South Korea has come up with a novel way of ensuring that weaker companies get cash during economic slumps: it’s offering tax incentives to investors in high-yield debt funds.

The Financial Services Commission announced measures Tuesday that effectively could help wealthy retail investors in such funds reduce their tax burden. The regulator said that income from such funds won’t be added to a person’s total income when calculating taxes, up to a limit.

The tax rates that could apply if it were included in income would likely be higher than the 15.4% total of withholding tax and local surtax to which the income is subject, for funds that meet certain requirements including investing at least 45% of their assets in won bonds rated BBB+ or lower.

The incentives, which also include preferential access to initial public offerings, may help attract 3 trillion won ($2.3 billion) of new cash into the high-yield funds, according to the Korea Financial Investment Association.

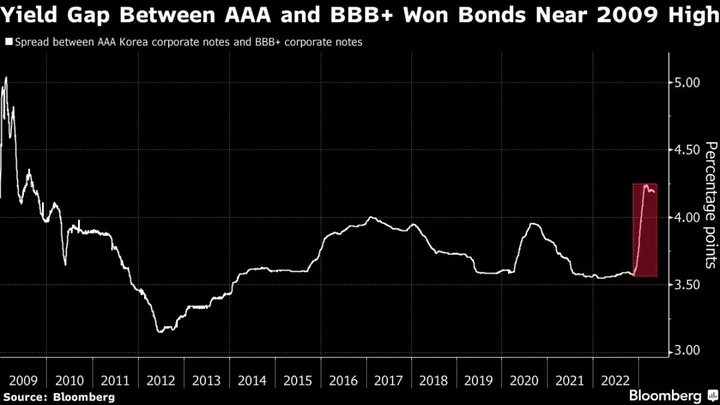

The government is trying to channel more funding from the debt market into lower-rated firms, who are still facing elevated borrowing costs compared with high-grade borrowers after a debt crisis hit the nation late last year. Yields on BBB+ rated Korean notes in March exceeded AAA debt yields by the most since 2009, and the gap remains near that level, Bloomberg-compiled data show.

“While institutional investors usually shun lower-rated bonds, retail investors have bought bonds with BBB ratings,” said Kim Ki-myung, credit analyst at Korea Investment & Securities Co. “The measure will lighten the tax burden for wealthy investors so it’ll have an effect.”

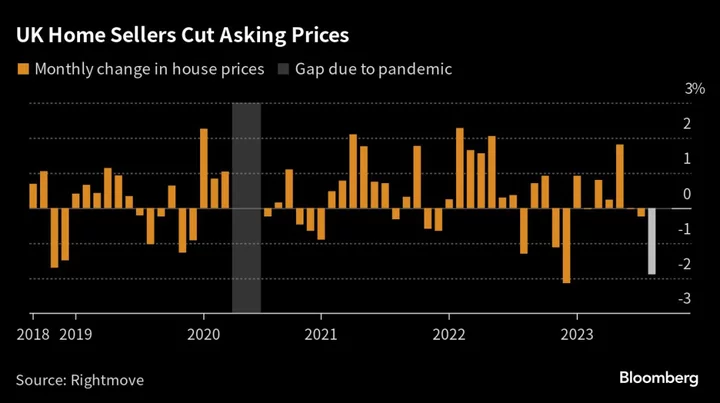

Korea is reviving tax incentives that were introduced in 2014 and suspended three years later, underscoring policymakers’ concern about the financial health of vulnerable sectors such as the project-finance industry and some lower-rated bond issuers. Weaker companies are struggling in the face of a depressed real estate market that’s seen a surge in unsold housing inventories, and a sluggish economy weighed down by an export slump and cooling consumption.