While Nvidia Corp. shares have roughly tripled this year, those that the company relies on to produce the chips at the heart of the artificial-intelligence frenzy have yet to see such stellar rewards.

Taiwan Semiconductor Manufacturing Co Ltd., which makes most, if not all, of the chips designed by Nvidia, is showing a more modest 30% gain. ASML Holding NV, whose extreme ultraviolet lithography systems are essential in the production process, is up 27%.

The contrast in performance reflects Nvidia’s position as the most immediate beneficiary of the demand for technology that powers AI applications. For TSMC and ASML, any gains will be longer term, while in the short run, much of their vast client bases are being hit hard by a slump in global chip demand.

These factors are reflected in estimates of adjusted earnings per share. Over the past six months, analysts have raised current year forecasts for Nvidia by 77%, according to data compiled by Bloomberg. In the same period, estimates for TSMC were trimmed by 15%, while those for ASML held steady.

Nvidia is “expensive for a reason,” said Richard Clode, a portfolio manager with Janus Henderson. “You’ve ultimately got to see upside to earnings and profit forecasts. That’s the only thing that sustainably keeps stocks higher, and the only company we are seeing at the moment is Nvidia.”

Here are four charts showing how Nvidia is pulling clear of peers as the AI frenzy gathers momentum:

Nvidia’s market capitalization has surged past the $1 trillion mark without a pause, taking the firm’s value beyond that of ASML and TSMC combined. It’s now twice as big as ASML, having been worth less as recently as January, and four times larger than TSMC.

Earlier this month, TSMC tempered its annual spending budget, a blow for its equipment supplier ASML, whose quarterly order intake has slumped to the lowest level since 2020.

Trading at 50 times estimated annual earnings, Nvidia is the second most-expensive among profitable members of the Philadelphia Semiconductor Index, leaving TSMC and ASML far behind.

Heightened tensions between China and Taiwan, which motivated Warren Buffett to close out his position in TSMC, have worked against the Taiwanese chipmaker’s valuation. A US-led effort to restrict China’s access to semiconductor technology has also hit ASML, as the Netherlands readies export curbs on some of its advanced machines.

“The geopolitical side is something that has to be factored into valuation,” said Gene Munster, co-founder and managing partner at Deepwater Asset Management.

While analysts have increased estimates of Nvidia’s forward adjusted earnings per share by 79% in the past six months, those for TSMC and ASML have fallen.

Even though TSMC is the sole maker of Nvidia’s AI processors, its revenue may see only a low single-digit percentage boost in the short term, according to Bernstein analysts led by Mark Li. That’s because Nvidia’s processors account for a small portion of TSMC’s revenue, and capacity for packaging these chips is tight.

For ASML, boosts from generative AI won’t come until 2025, said Societe Generale analyst Alexander Peterc. It takes over a year for the Dutch firm to fulfill an order for the EUV equipment that is indispensable to producing the most cutting-edge chips, and these machines are almost fully booked for next year. For 2025, the benefit may amount to 3% additional sales, Peterc estimated.

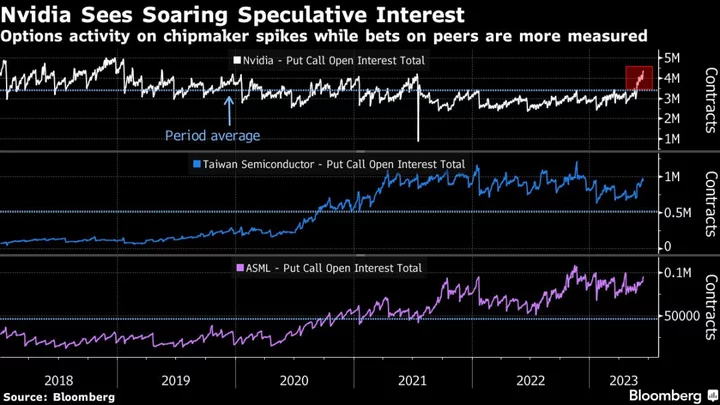

Nvidia traders have been snapping up options to bet that the stock will rise or fall, sending total speculative interest to the highest level in four years. Wagers on TSMC and ASML’s American depositary receipts have also been rising, but to levels short of their November peaks.

Tech Chart of the Day

Nikola Corp. shares have more than doubled in June, rallying with other growth and technology stocks after the Federal Reserve paused its series of interest-rate hikes. Last week, the electric truck-maker’s ousted founder Trevor Milton called for leadership change, a statement that Nikola said was in “direct violation of the agreements” he made when he left. The stock is still down 98% from its 2020 peak.

Top Tech Stories

- Intelsat SA and SES SA ended talks on a merger that would have created a satellite giant to help fend off growing competition.

- Netflix Inc. promised to back and cultivate the Korean showrunners and studios behind viral shows like Squid Game, outlining how it plans to spend some of the $2.5 billion it’s earmarked for K-drama.

- Nvidia’s stratospheric ascent has lured at least 100 more ESG funds in recent weeks, transforming the company into one of the most popular stocks among asset managers who integrate environmental, social and governance metrics into their investment strategies.

- SoftBank Group Corp.’s Vision Fund is preparing to start another round of layoffs as soon as this week, following an approximate 30% reduction last fiscal year, according to people familiar with the matter.

- Telecom Italia SpA is restarting efforts to sell a minority stake in its enterprise unit, potentially valued at more than €6 billion ($6.6 billion), as it seeks ways to reduce debt, according to people familiar with the matter.

--With assistance from Michael Msika.