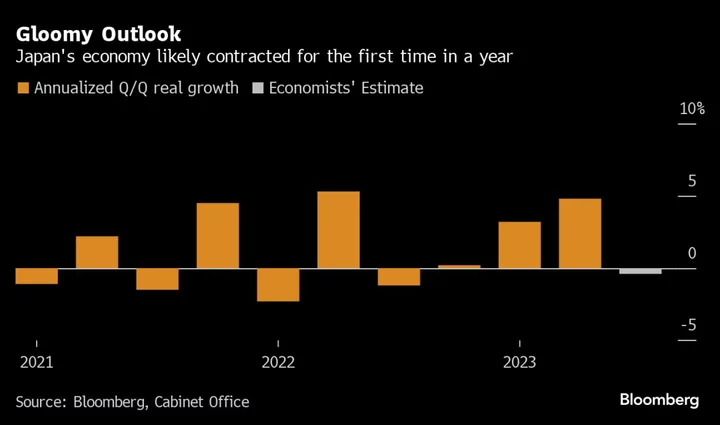

Japan’s economy likely shrank over the summer as the impact of trade weighed on the nation’s sputtering recovery, a result that would support continued caution at the central bank and the government’s case for its latest round of stimulus measures.

Economists estimate that real gross domestic product shrank at an annualized pace of 0.4% in the three months through September, compared with 4.8% growth in the previous quarter.

The expected contraction would be the sixth quarterly drop since spring 2020, a stop-start stretch of results that suggests the economy is yet to find a stable footing as consumers struggle with the strongest inflation in decades, fueled partly by weakness in the yen.

A lackluster result would give the government evidence that the economy needs extra support to secure its recovery. For the Bank of Japan, a contraction may heighten concern that growth in the economy still isn’t stable enough to withstand the ending of negative interest rates in the coming months, even if pivoting on policy might help curb inflation.

The expected contraction is likely to be driven largely by a rebound in imports after a sharp drop in the previous quarter, rather than a marked improvement in domestic consumption and business spending. The country’s imports fell by 4.4% in the three months through June.

“Supply chain strains, such as for automobiles, have eased enabling companies to return to normal production,” said Shumpei Goto, researcher at The Japan Research Institute Limited.

The drag of net trade will likely account for most of the fall in GDP with the balance of other factors in the economy largely showing a stagnant performance. Consumer spending is expected to inch up 0.3% on a non-annualized basis after falling the previous quarter, while capital outlays are seen rising by 0.1%, compared with a 1% fall in the second quarter.

While hot weather helped boost consumer spending during the first summer without pandemic restrictions, the gains don’t seem strong enough to outweigh the losses recorded during the previous quarter. Sticky inflation and stagnant payrolls have likely eroded consumers’ spending appetite, according to some economists.

Kishida has already opted for more spending to try and support consumers and firms amid a continuing drop in his approval ratings.

The cabinet green-lighted a 13.2 trillion yen ($87 billion) extra budget last week to fund Kishida’s economic package worth over 17 trillion yen. The measures center on income tax cuts and handouts to low-income households aimed at helping consumers cope with the cost-of-living crunch triggered by inflation that is outstripping wage increases.

With persistent inflation and some signs of continued wage growth, BOJ Governor Kazuo Ueda recently hinted that Japan is making progress toward its 2% stable inflation target. Those comments have fueled speculation of a possible early move to adjust policy by the BOJ. But a weak GDP result could also provide a reason for the BOJ to stand pat until clearer signs that a virtuous cycle of wages, prices and growth is strengthening.

The yen’s recent weakness is another factor fueling inflation by pushing up the prices of imports. The currency weakened to around 145 against the dollar in the summer quarter from around 138 in the previous three months.

“A weaker yen worsens the terms of trade, causing money to flow out of the country, making it difficult for companies to raise wages and crimping consumption,” said Goto. “If the yen continues to weaken, it will be difficult to create a virtuous cycle.”