Embattled Swedish landlord SBB is facing an inflection point after one of its creditors demanded its money back, the first time such a written notice has been given.

Stockholm-based Samhallsbyggnadsbolaget i Norden AB — as the firm is officially known — has been at the center of Sweden’s property crisis as landlords scramble to find ways to refinance billions of dollars of bonds amassed in the cheap-money era. Now one of those bondholders has run out of patience, saying repayment is needed on the grounds SBB breached a key term in its debt.

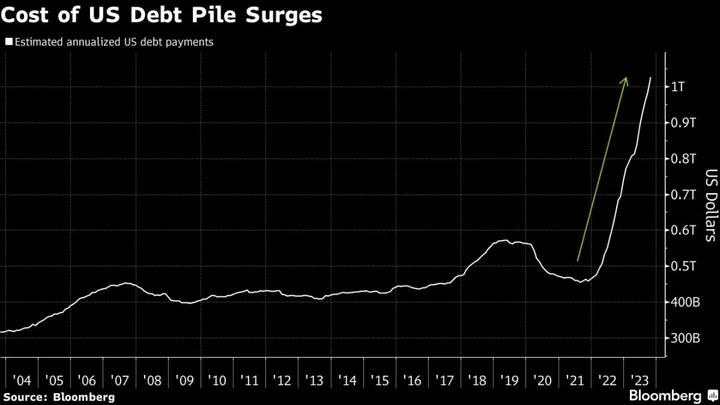

The pressures now being felt among borrowers such as SBB and Heimstaden Bostad AB underscore the depth of Europe’s unfolding real estate crisis where companies like Signa Holding GmbH are teetering on the brink. In Sweden much of the bond debt is floating rate and short term, meaning the squeeze from higher interest rates has hit the country first.

SBB’s creditor sent a letter to the company claiming the landlord had breached a threshold measuring the amount of profit divided by the interest owed on its debt — known as the interest-coverage ratio — and as a result the company must immediately repay the notes ahead of their scheduled maturity in 2028 and 2029, according to a statement. SBB did not disclose the identity of the bondholders demanding the so-called acceleration.

SBB said it “firmly rejects” the claim that it is in breach “and as such considers that the acceleration notice received from this Eurobond holder is ineffective.”

The holdings of the creditor total about €46 million ($49.2 million) in the two series of euro-denominated social bonds, which correspond to about 1% of SBB’s total bond stock, according to the statement.

“The debt held by those making these claims is a very small fraction of our outstanding debt,” said Chief Executive Officer Leiv Synnes in an interview.

The development comes in the wake of a major reorganization at SBB, announced by Synnes in September, to split the company into three units and secure fresh funds to cover a near-term funding gap of about $730 million. Despite taking a major step toward stabilizing its finances, the group’s bonds have continued to trade at deeply distressed levels while its share price has languished near record lows.

The CEO, who declined to give the names of the those making the claim, told Bloomberg that “the issue itself is not a new one, similar opinions have been voiced previously and we made our position clear already in May.”

Earlier this summer a group of bondholders, advised by PJT Partners, demanded that SBB make a number of changes at the company. The group warned at the time that “a signification portion” believed the landlord had breached the interest-coverage covenant and would push for an event of default if progress wasn’t made quickly enough.

Read More: Embattled SBB Hit With Bondholder Demands as Pressure Mounts

“It’s in SBB’s and all our stakeholders’ best interest to allow the company to continue to execute on its strategy and strengthening its financial position,” Synnes said.

The Stockholm-based landlord had been due to report earnings for the third quarter today, but earlier this week pushed back the publication date to Monday, Nov. 13.

(Updates with further context.)