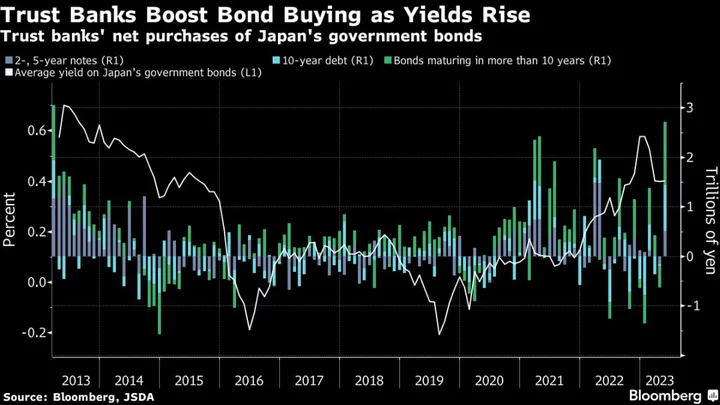

Japanese trust banks purchased a record amount of super-long government bonds in May as speculation over a possible tweak to the Bank of Japan’s yield-curve control policy receded.

Trust banks, often seen as proxies to pension funds, net purchased ¥1.27 trillion ($8.9 billion) of debt in May with original maturities of more than 10 years, according to the latest data from the Japan Securities Dealers Association on Tuesday.

That’s when Japan’s 20-year yield fell to below 1% for the first time since October as Kazuo Ueda retained and reaffirmed dovish policies when he took over as the central bank chief in April. The yield once again slipped below that level after Japan sidestepped the global tightening wave last week.

“Since Ueda’s first monetary policy meeting as a chair in April, speculation has grown the BOJ will keep ultra-easy policy unchanged for a while,” said Ayako Sera, a market strategist at Sumitomo Mitsui Trust Bank Ltd. “Therefore, any pickup in yields of super-long debt may have attracted buying interest from investors.”

“However, now yields are low again, so it’s very difficult for investors to decide where to pour the funds as absolute yield levels are quite important for their investment decision,” she said.

Trust banks also purchased ¥938 billion of 10-year securities in May. Overseas investors sold long and super-long debt while buying intermediate securities over the same period, according to JSDA data.