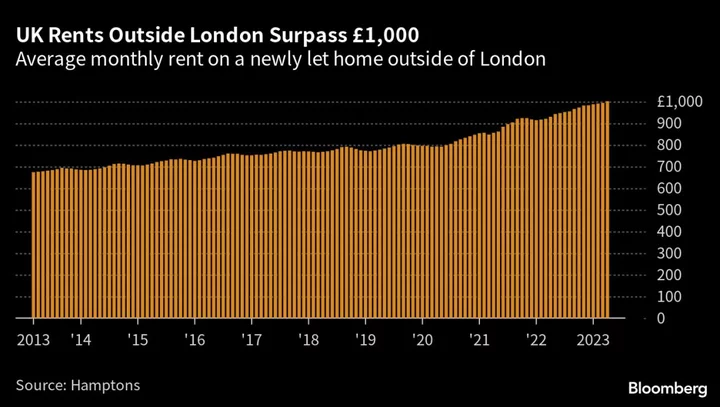

Spending four figures a month on rent is a typical sacrifice for Londoners. Now it’s becoming the norm for the rest of the UK.

The average monthly rent on a newly let home outside of London surpassed £1,000 ($1,253) for the first time in April, according to a report from broker Hamptons International. That’s almost 8% higher than the same month last year, piling more pressure on tenants in the midst of a cost-of-living crisis.

“With rents on the open market rising quickly, tenants will face the choice of staying put or moving to a smaller home in a more affordable area,” said Aneisha Beveridge, head of research at Hamptons. “While anyone choosing to sit tight tends to face smaller rental increases than those moving home, they are not immune.”

Britain’s housing market is facing disruption in the wake of higher borrowing costs and the threat of a house price plunge. More than 1.4 million Britons will be forced to refinance their mortgages this year at a significantly higher rate, as the Bank of England sticks with its unprecedented rate-increase cycle.

Read more: BOE Raises Key Rate to 4.5%, Signaling More Hikes May Follow

That’s as wannabe homeowners remain trapped in the red-hot rental market, watching their monthly bills rise and mortgage deals move further out of reach. Rents across the whole of Britain have risen more than 25% since the start of the pandemic, according to Hamptons, meaning tenants are coughing up almost £3,000 more a year.

Rent increases in the capital are breaking records too. The average monthly rent in Greater London rose 17% in a year to surpass £2,200 for the first time in April, adding an extra £3,895 burden on tenants.

Meanwhile, the gap between inner and outer London rents widened to over £1,100 last month from just £221 in June 2021, the report said. This signals a reversal of the Covid-driven shift to the outskirts of the city, where tenants could access more living space and find cheaper deals.

The sharp increase in the price of a home loan has piled pressure on landlords. They are more exposed to pricier mortgages than other borrowers because most are on interest-only deals, which are more sensitive to rate increases. The Renters’ Reform Bill — an eagerly-awaited piece of legislation that is set to be published in the coming weeks — is likely to limit how often landlords can hike monthly payments, while making it more difficult to evict unwanted tenants.

Still, the outlook is rosier for Britain’s richest rental investors. Grainger Plc — the nation’s largest listed residential landlord — last week boosted its dividend by 10%, attributing a surge in rental income to an “institutional-landlord-friendly investment landscape.”

“Affordability constraints will likely hit the brakes on rental growth at some point this year,” Hamptons’ Beveridge said. “However, it’s unlikely to slow considerably due to the number of landlords looking to pass on their rising costs.”