Japanese Prime Minister Fumio Kishida announced a larger-than-expected economic stimulus package that aims to boost growth and help households hit by inflation, as his administration tries to shore up falling support.

Kishida said Thursday that the measures will be worth more than ¥17 trillion including the impact from tax cuts and other costs. Around ¥13.1 trillion ($87.1 billion) of spending will be funded through an extra budget, he said.

“We’re seeing the chance to transition into a new economic stage for the first time in three decades,” said Kishida. “The key here is to strengthen firms’ ability to earn, which in turn can become the source of wage hikes.”

He is set to give further details of the package in a press conference later Thursday.

Income and residential tax rebates worth ¥3.5 trillion and more than ¥1 trillion in aid for low-income households will form a key part of the package, according to local media reports.

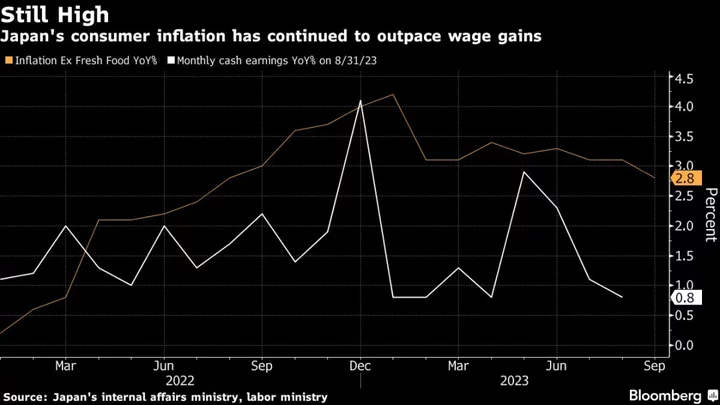

The package is Kishida’s latest attempt to appease voters who are critical of his handling of inflation. Price growth — the fastest in decades — has outpaced pay rises.

While the package is smaller compared to others in recent pandemic years, the scale of fiscal spending indicated by draft plans obtained by Bloomberg is around twice the size expected by economists surveyed by Bloomberg last month. The draft showed fiscal spending worth ¥21.8 trillion.

The extra outlays will likely add to the country’s mountain of debt, and may have little impact on voters’ opinion of Kishida.

“Part of the reason why people don’t like tax rebates much is they think they will be temporary,” said Harumi Taguchi, principal economist at S&P Global Market Intelligence. “Many people may just save them as they expect taxes to go back to the same level. I also have doubts about the impact because it won’t be delivering money to people in a tangible way.”

Support for Kishida continued to slide even after he outlined the planned tax cuts and handouts.

Surveys by the Nikkei newspaper and broadcast news network ANN last week found approval for Kishida at its lowest since the premier took office two years ago, at 33% and 26.9% respectively. The Nikkei poll showed that around two-thirds of respondents viewed plans for an income tax reduction in the package as inappropriate.

The income tax cuts are set to be ¥30,000 per person, and the residential tax rebate ¥10,000 per person, according to local media reports. They won’t start until June next year, a delay that may frustrate households seeking quick relief from inflation.

The package comes with Kishida yet to make clear how he will fund bigger-ticket initiatives such as boosting spending for defense, and countering the declining birthrate. There’s also simmering discontent within Kishida’s own ruling party, with one senior member telling parliament that the premier lacks leadership, in an unusual display of disunity.

“Higher wages would be the biggest help for households,” S&P’s Taguchi said. “The government should focus on helping companies create an environment where companies find it easy to raise wages.”

With his latest package, Kishida aims to also spur future growth, rather than just boost sagging demand now. At least some of the measures are expected to help push up wages among firms, and add to support for domestic investment into semiconductors, according to the documents obtained by Bloomberg.

Fueling growth in the economy instead of relying on borrowing has been a challenge for years as Japan’s economy struggled to end deflation.

Achieving that transition to stronger growth is key for the heavily indebted nation’s fiscal health. So far Japan’s general government debt has grown to a size equivalent to 255% of its economy, according to the International Monetary Fund.

The switch is all the more urgent, as the country is at a potential inflection point where the central bank is gradually letting interest rates rise, a factor that would ramp up borrowing costs for the government.

--With assistance from Toru Fujioka and Isabel Reynolds.

(Updates with latest comments from Kishida)