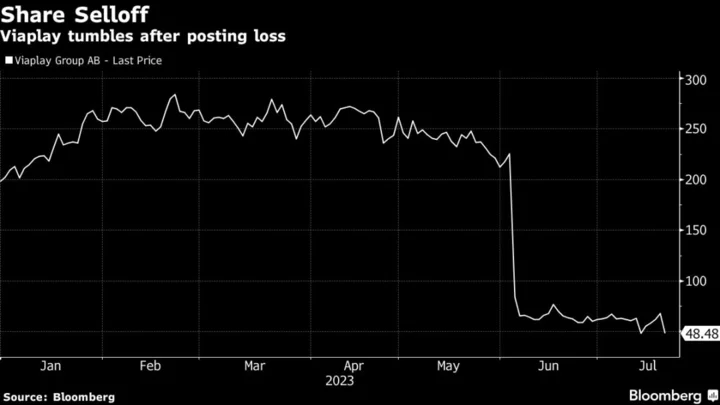

Viaplay Group AB fell as much as 33% after the struggling Swedish streaming service said it’s letting go of more than 25% of its workforce and putting the whole group up for sale.

The strategic review announced Thursday may also include equity injections and exiting various markets, Viaplay said as part of its earnings report for the second quarter. The Stockholm-based company has now lost 80% of its market value from a rout that began in early June when it shocked investors by slashing guidance for 2023 and replacing its chief executive officer.

The development comes as the streamer of Nordic drama series and sports posted a net loss of 5.89 billion kronor ($574 million) for the three months to June with an admission that “the pursuit of subscriber volume growth has been at the cost of value.”

“It’s a fact that the assumptions on the range of initiatives that we have had, particularly around international expansion, are not adding up,” Chief Executive Officer Jorgen Madsen Lindemann said by phone. “We also see that our content cost in the Nordics are to some extent exceeding our revenues.”

The firm is now planning to let go of more than 25% of its workforce, which totaled 1,691 people at the end 2022. Viaplay will instead focus on its Nordic, Netherlands and Viaplay Select operations. The ambition is to find solutions — including partnerships, asset sales and exits — for the rest of its markets before 2024, the CEO said.

The company will also need to “reach agreement” with creditors and is addressing covenant and funding challenges through discussions with its lenders. Those discussions include both its banks and bondholders, Chief Financial Officer Enrique Patrickson said in an interview.

“The core bank group we work with is very aware of the situation and is looking at our cash profile,” the CFO said via phone, adding that the potential covenant breach relates to the firm’s projection of a negative free cash flow for both 2023 and 2024.

Read More: Viaplay Sinks as Analysts Question Uncertain Future: Street Wrap