Kenyan President William Ruto intends ramping up government spending on initiatives ranging from increasing access to affordable housing and health care to support for farmers and small businesses, and expects taxpayers to foot the bill.

The National Treasury has submitted legislation to parliament that proposes doubling the value-added tax rate on fuel to 16% and imposing new taxes on digital media content and the transfer of virtual assets. The maximum pay-as-you-earn income tax rate will also be increased to 35% from 30%.

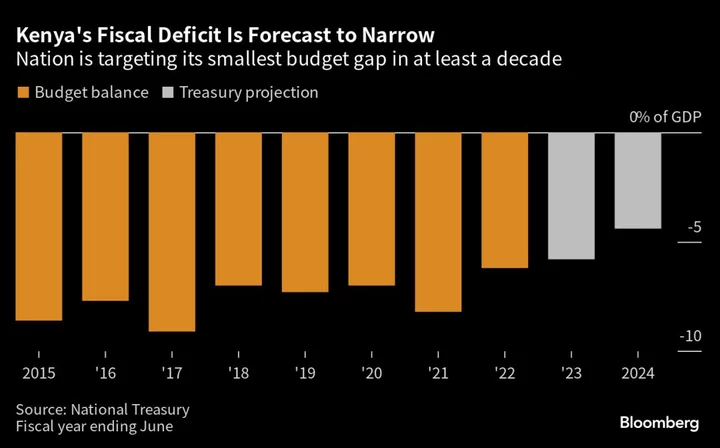

The government expects the measures to boost its revenue by 17% to 2.57 trillion shillings ($18.39 billion) in the fiscal year through June 2024, while expenditure is projected to rise 9% to 3.68 trillion shillings, the annual budget tabled in parliament on Thursday shows. The budget deficit is forecast to narrow to 4.4% of GDP, the lowest level in at least a decade, from an estimated 5.8% this year.

The budget has been prepared amid “a perfect storm” of shocks, Treasury Cabinet Secretary Njuguna Ndung’u said in his budget speech to lawmakers in Nairobi, the capital. Key challenges include the worst drought in four decades, the spillover of Russia’s invasion of Ukraine and monetary policy tightening in developed economies, the minister said.

Ruto, who took office in September, has pledged to fire up East Africa’s second-largest economy, while avoiding a debt default — as has happened in Zambia and Ghana. But the move to extract more money from already-stretched taxpayers who are contending with surging food costs has stoked outrage, and sporadic protests have been held against the proposed gasoline price increase.

The president has said that the government is living beyond its means and urgent adjustments are needed to avert a debt crisis, but main opposition leader Raila Odinga has warned that the increased taxes could push the economy into recession and said they should be fiercely resisted.

The economy is expect to grow 5.5% this year, up from 4.8% in 2022, supported by a recovery in agriculture, ongoing governmentr investment and the services sector, according to Ndung’u.

Borrowing Surge

State expenditure has risen by an average 12% annually over the past decade, according to parliament’s budget office, as borrowing increased to fund infrastructure projects.

Public debt grew 12% year-on-year to 9.4 trillion shillings as at end of March, equivalent to 64.7% of gross domestic product, according to the Treasury. It sees debt servicing costs rising by a third to 1.8 trillion shillings in the next fiscal year.

Constrained access to international capital markets due to monetary policy tightening in advanced economies and recent downgrades in Kenya’s credit ratings could affect the government’s fund-raising plans, the parliamentary budget office said in a report.

Other highlights:

- The inflation rate is expected to return to within the central bank’s 2.5% to 7.5% target range by December.

- Interest rate increases and improved farm yields due to favorable weather conditions should help ease price pressures.

- Kenya remains committed to meeting all its debt obligations as and when they fall due, including settling a $2 billion Eurobond that matures in June 2024, according to Ndung’u.

- Some state companies will be privatized to ensure they are run optimally along commercial lines and reduce their reliance on funding from the Treasury.

--With assistance from Monique Vanek and Helen Nyambura.

(Updates with other budget highlights in bullet points.)