PDD Holdings Inc. surged 18% after reporting a stronger-than-anticipated doubling in revenue, as hit shopping app Temu ramped up discounts and marketing to grab consumers from Shein and Amazon.com Inc.

The Chinese-owned e-commerce platform reported a 47% increase in net income off sales of 68.8 billion yuan ($9.6 billion) in the September quarter, surpassing by about 25% the average revenue estimate. The stock rose the most since May.

Its growth far outpaced Chinese rivals including Alibaba Group Holding Ltd., underscoring how it’s used promotions to woo bargain-seeking consumers at a time of economic uncertainty. PDD scored with Temu — featured with much fanfare during this year’s Super Bowl — which Citigroup’s Alicia Yap estimates handled $4.2 billion of transactions during the quarter and likely yielded about 13% of PDD’s total revenue.

The company has so far kept Temu’s performance under wraps. Its US-listed shares have soared 90% since July while Alibaba and JD.com Inc. have tumbled. The outperformance reflects anticipation that it will continue to steal market share at home and win fans among US consumers as well.

“Although our business outside of China is still at an early stage, it has made meaningful progress since its launch a year ago,” Chief Executive Officer Chen Lei told analysts on a conference call. “While we have broadened our reach, the business is still in its early stage and we’ll face uncertainties.”

PDD Soars as Results Show Explosive Temu Growth: Street Wrap

Temu is regraded as a potentially disruptive force in global e-commerce. The site — which follows the same strategy of cut-rate pricing employed by arch-foe Shein as well as PDD’s own domestic app Pinduoduo — has expanded operations into scores of countries.

“Management commented that Temu has made meaningful progress in business expansion, helping thousands of manufacturers to reach overseas customers in 40+ countries and regions,” Goldman Sachs Group Inc. analyst Ronald Keung wrote in a research note. “The company plans to further collaborate with manufacturers to connect them directly with overseas customers based upon a more flexible supply chain.”

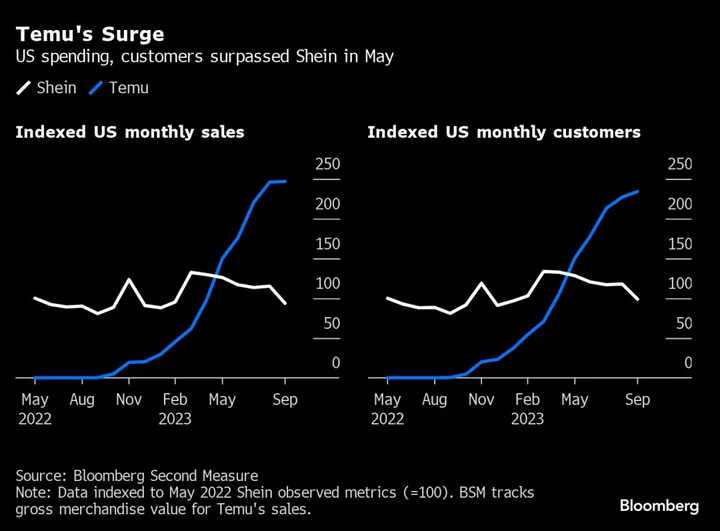

Sales on the platform first topped Shein’s in May in the US, when it beat its rival by about 20%, according to Bloomberg Second Measure, which analyzes consumers’ card transactions. The data show it’s extended that lead every month since and in September, recorded more than double Shein’s sales in the country.

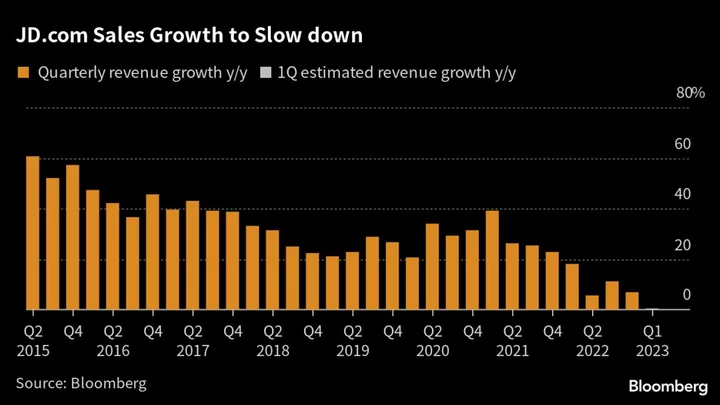

At home, the company is making inroads against the two market leaders, Alibaba and JD.com. During the just-concluded Singles’ Day shopping festival, PDD likely racked up 20% growth in transactions versus its rivals’ single-digit rises, Goldman Sachs estimated.

What Bloomberg Intelligence Says

The firm’s enlarged operations in China could have generated higher-than-expected cost savings from economies of scale and operating efficiency, offsetting the drag on earnings from hikes in sales and marketing expenses.

- Catherine Lim and Tiffany Tam, analysts

Click here for the research.

Temu Owner May Extend Rally on Peer-Beating Growth: Tech Watch

Some investors however worry that Temu’s pitched battle with Shein could end up hurting the parent’s bottom line.

Read More: Temu’s Win Over Shein in the US Is Hurting Its Bottom Line

JD.com rolled out a $1.4 billion discount spree in March to capture new users, igniting a price war. Alibaba also launched a “value-for-money battle” to lure buyers and merchants. Some analysts note that PDD’s aggressive spending — now a sector-wide phenomenon — will further pressure margins.

PDD is among the last of the major Chinese internet companies to report earnings, some of which yielded warning signs about the health of the Chinese economy.

This month, Alibaba lost $22 billion in market value after calling off a spinoff of its giant cloud unit, citing a tightening of US curbs on advanced chips for China. But Tencent Holdings Ltd. and JD.com both delivered solid results that mitigated investors’ concerns over an economic slowdown.

--With assistance from Jeanny Yu.

(Updates with share price from first paragraph)