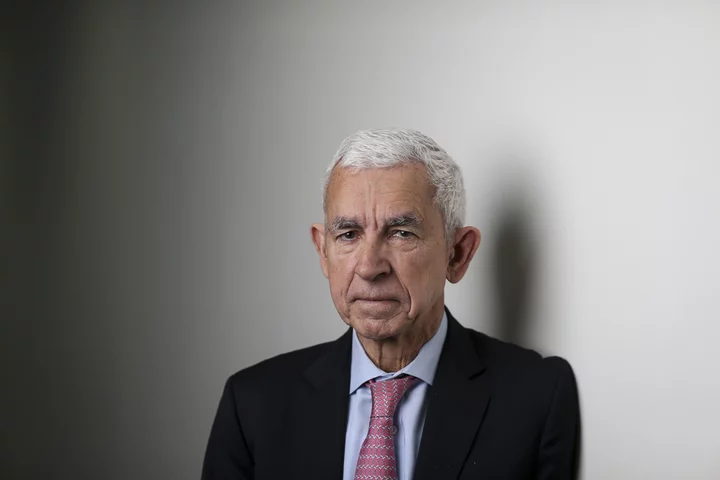

Laszlo Birinyi, the investment adviser who created an analysis for using money flows to determine likely stock moves, has died. He was 79.

He died on Aug. 21 after struggling with multiple health issues, said his wife, Jill Costelloe Birinyi. She called him “a brilliant, quiet, private person who was a true American immigrant story.”

The Hungarian-born Birinyi rose to prominence as a top market forecaster in the 1990s by using money flow analysis, which gauges whether a stock is likely to rise or fall based on how many shares are traded at different prices. The data shows the conviction behind price moves, the theory goes, suggesting that when falling shares are accompanied by increased trading volume, further decline in share price is possible.

“Laszlo was always thoughtful, and I would say at some times iconoclastic, because he didn’t necessarily go with conventional wisdom,” Mike Holland, chairman of Holland & Co. a New York-based investment management firm, said in a 2013 interview. “He went with where his facts and methods take him. It was always interesting to listen to him.”

Birinyi advised selling internet shares shortly before the dot-com era bubble burst in the early 2000s. He was among the first to tell investors to start buying US equities when the Standard & Poor’s 500 Index reached a 12-year low on March 9, 2009. He predicted in August 2015 that stocks would “come out OK” as a six-day rout sent the S&P 500 into a correction. The index went on to rally 13% through Nov. 3.

“My approach is to dissect the stock market,” Birinyi was quoted as saying in the The Heretics of Finance: Conversations with Leading Practitioners of Technical Analysis (2009). “I ask, ‘What is going on in the market? What are the trends and the dynamics?’ Then I let the market tell me the story.”

He founded Birinyi Associates Inc. in 1989 as a research and money management firm that analyzes flows and historic stock market data. The Westport, Connecticut-based firm serves institutional and high-net-worth individuals.

Salomon Brothers

Previously, he was a director at Salomon Brothers Inc. in New York, where he oversaw equity market analysis and produced the firm’s weekly commentary.

Birinyi was inducted into PBS’s Wall Street Week Hall of Fame in 1999 after he was the show’s top-ranked Dow Jones Industrial Average forecaster for most of the 1990s.

Laszlo Birinyi Jr. was born on Sept. 20, 1943, in Hungary. When he was 7, his family immigrated to Pennsylvania, where his father worked as a stone mason.

He graduated from the University of North Carolina at Chapel Hill in 1967 with a degree in history.

He credited one of the school’s earliest computer classes with giving him the knowledge needed to land his first Wall Street job, as a computer programmer at Auerbach, Pollack & Richardson, in 1972.

After completing a master’s degree in business administration at New York University in 1975, he started at Salomon Brothers in 1976, where he spent a decade on the trading desk.

Training Course

Much of Birinyi’s work drew on trends in flows and historical cycles of gains and losses. His time at the firm led him to write The Equity Desk, a book for the company’s training course.

While at Birinyi Associates, he served as global trading strategist for Deutsche Bank Securities Inc. from 1998 to 2002.

In 2001, he endowed the Laszlo Birinyi Sr. Distinguished Professorship in Hungarian Culture at his alma mater, funded with a gift of $1 million. He also served as a director of UNC’s endowment, helping to select fund managers and oversee fund performance.

With his wife, Birinyi had two daughters, Natalie and Anna. Also surviving him are his brother and a grandson.

“He built a company and a life of excellence,” his wife said in an interview, “but what he said he was always most proud of was that he had dinner every night with his family.”