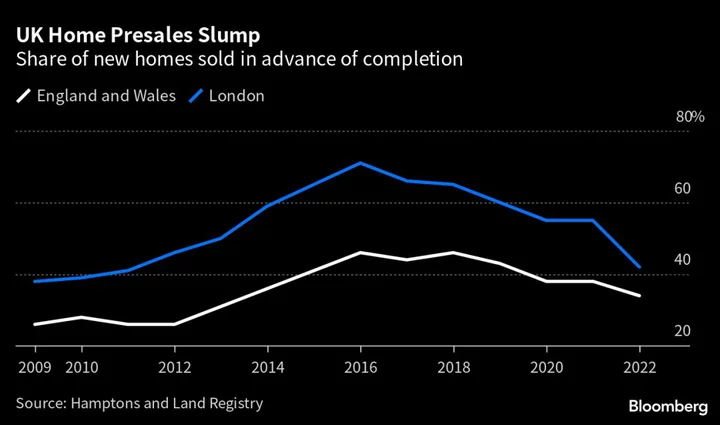

London homes used to fly off the shelves even before they were built. Now the city has lost its crown as the hub for off-plan deals, as investors hunt for richer returns outside the capital.

The proportion of new homes sold in advance in London dropped to 44% last year, tumbling from a peak of 71% in 2016, according to a report from broker Hamptons International. That’s largely due to an exodus of investors from the capital’s presale market, as their attention turns to higher-yielding regions like the northwest of England, where the share of off-plan sales is now higher than London.

“With house price growth in the capital lagging the rest of the country since 2016, it’s meant they’ve increasingly been looking further north,” said David Fell, a senior analyst at Hamptons. “Higher interest rates are likely to exacerbate this shift, with these cheaper locations offering higher yields.”

The UK housing market is facing disruption as a double whammy of high interest rates and a cost-of-living crisis threatens to weigh on property prices. David Miles, a senior economist at the Office for Budget Responsibility, last week said the end of the cheap-money era means the age of bumper UK house price growth may be over.

Read more: UK’s Era of Big House Price Rises Ending, OBR Official Says

The share of new homes sold off-plan across England and Wales slipped to its lowest level since 2013 last year, falling to 34% from a peak of 46% in 2016, according to Hamptons. At the same time, the proportion of investors purchasing presale homes dived to 21% from 70% in 2015, when a buying spree was underway before the introduction of a stamp duty surcharge on second homes in 2016 damped demand.

Instead, first-time buyers now make up the bulk of home deals before completion. That’s contributed to a decline in off-plan apartment sales — typically popular with yield-hungry investors — with new terraced houses now more likely to sell ahead of completion than flats for the first time since at least 2007, the Hamptons report said.

Still, in regions with the potential for strong investor returns — such as Birmingham, Brighton and Manchester — demand is strong for off-plan homes. A record 50% of new properties were sold ahead of completion in areas where the average buy-to-let yield surpassed 10% last year, according to Hamptons.

That’s a blow for London, which offers investors the lowest average returns in England and Wales.

Read more: Europe’s House Price Woes Are Coming for Vienna: City Tracker

The decline in off-plan transactions will likely concern builders, who’ve already been stung by the end of the Help-to-Buy program. That’s because they typically use the presale cash to quickly pay back any money borrowed to build the homes. These sales are even more crucial for developers when interest rates are high, meaning they may need to slow down homebuilding to avoid pricey repayments.

“The fall in off-plan sales means housebuilders will find other ways of de-risking developments,” Hamptons’ Fell said. “This will probably mean bulk sales to build-to-rent operators.”