A Labour government would seek to end the stealth raid on the incomes of working households and give businesses lasting tax relief on investment, Shadow Chancellor Rachel Reeves said as she pledged to tackle poor living standards and economic growth.

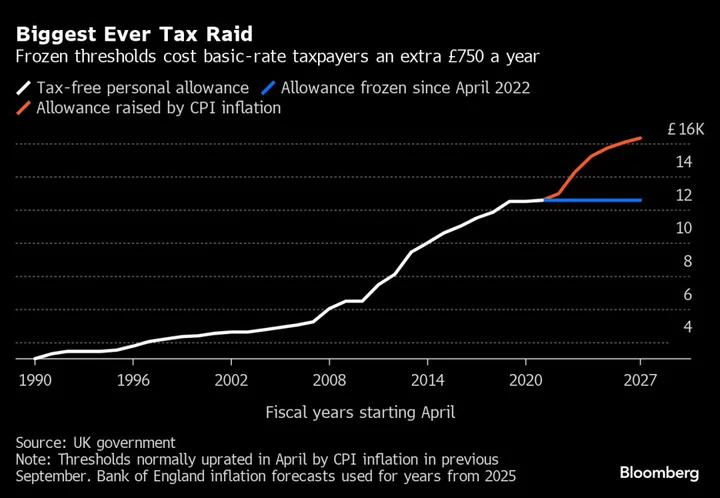

Speaking to the media on Monday, she said Labour aims to lift a freeze on tax thresholds that is on track to cost workers on the basic 20% rate of income tax £750 ($920.14) a year each. She would also make full-expensing, a 100% tax relief on capital investment, permanent.

The policies would have to be affordable within her fiscal rules that debt must be falling as a share of GDP and day-to-day spending covered by tax revenue, she added.

Asked whether she would move to a more generous measure of debt to hit the target, Reeves said: “I’m not going to try to fiddle the figures or make something different to get better results. We will use the same models the government uses.”

Reeves was speaking days before Chancellor of the Exchequer Jeremy Hunt delivers his autumn statement on Nov 22, when he is expected to set out a series of growth-enhancing policies, including an extension to full-expensing for at least one year.

Labour is on course to form the next government. It is leading the ruling Conservative Party in opinion polls by around 20 points and has been steadily building support among business with pledges to boost growth, bring down taxes and keep the public finances in check.

“It is because this is a government of low growth that it is a government of high taxes,” Reeves said. She specifically attacked “the 25 tax rises that we’ve seen under Rishi Sunak.”

A Conservative Party official said: “Labour haven’t got a leg to stand on. They increased taxes in every single one of their budgets last time they were in government and they’ll do it again if they ever get into office.”

Despite the surge in the polls, Reeves has been criticized for not offering a clear alternative to Hunt. She stressed that growth was Labour’s No. 1 priority and pointed to planning and pensions reforms as key to unlocking business investment. Both are being pursued by the Conservatives.

With the tax burden at levels not seen since shortly after World War II, both parties have also made commitments to lower it.

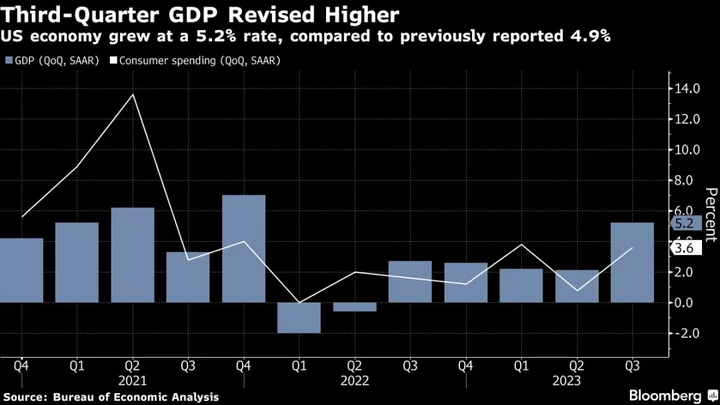

“We have got the worst of both worlds, where we’ve still got high inflation but you’ve got growth on the floor,” Reeves said. “The impact of that has been higher taxes. It does concern me that people on average earnings are paying more in tax because they are dragged into higher tax brackets. That is a sign of failure. The government is picking the pockets of working people.”

She said Labour will back the government if it extends full expensing. “If they extend full expensing by one year, we would support that and if there is money available we would like to see it made permanent,” Reeves said.

Full expensing allows companies to write off the cost of investment in one go. In effect, for every pound they invest, their taxes are cut by 25 pence. The policy is currently due to end in March 2026. It would cost up to £10 billion a year to extend. Re-linking income tax thresholds with inflation would cost about £3 billion by 2027-28.

A six-year freeze on the amount people can earn before paying income tax has been described as the biggest tax raid on record, with the government set to raise £40 billion annually by 2028 as rising wages drag millions of people into paying basic or higher-rate tax. The policy was introduced when Sunak was chancellor and subsequently extended by Hunt.

The average basic-rate taxpayer will be paying an extra £750 a year in tax by the end of the forecast, Bloomberg calculations show.

The Resolution Foundation think tank estimates that Hunt will have about £15 billion of fiscal headroom at the autumn statement, up from £6.5 billion in March but still low by historic standards.

Reeves repeated that she has “specifically ruled out a wealth tax” and that there are “no plans to increase taxes” besides the announced £5 billion-£7 billion from scrapping non-dom breaks for wealthy foreigners, charging VAT on private school fees and closing a private equity loophole.

Labour would boost investment by pension funds in the UK by giving regulators more power to consolidate the sector to ensure it “delivers the full potential for British savers and UK Plc.”

The proposals would also see a co-investment scheme set up with the British Business Bank to draw more private investment into UK start-ups.

(Adds pension fund investment plans in 18th and 19th paragraphs)