Bets on a bond-market rally aren’t in the clear just yet.

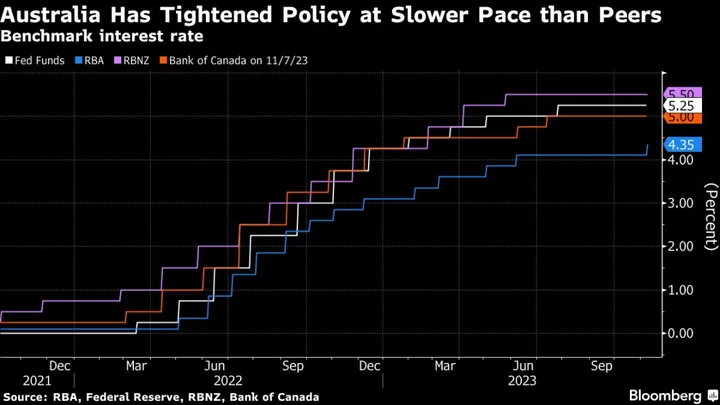

Federal Reserve Chair Jerome Powell on Wednesday appeared to give traders the positive signal they’ve been waiting for — that the central bank may finally be wrapping up it’s steepest interest-rate hikes since the early 1980s. Then the next day, European Central Bank President Christine Lagarde said she had an “open mind” on whether to tighten policy further, underscoring the shifting sentiment underway at the world’s central banks.

But other forces are tamping down the optimism.

Wall Street securities dealers expect a glut of Treasury sales to start coming soon as the government steps up its borrowing. The Fed could keep hiking rates — or hold them higher for longer — if inflation proves stickier than expected. And the Bank of Japan has taken a step back from its ultra-loose monetary policy by allowing bond yields to push higher, giving Japanese buyers more incentive to invest at home and pull money back from the US.

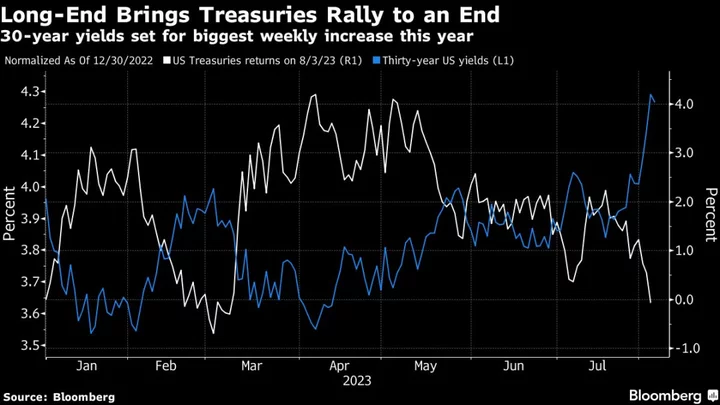

The risks were on display Thursday, when yields surged after the release of stronger-than-expected data on the US economy and word of the BOJ’s impending move leaked out. That more than erased any dip seen after the Fed’s meeting, pushing 10-yield Treasury back toward the year’s peaks.

“Jerome Powell, he was a little late to start the hiking cycle and he may stay stubbornly high,” Ken Shinoda, a portfolio manager at DoubleLine Capital, said on Bloomberg television. “The market is expecting cuts as soon as next year and he may stay higher for longer.”

The factors are threatening to prolong the bond market’s fitful recovery from last year’s rout, when rate hikes hammered investors with the deepest losses in decades.

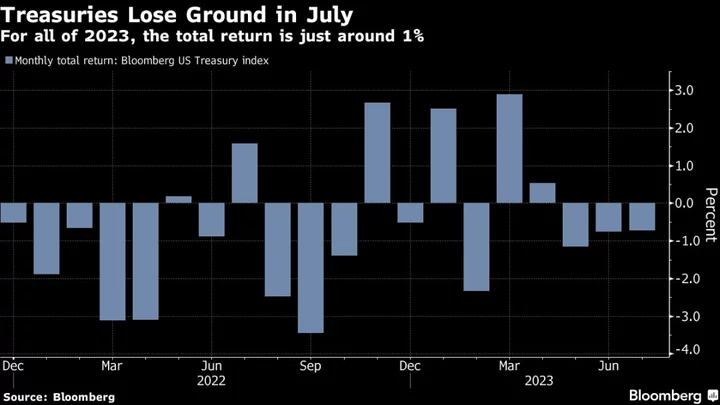

The Treasury market is headed toward its third straight consecutive monthly loss, leaving the securities with a gain of around 1% for the year, according to Bloomberg’s benchmark index. That’s far short of the rally some on Wall Street were expecting when the year began.

Treasuries will be more “properly priced when the market fully reflects the possibility of the Fed holding rates above 5% through the middle of next year and only gradually bringing them down from that,” said Jason Pride, director of investment strategy and research at Glenmede, which has shifted funds into cash and short-dated debt to protect against market swings.

Of course, there’s no doubt that the toll of the Fed’s rate hikes is largely over with, given that inflation has steadily receded and is well below last year’s peaks.

Swaps traders are pricing in that Wednesday’s rate hike — which pushed its benchmark to a target range of 5.25% to 5.5% — will likely be the Fed’s last. The contracts show a less than 50% chance that it will raise rates again this year, with rate cuts seen beginning as soon as March. Around a full percentage point of cuts are currently anticipated in 2024.

But with Powell taking a data-dependent approach, those expectations could easily change if economic growth or inflation accelerates. Next week has a slew of key US data, including the Labor Department’s monthly jobs report. Economists expect it to show a slight slowdown in wage and payroll growth, which would likely support the view that the Fed will hold steady when it next meets in September.

In the coming week, the Treasury Department will deliver its quarterly refunding announcement laying out how much it expects to borrow in the months ahead. Dealers have forecast that it will kick off a multi-quarter wave of heightened supply as the US contends with a growing budget deficit, in part because of rising interest costs.

“This does further some concerns we have about the supply-demand backdrop in the US rates space,” said Mark Cabana, head of US interest-rate strategy at Bank of America Corp. “We see risks that Treasuries will have to continue to cheapen in order to incentivize demand.”

Other pressure is coming from overseas. The BOJ on Friday indicated it would effectively double the range it sets for 10-year bond rates by offering to buy them at a yield of 1%, a small step back from the loose monetary policy that’s made it a holdout among the world’s major central banks.

That’s significant because it means “global bond yields have lost their anchor to some degree,” Jim Caron, the co-chief investment officer for global balanced risk at Morgan Stanley Investment Management Inc., told Bloomberg Television.

What to Watch

- Economic data calendar

- July 31: MNI Chicago PMI; Dallas Fed Manufacturing; Senior Loan Officer Opinion Survey

- Aug 1: S&P Global US manufacturing PMI; Construction spending; JOLTS job openings; ISM manufacturing/prices paid/employment/new orders; Dallas Fed Services activity; Ward vehicle sales

- Aug 2: MBA mortgage applications; ADP employment

- Aug 3: Challenger job cuts; nonfarm productivity; unit labor costs; weekly jobless claims; S&P Global US services PMI; factory orders; durable goods; ISM services index

- Aug 4: US employment report

- Federal Reserve calendar:

- Aug 3:Richmond Fed President Tom Barkin

- Treasury auction calendar:

- July 31: 13- and 26-week bills

- Aug 1: 42-day cash management bills

- Aug 2: 17-week bills

- Aug 3: Four- and eight-week bills

--With assistance from Ye Xie.