CHICAGO--(BUSINESS WIRE)--Aug 31, 2023--

Rent Butter, the first advanced tenant screening solution designed specifically for workforce and affordable housing, today announced the completion of its seed financing round. The $3-million round was led by RET Ventures (‘RET’), an industry-backed venture fund focused on single and multi-family real estate technology. RET’s investment comes from the RET Ventures ESG Fund (the “Housing Impact Fund”), which invests in technologies that benefit real estate operators while advancing social or environmental goals.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20230831874981/en/

(Graphic: Business Wire)

Founded by Chris Rankin and Tom Raleigh in 2021, Rent Butter was built to help owners and operators of workforce and affordable housing communities better assess risk when screening potential residents. The workforce housing industry includes multifamily, single family and manufactured housing. Traditionally, owners vetting rental applicants have relied primarily on static data like credit scores and background checks, which provide only a partial picture of renters’ financial footing. Rent Butter has seen significant traction since its founding, with properties comprising more than 100,000 residential units utilizing the solution. The company has plans to expand its product offering and customer base into conventional Class A and B multifamily and single-family rentals in 2023.

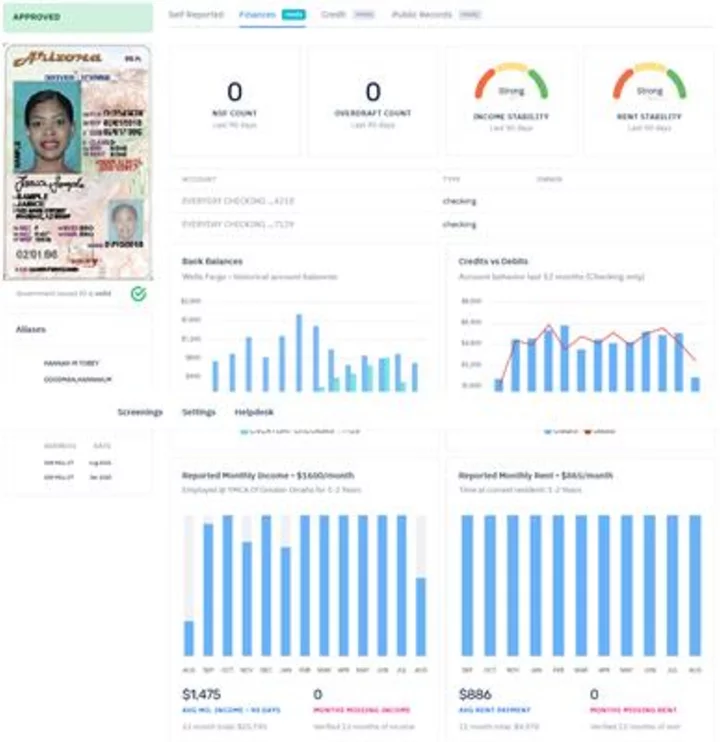

Rent Butter’s digital application allows applicants to transcend the static credit score by sharing alternative data like banking, behavior & other unique metrics, and then provides property owners with in-depth financial and credit behavior reports in a matter of seconds. By reviewing the entire financial history of a prospective resident and using predictive analytics, Rent Butter highlights key trends — such as whether their credit score is rising or getting worse — enabling property operators to make more accurate and equitable assessments of individuals’ ability to pay rent. The platform also validates important documents like applicant I.D.s, employment, and income in real-time to protect owners against fraud.

“When founding Rent Butter, our main goal was to create an alternative to the antiquated tenant screening process and to empower property owners with a more dynamic, complete picture of an applicant’s financial status and history – reducing turnover and at the same time opening the door for potential renters who may have otherwise been turned away,” said Tom Raleigh, Co-Founder and CEO of Rent Butter. “As we continue to grow our customer base, we’re thrilled to have a partner like RET Ventures who understands our mission and is so deeply entrenched in the industry. This investment will allow us to expand our team and continue to refine our product and integration capabilities.”

Rent Butter has emerged as an essential tool that not only de-risks the leasing process for property owners but also helps applicants who may have been denied housing previously due to poor credit history build a financial resume. By allowing owners to underwrite risk based on alternative data like banking reports, credit behavior analyses, and true income/expense ratios, Rent Butter empowers them to make more informed renting decisions. Rent Butter is also working to create a better leasing experience by fitting seamlessly within property managers’ existing workflows.

“Rent Butter’s approach to the tenant screening process aligns perfectly with the mission of our Housing Impact Fund, and its ability to improve both the owner and resident experience makes it an ideal investment for us,” said Aaron Ru, Principal at RET Ventures. “The platform’s in-depth financial reporting methods coupled with its easy-to-use interface delivers instant value to owners looking to enhance their leasing operations, and to renters who may be struggling to find housing. Just two years after its founding, Rent Butter has already made significant strides on product development and market penetration, and we look forward to backing them as they enter this next phase of growth.”

Added Chris Rankin, Co-Founder and CTO of Rent Butter: “As we continue our national expansion, I’m looking forward to arming even more multifamily owners with the insights needed to make the most informed assessments while giving prospective tenants credit for their overall financial behavior . With the support of the incredible team at RET Ventures, I am confident that we can help create a more equitable future for the real estate industry.”

About Rent Butter

Rent Butter is the first advanced tenant screening solution designed specifically for owners and operators of Class B and C multifamily housing. Founded in 2021, Rent Butter was created to empower multifamily property owners to better assess risk when screening potential tenants while helping renters build a financial resume. The digital application provides owners with in-depth banking and credit behavior reports, instantly validates important identification documents, seamlessly integrates with existing CRMs, and helps reduce eviction and turnover at multifamily properties. For more information, please visit: https://rentbutter.com/ or see their video here: https://vimeo.com/813308910/576a7a4022

About RET Ventures

A leading real estate technology investment firm, RET Ventures is the first industry-backed, early-stage venture fund strategically focused on building cutting-edge "rent tech" — technology for multifamily and single-family rental real estate. RET invests out of core venture funds and a Housing Impact Fund, backing companies that address a range of pain points for real estate operators.

Through its deep expertise and connections, RET provides solutions to issues ranging from housing affordability and sustainability to risk management and operational efficiency.

The firm's Strategic Investors include some of the largest REITs and private real estate owner-operators and managers, who control over 2.5 million rental units worth $600 billion.

For more information, please visit www.ret.vc

View source version on businesswire.com:https://www.businesswire.com/news/home/20230831874981/en/

CONTACT: MEDIA CONTACT

Shlomo Morgulis

Antenna | Spaces

retventures@antennagroup.com

KEYWORD: ILLINOIS UNITED STATES NORTH AMERICA

INDUSTRY KEYWORD: PROFESSIONAL SERVICES DATA MANAGEMENT DATA ANALYTICS TECHNOLOGY RESIDENTIAL BUILDING & REAL ESTATE SOFTWARE CONSTRUCTION & PROPERTY

SOURCE: Rent Butter

Copyright Business Wire 2023.

PUB: 08/31/2023 03:26 PM/DISC: 08/31/2023 03:26 PM

http://www.businesswire.com/news/home/20230831874981/en