A mountain of copper and cobalt worth up to $2 billion is piled up in DR Congo, symbolising the wildly volatile market for metals touted as crucial to the green energy revolution.

As many as 13,000 tonnes of cobalt powder are thought to be hoarded in the Chinese-owned Tenke Fungurume mine -- equivalent to seven percent of the world's production last year.

It was stuck for over nine months, alongside an even larger stockpile of copper, due to a dispute over royalties between owners CMOC and the DRC's state mining company Gecamines.

With the export ban lifted, CMOC has begun to shift its giant stash of metals.

Releasing the cobalt all at once would crash the market, where prices are already at rock-bottom. But initial fears that the resumption of business at Tenke Fungurume would lead to market turbulence have been allayed.

"The price of cobalt is not affected," said Zhou Jun, a CMOC vice president and the head of Tenke Fungurume mine, in southeastern Democratic Republic of Congo.

Most of the cobalt will be sold piecemeal as part of long-term supply contracts, he said.

Harry Fisher, an analyst at Benchmark Mineral Intelligence, likewise said that the cobalt price was unlikely to sink further.

But the stockpile could prolong the period of low prices, he said.

CMOC now faces an uphill struggle to clear its stockpile.

Endless rows of half-tonne sacks of cobalt hydroxide powder dot the mine's free space, alongside bundles of refined copper sheets, gathering dust.

An expert on mining in the DRC, who asked for anonymity, called the size of the stockpile "mind-boggling".

"It's nine months of production just sitting on the ground. The shortfall to the Congolese treasury is evident," he said.

The hoard is testament to the cost of commercial disputes in Congo's high-stakes mining industry.

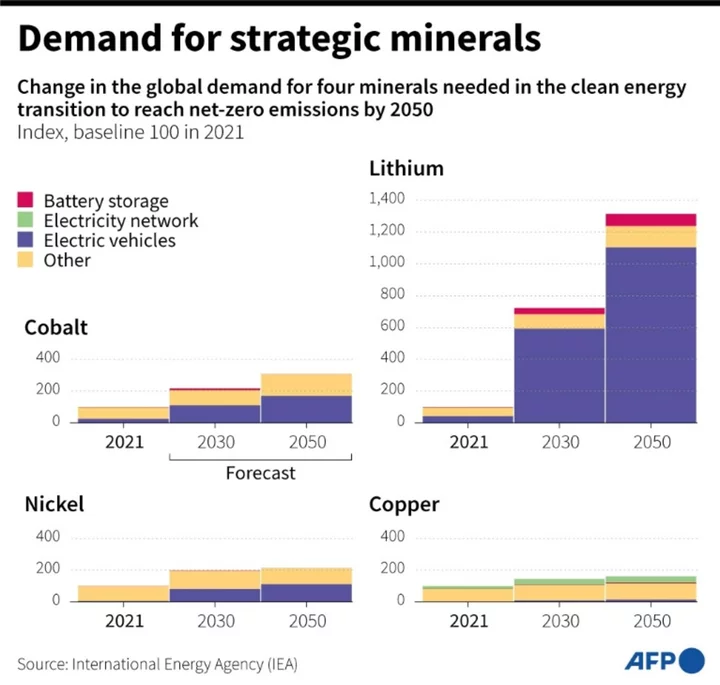

Congo is Africa's largest mineral producer, and supplies over 70 percent of the world's cobalt, a metal critical to batteries used in electronics and electric cars.

The extemely poor African nation relies heavily on its mining sector.

- Price pressure -

Tenke Fungurume, the world's second-largest cobalt mine, produced about 20,000 tonnes of copper and 1,500 tonnes of cobalt a month through 2022, according to company figures.

The ore piled up from July 2022, when the corporate-owned Tenke Fungurume was slapped with an export ban, to April when the ban was lifted.

Based on production statistics, the stash of copper at the mine could be worth up to $1.5 billion, according to current London Metal Exchange prices.

Global production of copper is in the millions of tonnes per year so Tenke Fungurume's copper stockpile is unlikely to further lower prices.

Benchmark Mineral Intelligence in April estimated the value of the cobalt stockpile at $340 million.

During AFP's visit to the mine, trucks loaded with copper were driving out of the site, but there was little evidence of cobalt leaving.

CMOC spokesman Vincent Zhou said that 57,000 tonnes of copper had left Tenke Fungurume in May. The cobalt will be "released rhythmically according to the market demand," he said.

Cobalt prices have tumbled about 65 percent from May last year, from about $40 per pound to $14, according to Fastmarkets, a price-reporting house.

Fisher, the analyst, said it could take up to 10 months to shift the stockpile, pointing out that doing so is a "logistical challenge".

The Congolese mineral belt has one highway leading out of the country towards Indian Ocean ports such as Durban or Dar es Salaam.

But the route is dotted with tolls, frequently targeted by thieves, and subject to monster traffic jams.

- 'All losing money' -

CMOC and Gecamines reached a resolution in April, but the contents of their agreement are not public.

Zhou, the CMOC vice president, compared the dispute to that of one between a "squabbling married couple".

The affair coincided with a push by Congo to renegotiate mining contracts it deems unfair.

DRC President Tshisekedi visited Beijing in late May to discuss Chinese mining contracts, among other issues.

The mining expert said the Tenke Fungurume export ban had benefitted no one.

"They're all losing money," he said, suggesting cash was needed ahead of a December presidential election.

Gecamines did not respond to a request for comment.

AFP visited the Tenke Fungurume mine as part of a trip facilitated by the Cobalt Institute, a lobby group.

eml/gw