Prime Minister Kyriakos Mitsotakis is stepping up the pace of reform at the start of his second term in office as he looks to capitalize on a commanding majority to consign Greece’s crisis years to history.

In a clear signal to investors, the 55-year-old premier pledged to make an early repayment of €5.3 billion ($5.8 billion) for the next two years of bilateral bailout loans from European countries as he set out plans to reclaim Greece’s investment-grade credit rating by the end of the year. Shedding its status as the euro-area’s only junk-rated issuer would mark a symbolic moment for Greece, 13 years after the early waves of the debt crisis saw it downgraded.

In an interview with Bloomberg Television’s Francine Lacqua, Mitsotakis set out a series of plans and objectives for the next four years that aim to consolidate the country’s position in the European Union after years of economic hardship. He pledged to bring incomes for Greeks significantly closer to their European peers and to accelerate the pace of debt reduction while boosting the use of renewable energy and increasing exports to 60% of gross domestic product from 50%.

“It’s a commitment to investors,” Mitsotakis said Tuesday in Athens. “This is not just about management. It’s not just about, playing defense. It’s really about changing the country.”

Mitsotakis won a resounding majority last month for another four years in office, giving his conservative administration a mandate to implement investor-friendly policies he’d touted during his campaign. That will mean chipping away at Greece’s €356 billion of debt, the highest relative to output in the euro area. “I want to continue making Greece a very attractive destination for foreign investment,” he said.

Moody’s Investors Service and Scope Ratings both said that Mitsotakis’s electoral win was a credit positive event for the country. “A steady continued improvement in the fiscal primary balance would provide us a level of assurance that this government will continue to prioritize debt reduction,” S&P Global Ratings told Bloomberg on Wednesday.

The firm will be watching how the fiscal trajectory unfolds and believes that a meaningful progress in legal reform would be “a positive signal of the new government’s intent in tackling more difficult areas of structural bottlenecks hindering longer-term growth potential.”

Investors have already piled into Greek bonds this year on the expectation the nation will regain an investment grade, making them the best performers in the developed world. That has cheapened the nation’s borrowing costs to such an extent that it now pays less than Italy, even as Rome’s debt is deemed safer by rating firms.

“We are already trading as if we are an investment-grade country, but we also need the official stamp of approval by the rating agencies,” Mitsotakis said.

Beyond the economic program, Mitsotakis outlined a political project that seeks to build a new consensus in the center ground of Greek politics.

The election result saw Mitsotakis hold at bay the far-right — which has been making advances across Europe’s biggest economies — while also handing his left-wing rivals a defeat that persuaded opposition leader and former premier, Alexis Tsipras, to quit as leader of his Syriza party.

Mitsotakis’s center-right New Democracy party got 40.6% of the vote, giving it 158 members in the 300-seat parliament and increasing the party’s share of the vote after a term in office.

The prime minister said that he’d done that while shifting his traditional conservative New Democracy group to more liberal positions on issues like LGBTQ laws while tackling the immigration problems that have helped to fuel support for extremists in other countries.

“I’m happy because essentially, we prevailed through politics of competence and reason, we moved the party toward the political center. So yes, there is a future beyond populism,” Mitsotakis said.

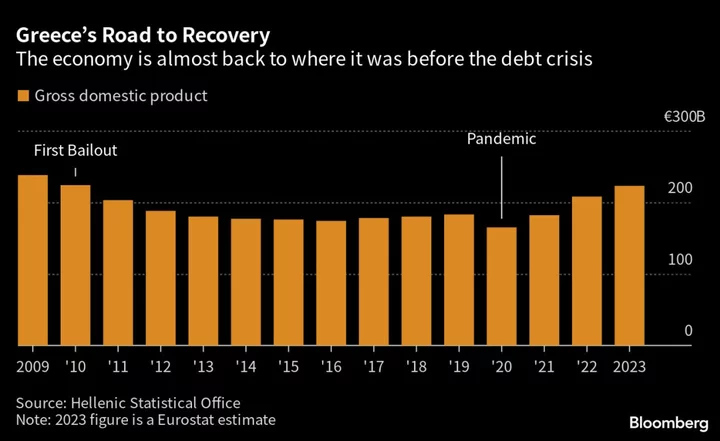

He made his stewardship of the economy a central pillar of his re-election campaign, with gross domestic product having recovered to just about where it was when the country lost its ability to repay its debt in 2010. Unemployment has more than halved from its peak of 28%, and stocks and bonds have soared. The Athens Stock Exchange General Index is up more than 39% this year.

On Tuesday, he put some more detail to those plans.

Greece will move forward with Athens International Airport initial public offering in early 2024, Mitsotakis said. The plan is to proceed with an offering for a 30% stake in the airport, with the company’s largest shareholder ready to buy 10% of those shares.

“We are also looking to divest our stakes in the banks,” the premier said. The Hellenic Financial Stability Fund, a bank recapitalization tool that was established at the start of the country’s bailout programs, has already started the process for divesting from Greek lenders.

The HFSF currently holds a 40% stake in National Bank of Greece SA, 27% of Piraeus Bank SA, 9% of Alpha Bank SA and 1.4% of Eurobank Ergasias Services and Holdings SA. Eurobank has said that it will buy back the fund’s holding in the lender and that it has already received the official approval from the European Central Bank to submit the relevant request.

--With assistance from Jacqueline Simmons, Alexander Weber and Aline Oyamada.

(Updates with S&P Global Ratings comments from sixth paragraph.)