The Japanese government will allow seven of nation’s major power companies to raise household electricity prices from June, a move likely to add to inflationary pressure.

Price hikes by the companies will be between 14% to 42%, Chief Cabinet Secretary Hirokazu Matsuno said in a press conference Tuesday morning. Tokyo Electric Power Co., which supplies electricity to Japan’s biggest city, received approval for the smallest rate increase among the regional utilities.

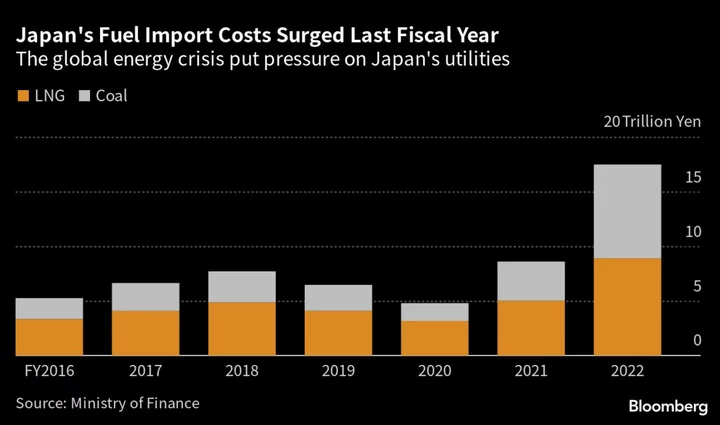

Power companies in the resource-scant nation have been hammered by last year’s global energy crisis as costs for importing fossil fuels surged. Higher electricity bills would boost upward momentum in prices as the Bank of Japan keeps a close eye on the sustainability of inflation.

Japan utility shares jumped on the measure, with Tokyo Electric up as much as 3.9%. Hokuriku Electric Power Co., which will boost rates the most of its rivals, surged 5.8% to the highest intra day level in two years.

Electricity rates are rising from the UK to South Korea after Russia’s invasion of Ukraine in 2022 upended fuel markets, sending the price of natural gas and coal to record high levels. Governments are trying to contain the fallout, with utilities struggling to shore up balance sheets.

The timing of Japan’s decision is awkward for Prime Minister Fumio Kishida, amid speculation he may call an early election after this week’s Group of Seven summit.

Government measures scheduled to expire in September are currently holding down electricity prices for households by around 20% as Kishida tries to relieve the pain of soaring costs.

Households’ real wages have fallen in each of the 12 months through March, pointing to a risk of a slump in consumer spending once pent-up demand from the pandemic has run its course. A weaker local currency is exacerbating the situation as power producers need to procure fuel from abroad.

(Updates with company shares in the fourth paragraph.)