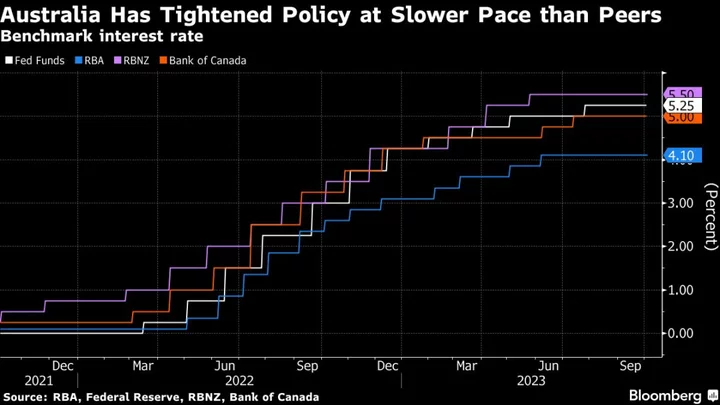

Australia’s most aggressive monetary policy tightening in about three decades is working to cool inflation, though lags in transmission mean the full effects of interest-rate increases to-date are still to be felt.

As the Reserve Bank’s 4 percentage points of hikes since May 2022 work their way through the economy, they “will provide further impetus to lower inflation in the period ahead,” Assistant Governor Chris Kent said in a speech at Bloomberg’s office in Sydney on Wednesday.

“The board is paying close attention to economic developments here and overseas, and some further tightening of monetary policy may be required to ensure that inflation, which is still too high, returns to target in a reasonable timeframe,” Kent said.

His comments come amid expectations the RBA, like global counterparts, is approaching the end of its tightening cycle. The RBA is in watch-and-wait mode, having kept the cash rate at a more than 11-year high of 4.1% at its past four meetings.

Since May last year, household mortgage payments – interest plus scheduled principal repayments – have risen to almost 10% of household disposable income from around 7%.

“This is above estimates of the peak reached in 2008 when the cash rate was 7.25%,” Kent said.

“Required mortgage payments are at a record share of household disposable income and will rise further as more fixed-rate loans expire,” he said.

Roughly half of the loans that were fixed during the pandemic have already rolled off onto higher rates since the central bank began tightening around 18 months ago, with most borrowers managing the transition well, RBA research published last week showed.

Kent highlighted five key channels through which monetary policy affects economic activity:

- Cash-flow channel where households pay more on their debt and earn more on their savings

- Intertemporal substitution: where households and businesses have a greater incentive to save than spend

- Asset-price channel, with Kent pointing to various estimates that each 1% decline in wealth results in a fall in consumption of around 0.1%–0.2%

- Credit channel where the supply of loans and availability of funding to business are reduced

- Exchange rate channel, with Kent saying tighter monetary policy has helped to support the Australian dollar in the face of other global influences that have weighed on the currency

Economists expect the RBA to hike once more to take the cash rate to 4.35%, while financial market pricing shows about a 50% chance of another move.

Data on Australia’s A$2.3 trillion ($1.5 trillion) economy has been mixed. Figures out Tuesday showed businesses are coping better with higher borrowing costs than households, with consumer sentiment in “deeply pessimistic” territory.

The labor market has proved resilient with the unemployment rate hovering near its lowest level since the 1970s over the past year. At the same time, Australia’s housing market has seen a surprising rebound in prices.