Japan’s businesses increased investment modestly, showing hints of resilience even as the broader economic recovery loses momentum.

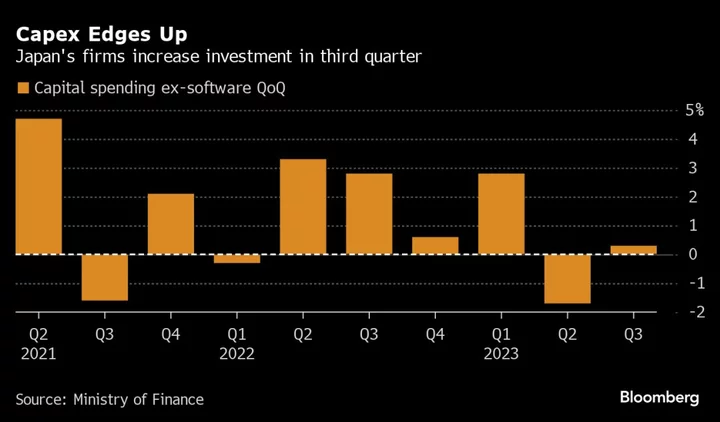

Capital expenditures on goods excluding software rose 0.3% in the three months through September compared with the previous quarter, the finance ministry reported on Friday.

Spending on equipment including software rose 3.4% from a year earlier, in line with the forecast by analysts.

The data will be factored into any potential revisions made to the initial reading of gross domestic product for the period, which showed the economy shrank at an annualized pace of 2.1%.

Friday’s capital investment figure compared with similar figures in those third-quarter GDP statistics, which showed business investment slipping 0.6% quarter on quarter. The second GDP reading is due on Dec. 8.

Separately, labor ministry data showed the job market strengthened a bit in October. The unemployment rate inched lower to 2.5%, the lowest since June. The jobs-to-applicant ratio edged up to 1.30, meaning there were 130 jobs offered for every 100 applicants.

Taken together, the two sets of data suggest companies may not have been as gloomy about their prospects over the summer as previously thought. Even so, some analysts expect GDP to contract again in the current quarter, putting the economy in a technical recession as overseas economies slow and consumer spending remains weak in the face of inflation.

What Bloomberg Economics Says...

“Japan’s October jobs data suggest hiring demand is slowly gaining vigor — and that’s likely to be encouraging for the Bank of Japan, which wants brisk wage growth to push prices higher.”

— Taro Kimura, economist

For the full report, click here

Gains in exports have been limited to single-digits during most parts of this year as demand has cooled in Japan’s key trading partners, especially China. Imports of raw materials have been growing at a much slower pace this year and overall imports are falling partly because of limited demand at home.

Corporate appetite for investment is a factor that helps determine the course of public policy. The government and the central bank have been supporting the economy via stimulus spending and monetary easing.

The government passed an extra budget to fund a fresh stimulus package for the economy earlier in the week, and the BOJ is expected to maintain its main policy framework including negative interest rates when its board meets later this month.

Authorities are watching companies for signs they’re willing to channel more profits into the pockets of workers, a development that might allow them to ease up on the policy throttle.

(Adds chart, details from report)