By Leika Kihara

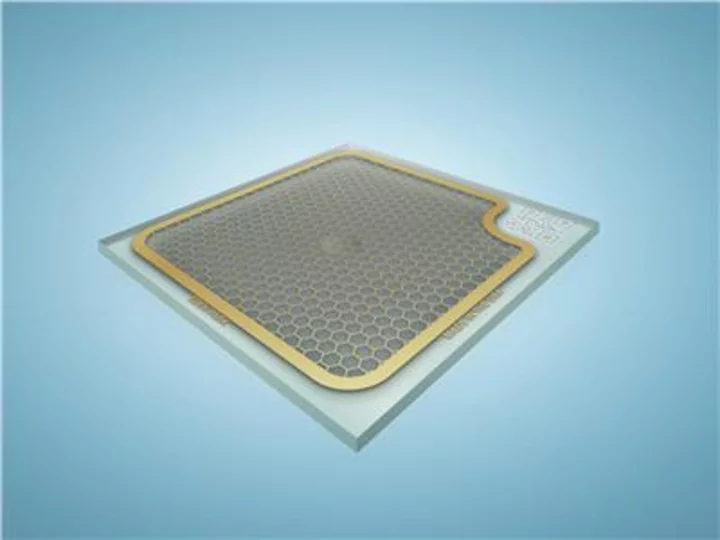

TOKYO Japanese Finance Minister Shunichi Suzuki said on Wednesday the government must look into whether it can buy the central bank's huge holdings of exchange-traded funds (ETF) at book value.

Suzuki made the remark in response to a proposal from an opposition lawmaker that the government buy the Bank of Japan's ETF holdings and distribute the assets to the younger generation, as part of efforts to revitalise the economy.

"The government must look into whether it's permissible to buy (the BOJ's ETF holdings) at book value for the purpose of securing sources of revenue," Suzuki told parliament.

Distributing ETFs to the younger generation would give rise to various issues that must be cleared, such as the risk of the households selling the ETFs and affecting broader stock price moves, he added.

BOJ Governor Kazuo Ueda told the same parliament session that it was premature to debate specifics on how the central bank could unload its ETF holdings.

"When achievement of our price target is foreseen, we will debate specifics (of an exit policy) at our policy meeting and disclose the information," Ueda said.

Ueda also said that in principle, the central bank plans to sell the ETFs at market value, instead of book value.

As part of efforts to sustainably achieve its 2% inflation target, the BOJ currently buys government bonds and risky assets such as ETFs. It also sets a -0.1% short-term interest rate target and a 0.5% cap on the 10-year bond yield.

(Reporting by Leika Kihara; Editing by Himani Sarkar)