Integral Corp. looks to accelerate growth by leveraging funds raised in its initial public offering last month, a rare public listing for a Japanese private equity firm. It aims to launch a fund of about $3.3 billion in four or five years.

Tokyo-based Integral plans to plow the IPO proceeds directly into its own funds, which it hopes in turn will help attract more outside investors and also provide portfolio companies a better sense of security, according to Reijiro Yamamoto, the firm’s representative director.

“With the additional funding, we can afford to do everything we wanted to do, including entering new assets and increasing our own capital investment,” Yamamoto said in an interview earlier this month.

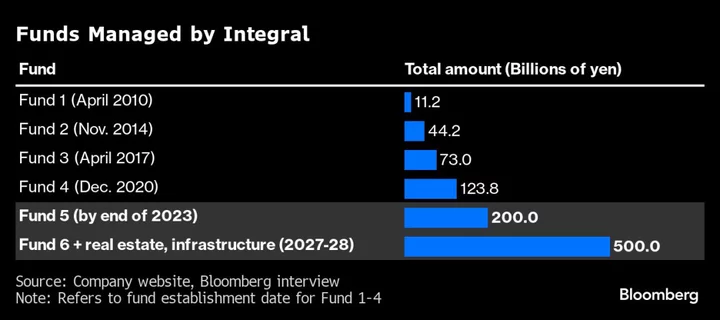

Integral looks to start raising its fifth fund by year-end, targeting over 200 billion yen ($1.3 billion) in capital, roughly 70% larger than its previous vehicle, Yamamoto said. It aims for 500 billion yen for its sixth fund within five years, and hopes to broaden its investment scope to real estate and infrastructure.

The firm, which was founded in 2007, raised 11.6 billion yen in its Tokyo IPO. Listings of private equity companies are rare, with only three others in the past decade, according to data compiled by Bloomberg.

Integral helped lead the turnaround of Skymark Airlines Inc., which relisted in Tokyo’s third-largest IPO of 2022, about six years after the company emerged from bankruptcy. The PE firm owns about a 20% stake in Skymark, and Yamamoto now serves as the airline’s chairman.

“We would like to contribute to the strengthening of Japan’s competitiveness by fostering promising domestic companies,” Yamamoto said. He noted that the firm seeks to build rapport by sending its own employees to work closely with portfolio company management teams.

Integral’s shares have fallen 18% since their debut, compared with a drop of about 6% in Topix over the same period. Yamamoto, who previously worked at Mitsui Bank Ltd. and Unison Capital Inc., said it is unfortunate that the IPO was priced at a “significant discount” to original expectations.

He said Integral is looking to pay dividends right away and may implement buybacks at some point.

--With assistance from Filipe Pacheco.