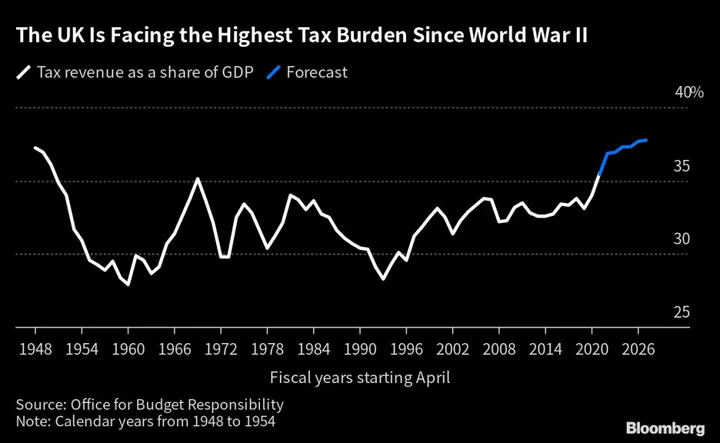

The UK government should raise taxes to help the Bank of England tame soaring prices if it’s serious about cutting inflation in half this year, according to Standard Chartered’s head of research for Europe and the Americas.

Sarah Hewin said Chancellor of the Exchequer Jeremy Hunt should consider “income and wealth taxes” to support the central bank’s relatively “blunt tool” of raising interest rates.

Prime Minister Rishi Sunak made slashing inflation one of his key priorities this year, but reaching that target is proving tougher than expected. At 8.7%, the headline rate is more than four times the 2% official target and underlying inflation is still rising.

Hewin’s call for a temporary inflation-busting tax increase is the second by a senior UK economist in the last few days. In an interview over the weekend, Kate Barker, a former member of the BOE rate-setting committee, said income taxes should increase for the better-off to help the central bank curtail inflationary pressures.

Their proposals fly in the face of the government’s ambition to cut taxes ahead of a general election, which is expected sometime in 2024. Hunt in the past few days ruled out tax cuts this year “if they make the battle against inflation harder.”

Hewin said tax rises would spread the pain more broadly because less than a third of households have a mortgage, which is one of the main channels through which interest rate rises work. Currently, a few households are taking a lot of pain for the benefit of everybody.

Rate rises are “more skewed towards those who have mortgages and particularly those who more recently have taken on mortgages,” she said,. “There is a generational impact. If you want to reduce demand, policymakers would want to take the tax option as well as the interest rate option.” Some taxes, like national insurance, can be raised quickly.

The BOE has raised concerns that monetary policy takes longer to reduce consumer demand than in the past because only 30% of households have a mortgage, and many of those are on fixed rates.

Separate analysis by Bloomberg suggested that monetary policy may even be backfiring. It showed that income on savings from higher rates is currently larger than the reduction in income due to higher borrowing costs.

Hewin said the UK is facing a unique inflation problem among advanced economies as the tight jobs market, which she argued is partly due to lack of access to European Union workers since Brexit, is driving up wages.

She believes the BOE will have to raise rates to 5.75%, a quarter point higher than her estimate for the peak in the US. She expects the UK economy to shrink 0.4% next year.