly interleaved, with intensely altered ultramafic rocks, and the mineralized zone is bounded to the north by a steeply N-dipping cataclastic zone. Within the mineralised zone lithologies, alteration and structure appear to be sub-vertical in contrast to wider Area 1 where lithologies generally dipping at a moderated angle to the north.

The main mineralized zone is strongly altered and characterised by intense veining and foliation that pervasively overprints original textures. An early phase of finely laminated grey ankerite/dolomite veins is overprinted by stockwork-like irregular siderite ± quartz ± chlorite ± sulphide veins. These vein arrays are often deformed with shear-related boudinage and in situ brecciation. Magnetite and/or haematite are common, in association with pyrite. Hydrothermal alteration commonly comprises quartz-dolomite-chlorite-magnetite (±haematite). Gold is hosted by disseminated and vein-related pyrite. Multi-phase breccias are well developed within the mineralised zone, with early silicified cataclastic phases overprinted by late, carbonate- iron-oxide- rich, hydrothermal breccias which display a subvertical control. All breccias frequently host disseminated pyrite, and are often associated with higher gold grades, particularly where magnetite or haematite is prevalent. In the sedimentary lithologies, albite alteration is intense and pervasive, with pyrite-magnetite (± gold) hosted in veinlets in brittle fracture zones.

Ikkari North is the characterised by broad, 100-200m wide intersections of fine-grained Savukoski sediments between mafic intrusive bodies. The sediments are pervasively carbonate altered and in places brecciated such that rafts of the wall rock occur in a carbonate matrix. Variable amounts of disseminated and semi-massive pyrite occurs at the contacts to preserved rafts of sediments within the matrix. Assays and observations of visible gold grains, indicate that these pyrite zones are variably mineralised with gold. Higher grade zones are associated with silica-sericite alteration and quartz veining that is confined to siltstone units within the larger brecciated domain.

Review by Qualified Person, Quality Control and Reports

Craig Hartshorne, a Chartered Geologist and a Fellow of the Geological Society of London, is the Qualified Person, as defined by National Instrument 43-101, responsible for the accuracy of scientific and technical information in this news release.

The majority of samples are prepared by ALS Finland in either Sodankylä or Outokumpu. Fire assays are subsequently completed in ALS Romania whilst multielement analysis is completed in Ireland or Sweden. A minority of samples are prepared by Eurofins Laboratory in Sodankylä and Fire Assay is carried out on site. A pulverised sub-sample is then sent to ALS Ireland for multi-element analysis. All samples are under watch from the drill site to the storage facility. Samples at both laboratories are assayed using 50g fire assay method with aqua regia digest and analysis by AAS for gold. Over limit analysis (>100 ppm Au) are conducted using fire assay and gravimetric finish. For multi-element assays, Ultra Trace Level Method by 4-Acid digest (HF-HNO3-HClO4 acid digestion, HCl leach) and a combination of ICP-MS and ICP-AES are used. The Company’s QA/QC program includes the regular insertion of blanks and standards into the sample shipments, as well as instructions for duplication. Standards, blanks and duplicates are inserted at appropriate intervals. Approximately five percent (5%) of the pulps and rejects are sent for check assaying at a second laboratory.

Results presented for Hole 123059 include results from screen fire assay as indicted in Table 4. Screen fire assays were requested due to the presence of coarse gold in the drill core and were performed by ALS Romania. Screen fire assays involve the screening of 1kg at 106 microns to separate the sample into a coarse fraction (>106μm) and a fine fraction (<106μm). After screening, two 50g sub-samples of the fine fraction are analysed using the normal 50g fire assay method with aqua regia digest and analysis by AAS for gold. The entire coarse fraction is assayed to determine the contribution of the coarse gold using fire assay and gravimetric finish. The “total” gold calculation for the 1kg sample is based on the weighted average of the coarse and fine fractions and is reported for the indicated samples.

Base of till samples are prepared in ALS Sodankylä by dry-sieving method prep-41 and assayed for gold by fire assay with ICP-AES finish. Multi-elements are assayed in ALS laboratories in either of Ireland, Romania or Sweden by aqua regia with ICP-MS finish. Rupert maintains a strict chain of custody procedure to manage the handling of all samples. The Company’s QA/QC program includes the regular insertion of blanks and standards into the sample shipments, as well as instructions for duplication.

About Rupert Resources

Rupert Resources is a gold exploration and development company listed on the TSX Exchange under the symbol “RUP.” The Company is focused on making and advancing discoveries of scale and quality with high margin and low environmental impact potential. The Company’s principal focus is Ikkari, a new high quality gold discovery in Northern Finland. Ikkari is part of the Company’s “Rupert Lapland Project,” which also includes the Pahtavaara gold mine, mill, and exploration permits (“Pahtavaara”). The Company also holds a 20% carried participating interest in the Gold Centre property located adjacent to the Red Lake mine in Ontario.

Neither the TSX Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Exchange) accepts responsibility for the adequacy or accuracy of this release.

1 Cautionary Note Regarding Forward Looking Statements

This press release contains statements which, other than statements of historical fact constitute “forward-looking statements” within the meaning of applicable securities laws, including statements with respect to: results of exploration activities and mineral resources. The words “may”, “would”, “could”, “will”, “intend”, “plan”, “anticipate”, “believe”, “estimate”, “expect” and similar expressions, as they relate to the Company, are intended to identify such forward-looking statements. Investors are cautioned that forward-looking statements are based on the opinions, assumptions and estimates of management considered reasonable at the date the statements are made, and are inherently subject to a variety of risks and uncertainties and other known and unknown factors that could cause actual events or results to differ materially from those projected in the forward-looking statements. These factors include the general risks of the mining industry, as well as those risk factors discussed or referred to in the Company's annual Management's Discussion and Analysis for the year ended February 28, 2023 availablehere. Should one or more of these risks or uncertainties materialize, or should assumptions underlying the forward-looking statements prove incorrect, actual results may vary materially from those described herein as intended, planned, anticipated, believed, estimated or expected. Although the Company has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking information, there may be other factors that cause actions, events or results not to be as anticipated, estimated or intended. There can be no assurance that such information will prove to be accurate as actual results and future events could differ materially from those anticipated in such statements. Any forward-looking statement speaks only as of the date on which it is made and, except as may be required by applicable securities laws, the Company does not intend, and does not assume any obligation to update any forward-looking statement, whether as a result of new information, future events or results or otherwise.

2 November 2022 Preliminary Economic Assessment and resource estimate for the Ikkari and Pahtavaara Projects.

The Mineral Resource estimate included in the Preliminary Economic Assessment (“Study” or “PEA” is reported according to the clarification criteria set out in the Canadian Institute of Mining, Metallurgy, and Petroleum Definition Standards for Mineral Resources and Reserves (“CIM Definition Standards”). These standards are internationally recognized and allow the reader to compare the Mineral Resource with that reported for similar project.

The results of the PEA will are set forth in an independent technical report prepared in accordance with National Instrument 43-101 Standards of Disclosure for Mineral Projects (“NI 43-101”) and which has been filed on SEDAR under the Company’s profile.

Readers are cautioned that the PEA is preliminary in nature and is intended to provide an initial assessment of the project’s economic potential and development options. The PEA mine schedule and economic assessment includes numerous assumptions and is based on both Indicated and Inferred Mineral Resources. Inferred Resources are considered too speculative geologically to have the economic considerations applied to them that would enable them to be categorized as mineral reserves, and there is no certainty that the PEA results will be realized. Mineral Resources are not Mineral Reserves and do not have demonstrated economic viability. Additional exploration will be required to potentially upgrade the classification of the Inferred Mineral Resources to be considered in future advanced studies.

The Mineral Resource estimate for the Project is reported in accordance with National Instrument 43-101 (“NI 43-101”) and has been estimated using the Canadian Institute of Mining, Metallurgy and Petroleum (“CIM”) “Estimation of Mineral Resources and Mineral Reserves Best Practice Guidelines”. The independent and qualified person for the Mineral Resource Estimates as defined by NI43-101 is Brian Wolfe, Principal Consultant, International Resource Solutions Pty Ltd. These are mineral resources not mineral reserves as they do not have demonstrated economic viability. Results are presented in situ. Ounce (troy) = metric tonnes x grade / 31.103475. Calculations used metric units (meters, tonnes, g/t). Any discrepancies in the totals are due to rounding effects.

The effective date of the 2022 Mineral Resource Estimate for Ikkari is 28 November 2022. The Mineral Resource Estimate at Ikkari is calculated using the multiple indicator kriging (MIK) method and is reported both within a designed open pit and as a potential underground operation outside that. The Mineral Resource Estimate at Ikkari is reported using a cutoff grade of 0.5g/t Au for mineralisation potentially mineable by open pit methods and 1.0g/t Au for mineralisation potentially extractable by underground methods. The potential open pit mine and cut off-grade is calculated using a gold price at $1650 per ounce, 5% mining dilution, 95% Au recovery. Open pit mining costs at $2.5/t, process costs at $11.3/t, other costs (including co-disposal, water and closure) at $4.0/t and G&A, including royalties and refining at $3.2/t. The calculated cutoff grade is rounded up to 0.5g/t for reporting. The underground cutoff grade is calculated at underground mining cost $21.8/t and underground mining dilution at 8% based on sub level caving. The calculated underground cutoff grade is rounded up to 1.0g/t as the resource is not constrained within mineable shapes.

The effective date of the 2022 Mineral Resource Estimate for Pahtavaara is 28 November 2022 and the is calculated using the multiple indicator kriging (MIK) method. The Mineral Resource Estimate is reported both within a designed open pit and as a potential underground operation outside that. The Mineral Resource Estimate at Pahtavaara is reported using a cutoff grade of 0.5g/t Au for mineralisation potentially mineable by open pit methods and 1.5g/t Au for mineralisation potentially extractable by underground methods. The potential open pit mine and cut off-grades are calculated using a gold price at $1650 per ounce, 20% mining dilution, 89% Au recovery, and a mining cost at $2.6/t. process cost at $10.2/t (concentration at Pahtavaara and transport to Ikkari), other costs (including TSF costs and closure) at $1/t and G&A including royalties and refining at $3.1/t. The calculated cutoff grade is rounded up to 0.5g/t for reporting. The underground cutoff grade is calculated at an underground mining cost $49.6/t and underground mining dilution at 10% based on long hole open stoping. The calculated underground cutoff grade is rounded up to 1.5g/t for reporting.

The effective date of the 2022 Mineral Resource Estimate for Heinä Central is 28 November 2022 and is calculated using the ordinary kriging (OK) method. The Mineral Resource Estimate is reported both within an optimised open pit and as a potential underground operation outside that. The Mineral Resource Estimate is reported at a 0.5g/t Au cutoff grade for mineralisation potentially mineable by open pit methods and at 1.2g/t Au for mineralisation potentially extractable by underground methods. The potential open pit mine and cutoff grade are calculated using a gold price at $1650/oz, 5% mining dilution, 78% Au recovery. Open pit mining costs at $2.5/t, process costs at $10.01/t (concentrate production at Heinä and transport to Ikkari), other costs (including TSF and closure) at $3.20/t and G&A including royalties and refining at $1.66/t. The calculated open pit cutoff grade is rounded up to 0.5g/t for reporting. The underground cutoff grade is calculated at underground mining cost $30/t and underground mining dilution of 5%. The calculated underground cut of grade is rounded up to $1.2g/t for reporting. The Heinä Central deposit also contains potentially recoverable copper. At the 0.5g/t Au cut-off grade for mineralisation potentially mineable by open pit methods Heinä Central also contains 12,000 tonnes of in situ copper. At the 1.2g/t Au cut-off grade for mineralisation potentially mineable by underground methods, Heinä Central also contains 1,800 tonnes of in situ copper. No economic value is applied to the copper content when designing the optimised open pit or calculating the potential cut-off grade at Heinä Central.

APPENDIX | |||||||

Table 1. Collar locations of new drill holes, Ikkari | |||||||

Hole ID | Prospect | Easting | Northing | Elevation | Azimuth | Dip | EOH (m) |

123027 | Ikkari | 453820.6 | 7497065.9 | 225.0 | 155.3 | -56.7 | 702.70 |

123036 | Ikkari | 453686.4 | 7496971.7 | 226.6 | 155.3 | -49.9 | 580.50 |

123039 | Ikkari | 453627.2 | 7496996.1 | 227.9 | 157.1 | -49.4 | 407.20 |

123044 | Ikkari | 453539.6 | 7496993.3 | 228.1 | 153.2 | -50.2 | 619.20 |

123047 | Ikkari | 454087.3 | 7497060.8 | 223.3 | 155.6 | -61.0 | 502.60 |

123055 | Ikkari | 453781.9 | 7496961.0 | 225.4 | 155.0 | -52.2 | 500.20 |

123056 | Ikkari | 453701.2 | 7496940.8 | 226.4 | 152.4 | -50.3 | 562.30 |

123063 | Ikkari | 453651.4 | 7496954.6 | 226.8 | 157.9 | -49.8 | 635.00 |

123070 | Ikkari | 454146.1 | 7496653.7 | 225.7 | 335.2 | -52.3 | 149.50 |

123072 | Ikkari | 454346.2 | 7496603.2 | 233.6 | 335.5 | -56.4 | 690.00 |

123077* | Ikkari | 454315.7 | 7496572.1 | 233.7 | 334.9 | -56.1 | 544.70 |

123077K1** | Ikkari | 454316.3 | 7496572.1 | 233.7 | 334.9 | -56.1 | 738.00 |

123080 | Ikkari | 454418.4 | 7496637.8 | 234.5 | 335.3 | -56.0 | 650.80 |

123081 | Ikkari | 454183.9 | 7496571.2 | 228.5 | 334.9 | -69.0 | 812.10 |

123082* | Ikkari | 454388.8 | 7496606.4 | 234.9 | 335.2 | -57.5 | 580.50 |

*Hole abandoned short of target

** Hole 123077K1 was drilled as a wedge hole from 123077 starting from 520m

Table 2. New Intercepts from Ikkari | ||||

Hole ID | From | To | Interval | Grade Au |

123027 | 220.00 | 221.00 | 1.0 | 1.8 |

228.00 | 280.00 | 52.0 | 2.1 | |

Including | 230.00 | 232.00 | 2.00 | 6.6 |

Including | 249.00 | 259.00 | 10.00 | 4.4 |

also includes | 251.00 | 252.00 | 1.00 | 10.6 |

297.00 | 303.00 | 6.00 | 4.0 | |

Including | 302.00 | 303.00 | 1.00 | 21.6 |

320.00 | 323.00 | 3.00 | 1.0 | |

329.00 | 345.00 | 16.00 | 1.0 | |

Including | 342.00 | 343.00 | 1.00 | 4.5 |

353.00 | 363.00 | 10.00 | 0.6 | |

Including | 360.00 | 361.00 | 1.00 | 2.4 |

375.00 | 382.00 | 7.00 | 0.4 | |

404.00 | 406.00 | 2.00 | 2.0 | |

456.00 | 457.00 | 1.00 | 1.4 | |

477.00 | 478.80 | 1.80 | 0.8 | |

486.00 | 492.00 | 6.00 | 0.6 | |

Including | 486.00 | 487.00 | 1.00 | 2.5 |

506.00 | 509.00 | 3.00 | 1.1 | |

527.00 | 539.00 | 12.00 | 0.8 | |

Including | 527.00 | 530.00 | 3.00 | 1.2 |

Including | 536.00 | 539.00 | 3.00 | 1.8 |

548.00 | 559.00 | 11.00 | 0.7 | |

Including | 557.00 | 558.00 | 1.00 | 2.3 |

565.00 | 568.00 | 3.00 | 4.5 | |

Including | 565.00 | 566.00 | 1.00 | 9.5 |

582.00 | 585.00 | 3.00 | 0.4 | |

590.00 | 592.00 | 2.00 | 0.6 | |

624.00 | 625.00 | 1.00 | 1.2 | |

634.00 | 635.00 | 1.00 | 2.1 | |

662.00 | 664.00 | 2.00 | 1.6 | |

672.00 | 676.00 | 4.00 | 0.5 | |

123036 | 130.90 | 133.00 | 2.10 | 0.6 |

167.00 | 174.00 | 7.00 | 0.7 | |

183.00 | 186.00 | 3.00 | 0.9 | |

196.00 | 215.00 | 19.00 | 0.9 | |

Including | 204.00 | 210.00 | 6.00 | 1.6 |

233.00 | 235.00 | 2.00 | 0.5 | |

262.00 | 288.00 | 26.00 | 1.8 | |

Including | 266.00 | 271.00 | 5.00 | 5.9 |

418.00 | 432.00 | 14.00 | 1.1 | |

Including | 419.00 | 420.00 | 1.00 | 3.2 |

Including | 426.00 | 427.00 | 1.00 | 4.3 |

508.00 | 519.00 | 11.00 | 1.0 | |

Including | 508.00 | 510.00 | 2.00 | 4.1 |

123039 | 308.00 | 313.00 | 5.00 | 0.6 |

335.00 | 341.00 | 6.00 | 0.6 | |

349.00 | 359.00 | 10.00 | 0.8 | |

Including | 358.00 | 359.00 | 1.00 | 3.3 |

371.00 | 377.00 | 6.00 | 2.7 | |

385.00 | 386.00 | 1.00 | 1.6 | |

400.00 | 404.00 | 4.00 | 1.5 | |

123044 | 167.00 | 176.00 | 9.00 | 0.6 |

193.00 | 194.00 | 1.00 | 1.0 | |

241.00 | 242.00 | 1.00 | 1.2 | |

347.00 | 352.00 | 5.00 | 0.6 | |

Including | 351.00 | 352.00 | 1.00 | 2.2 |

366.00 | 369.00 | 3.00 | 0.8 | |

418.00 | 419.00 | 1.00 | 1.2 | |

457.00 | 460.00 | 3.00 | 0.5 | |

514.00 | 515.00 | 1.00 | 1.0 | |

617.00 | 619.00 | 2.00 | 1.6 | |

123047 | 188.00 | 191.00 | 3.00 | 2.0 |

Including | 190.00 | 191.00 | 1.00 | 4.6 |

235.00 | 307.00 | 72.00 | 4.2 | |

Including | 240.00 | 241.00 | 1.00 | 15.6 |

and | 247.00 | 253.00 | 6.00 | 10.3 |

and | 259.00 | 260.00 | 1.00 | 10.1 |

and | 277.00 | 281.00 | 4.00 | 13.1 |

also includes | 280.00 | 281.00 | 1.00 | 27.2 |

and | 298.00 | 299.00 | 1.00 | 24.7 |

341.00 | 344.00 | 3.00 | 1.2 | |

Including | 341.00 | 342.00 | 1.00 | 2.8 |

354.00 | 371.00 | 17.00 | 1.1 | |

Including | 354.00 | 355.00 | 1.00 | 3.5 |

and | 370.00 | 371.00 | 1.00 | 7.3 |

378.00 | 420.00 | 42.00 | 0.9 | |

Including | 386.00 | 390.00 | 4.00 | 2.8 |

and | 402.00 | 408.00 | 6.00 | 2.4 |

also includes | 404.00 | 405.00 | 1.00 | 9.1 |

427.00 | 435.00 | 8.00 | 1.0 | |

483.00 | 485.00 | 2.00 | 1.1 | |

123055 | 99.00 | 102.00 | 3.00 | 0.6 |

108.00 | 160.00 | 52.00 | 1.7 | |

Including | 155.00 | 158.00 | 3.00 | 9.0 |

167.00 | 169.00 | 2.00 | 0.8 | |

177.00 | 192.00 | 15.00 | 0.6 | |

Including | 184.00 | 185.00 | 1.00 | 2.0 |

and | 189.00 | 190.00 | 1.00 | 2.1 |

207.00 | 211.00 | 4.00 | 0.5 | |

218.00 | 225.00 | 7.00 | 0.7 | |

Including | 218.00 | 219.00 | 1.00 | 2.0 |

268.00 | 282.00 | 14.00 | 0.7 | |

280.10 | 281.00 | 0.90 | 4.0 | |

424.00 | 448.00 | 24.00 | 1.9 | |

Including | 428.00 | 429.00 | 1.00 | 8.4 |

and | 444.00 | 446.00 | 2.00 | 8.8 |

123056 | 107.00 | 108.00 | 1.00 | 1.4 |

128.00 | 130.00 | 2.00 | 0.5 | |

150.00 | 152.00 | 2.00 | 0.7 | |

155.00 | 163.00 | 8.00 | 0.4 | |

197.00 | 198.00 | 1.00 | 1.0 | |

335.00 | 336.00 | 1.00 | 1.1 | |

516.00 | 517.00 | 1.00 | 2.2 | |

527.00 | 532.00 | 5.00 | 0.9 | |

551.00 | 553.00 | 2.00 | 0.6 | |

123063 | 45.00 | 46.00 | 1.00 | 2.8 |

170.00 | 178.00 | 8.00 | 0.4 | |

Including | 173.00 | 174.00 | 1.00 | 1.5 |

183.00 | 184.00 | 1.00 | 1.2 | |

198.00 | 204.00 | 6.00 | 5.1 | |

Including | 198.00 | 199.00 | 1.00 | 29.1 |

212.00 | 226.00 | 14.00 | 0.6 | |

Including | 212.00 | 213.00 | 1.00 | 2.9 |

239.00 | 249.00 | 10.00 | 0.8 | |

Including | 245.00 | 246.00 | 1.00 | 3.2 |

256.50 | 257.00 | 0.50 | 3.9 | |

287.00 | 299.00 | 12.00 | 1.5 | |

Including | 290.00 | 291.00 | 1.00 | 3.7 |

and | 293.00 | 295.00 | 2.00 | 3.4 |

323.00 | 325.00 | 2.00 | 0.7 | |

520.60 | 524.00 | 3.40 | 1.1 | |

529.00 | 534.00 | 5.00 | 2.0 | |

Including | 531.00 | 532.00 | 1.00 | 4.2 |

540.00 | 549.00 | 9.00 | 5.9 | |

Including | 540.00 | 541.00 | 1.00 | 49.6 |

123070 | NSI | |||

123072 | 358.00 | 360.00 | 2.00 | 2.9 |

Including | 358.00 | 359.00 | 1.00 | 5.1 |

471.00 | 474.00 | 3.00 | 1.0 | |

Including | 471.00 | 471.50 | 0.50 | 2.8 |

549.00 | 563.00 | 14.00 | 1.7 | |

Including | 560.00 | 563.00 | 3.00 | 5.2 |

575.00 | 611.00 | 36.00 | 0.8 | |

Including | 576.00 | 577.00 | 1.00 | 3.2 |

and | 596.00 | 597.00 | 1.00 | 6.6 |

123077 | 380.00 | 382.00 | 2.00 | 1.3 |

475.00 | 476.00 | 1.00 | 3.5 | |

492.00 | 495.00 | 3.00 | 0.9 | |

501.00 | 505.00 | 5.00 | 0.5 | |

123077K1 | 586.00 | 603.00 | 17.00 | 0.8 |

Including | 586.00 | 587.00 | 1.00 | 2.9 |

and | 594.00 | 599.00 | 5.00 | 1.6 |

617.00 | 618.00 | 1.00 | 3.1 | |

626.00 | 638.00 | 12.00 | 1.7 | |

Including | 626.00 | 627.00 | 1.00 | 8.4 |

and | 637.00 | 638.00 | 1.00 | 7.1 |

649.00 | 650.00 | 1.00 | 2.6 | |

661.00 | 662.00 | 1.00 | 1.0 | |

123080 | 312.00 | 313.00 | 1.00 | 1.7 |

367.00 | 368.00 | 1.00 | 1.8 | |

396.00 | 398.00 | 2.00 | 3.5 | |

Including | 396.00 | 397.00 | 1.00 | 5.1 |

411.00 | 412.00 | 1.00 | 1.1 | |

422.00 | 424.00 | 2.00 | 1.1 | |

442.00 | 443.00 | 1.00 | 3.0 | |

463.00 | 471.00 | 8.00 | 0.5 | |

565.00 | 608.00 | 43.00 | 1.3 | |

Including | 572.00 | 573.00 | 1.00 | 7.6 |

and | 590.00 | 590.60 | 0.60 | 6.2 |

and | 595.00 | 606.00 | 11.00 | 2.5 |

also includes | 595.00 | 597.00 | 2.00 | 6.1 |

123081 | 508.00 | 509.00 | 1.00 | 1.5 |

644.00 | 645.00 | 1.00 | 3.3 | |

654.00 | 658.00 | 4.00 | 1.1 | |

663.50 | 669.00 | 5.50 | 0.8 | |

Including | 663.50 | 664.00 | 0.50 | 3.6 |

681.00 | 684.00 | 3.00 | 0.7 | |

711.00 | 717.00 | 6.00 | 0.8 | |

Including | 712.00 | 714.00 | 2.00 | 1.7 |

724.00 | 725.00 | 1.00 | 3.8 | |

736.00 | 737.00 | 1.00 | 3.6 | |

123082 | 271.00 | 272.00 | 1.00 | 2.0 |

488.00 | 499.00 | 11.00 | 0.4 | |

Including | 489.00 | 490.00 | 1.00 | 1.0 |

and | 495.00 | 496.00 | 1.00 | 1.6 |

574.45 | 560.00 | 12.55 | 0.7 | |

Including | 556.00 | 557.00 | 1.00 | 2.8 |

No upper cut-off grade has been applied. 0.4g/t Au lower cut-off applied, a maximum of 5m internal dilution has been allowed when calculating intercepts. All intervals over the cut-off grade and exceeding 1gram-meter are presented here. Italic intervals indicate intercepts including within the wider intercept. Unless specified, true widths cannot be accurately determined from the information available. Bold intervals referred to in text of release. Refer to https://rupertresources.com/news/ for details of previously released drilling intercepts. EOH– End of Hole. NSI – No significant intercept

Table 3. Collar locations of new drill holes, Ikkari North | |||||||

Hole ID | Prospect | Easting | Northing | Elevation | Azimuth | Dip | EOH (m) |

123059 | Ikkari N | 454120.3 | 7497838.5 | 225.0 | 153.8 | -55.4 | 245.40 |

123060 | Ikkari N | 453932.1 | 7497696.4 | 224.4 | 156.5 | -54.3 | 215.50 |

123061 | Ikkari N | 454016.5 | 7497706.3 | 224.2 | 154.3 | -55.4 | 234.30 |

123062 | Ikkari N | 454183.5 | 7497703.1 | 224.4 | 154.7 | -56.1 | 206.90 |

123064 | Ikkari N | 453957.2 | 7497833.7 | 226.6 | 155.4 | -50.8 | 314.80 |

123065 | Ikkari N | 454156.3 | 7497856.1 | 225.6 | 154.6 | -50.0 | 437.90 |

123066 | Ikkari N | 454239.7 | 7497856.6 | 225.6 | 154.1 | -49.7 | 151.70 |

123067 | Ikkari N | 454084.2 | 7497916.2 | 226.5 | 155.6 | -50.5 | 541.50 |

123068 | Ikkari N | 454100.9 | 7497785.7 | 224.8 | 155.1 | -55.1 | 230.50 |

123069 | Ikkari N | 454139.8 | 7497891.1 | 226.2 | 152.8 | -49.5 | 317.00 |

123071 | Ikkari N | 454204.9 | 7497865.1 | 225.8 | 197.6 | -55.6 | 350.60 |

123073 | Ikkari N | 454257.6 | 7497811.3 | 225.2 | 188.5 | -54.7 | 512.40 |

123076 | Ikkari N | 454286.2 | 7497708.5 | 224.2 | 188.6 | -49.9 | 302.40 |

123078 | Ikkari N | 454373.8 | 7497666.4 | 224.0 | 186.8 | -50.1 | 302.60 |

123079 | Ikkari N | 454093.2 | 7497731.0 | 224.4 | 145.3 | -44.4 | 350.20 |

Table 4. New Intercepts from Ikkari North | ||||

Hole ID | From | To | Interval | Grade Au |

123059 | 176.00 | 183.00 | 7.00 | 0.8 |

Including | 176.00 | 177.00 | 1.00 | 3.0 |

193.00 | 194.00 | 1.00 | 0.5 | |

198.00 | 233.10 | 35.10 | 2.7* | |

Including | 198.00 | 223.00 | 25.00 | 3.7* |

also includes | 199.00 | 200.00 | 1.00 | 56.6* |

123060 | 123.00 | 124.00 | 1.00 | 0.6 |

134.00 | 135.00 | 1.00 | 2.1 | |

123061 | 66.00 | 67.00 | 1.00 | 0.5 |

131.00 | 135.00 | 5.00 | 0.5 | |

Including | 131.00 | 132.00 | 1.00 | 1.1 |

and | 135.00 | 136.00 | 1.00 | 1.2 |

149.00 | 151.00 | 2.00 | 3.0 | |

123062 | 100.00 | 101.00 | 1.00 | 2.2 |

118.00 | 121.20 | 3.20 | 1.9 | |

144.00 | 145.00 | 1.00 | 1.1 | |

123064 | 253.00 | 262.55 | 9.55 | 0.7 |

Including | 254.00 | 255.00 | 1.00 | 2.1 |

and | 257.10 | 258.00 | 0.90 | 2.5 |

123065 | 91.00 | 95.00 | 4.00 | 0.6 |

236.00 | 238.00 | 2.00 | 0.6 | |

247.00 | 250.00 | 3.00 | 0.5 | |

260.00 | 262.00 | 2.00 | 1.2 | |

319.00 | 321.00 | 2.00 | 1.4 | |

329.00 | 330.00 | 1.00 | 0.4 | |

331.00 | 332.00 | 1.00 | 0.7 | |

123066 | NSI | |||

123067 | 27.00 | 27.60 | 0.60 | 0.4 |

92.00 | 93.00 | 1.00 | 0.5 | |

284.80 | 289.00 | 4.20 | 2.0 | |

Including | 288.00 | 289.00 | 1.00 | 6.3 |

312.00 | 313.00 | 1.00 | 0.6 | |

509.00 | 519.00 | 10.00 | 0.5 | |

522.00 | 523.00 | 1.00 | 0.7 | |

528.00 | 529.00 | 1.00 | 0.5 | |

123068 | 80.00 | 81.00 | 1.00 | 5.9 |

165.00 | 173.00 | 8.00 | 2.0 | |

Including | 165.00 | 167.00 | 2.00 | 6.4 |

123069 | 291.40 | 306.00 | 14.60 | 1.1 |

Including | 296.50 | 302.00 | 5.50 | 2.2 |

also includes | 296.50 | 297.00 | 0.50 | 4.3 |

123071 | 18.20 | 19.20 | 1.00 | 0.6 |

105.00 | 106.50 | 1.50 | 1.5 | |

245.00 | 249.00 | 4.00 | 0.6 | |

269.00 | 270.00 | 1.00 | 0.7 | |

312.00 | 313.00 | 1.00 | 0.6 | |

123073 | 185.00 | 186.00 | 1.00 | 0.5 |

197.00 | 198.00 | 1.00 | 0.4 | |

346.00 | 352.00 | 6.00 | 0.5 | |

358.00 | 359.00 | 1.00 | 0.5 | |

365.00 | 369.00 | 4.00 | 1.7 | |

123076 | 70.00 | 71.00 | 1.00 | 0.8 |

123078 | NSI | |||

123079 | 31.00 | 32.00 | 1.00 | 1.2 |

*Results from Screen Fire Assays

No upper cut-off grade has been applied. 0.4g/t Au lower cut-off applied, a maximum of 3m internal dilution has been allowed when calculating intercepts. All intervals over the cut-off grade are presented here. Italic intervals indicate intercepts including within the wider intercept. Unless specified, true widths cannot be accurately determined from the information available. Bold intervals referred to in text of release. Refer to https://rupertresources.com/news/ for details of previously released drilling intercepts. EOH– End of Hole. NSI – No significant intercept

View source version on businesswire.com:https://www.businesswire.com/news/home/20230816303158/en/

CONTACT: For further information:James Withall

Chief Executive Officer

jwithall@rupertresources.comThomas Credland

Head of Corporate Development

tcredland@rupertresources.comRupert Resources Ltd

82 Richmond Street East, Suite 203, Toronto, Ontario M5C 1P1

Tel: +1 416-304-9004

Web:http://rupertresources.com/

KEYWORD: NORTH AMERICA CANADA

INDUSTRY KEYWORD: MINING/MINERALS NATURAL RESOURCES

SOURCE: Rupert Resources

Copyright Business Wire 2023.

PUB: 08/16/2023 07:00 AM/DISC: 08/16/2023 07:01 AM

http://www.businesswire.com/news/home/20230816303158/en