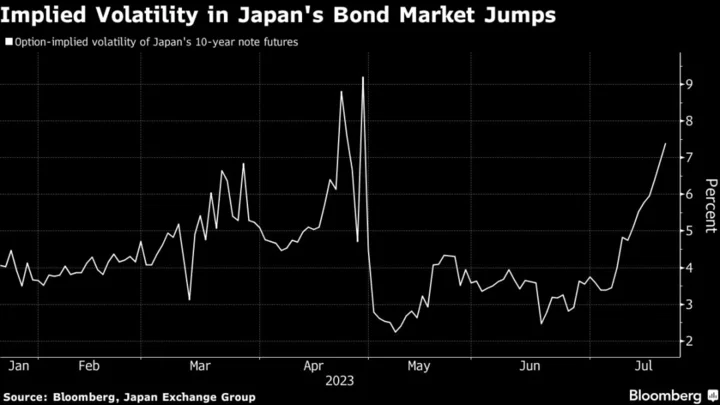

Investors in Japan’s bond market are bracing for turbulence that has the potential to test the Bank of Japan’s yield target in the lead up to next week’s policy decision.

Option-implied volatility of Japan’s 10-year bond futures climbed to 7.34% on Friday, the highest since April, according to data from Japan Exchange Group Inc. This indicates an expected daily spike or drop of about 5 basis points in the benchmark yield that the BOJ aims to cap at 0.5%. The rate fell to 0.455% on Thursday after touching a four-month high of 0.485% last week.

While the traders are jumpy, economists have pushed back their call for a policy shift from the central bank after Governor Kazuo Ueda repeatedly made the case for maintaining monetary stimulus. Slower-than-expected increases in consumer prices both in the US and UK point to easing inflationary pressures globally, bolstering their case. Yet inflation in Japan remains above the BOJ’s target.

“Volatility has risen before BOJ decisions and eased back after. We’ll continue to see a repeat of this again and again,” said Akio Kato, chief manager of the strategic research and investment division at Mitsubishi UFJ Kokusai Asset Management Co. in Tokyo. “Even if there’s no change, inflation is getting closer to the central bank’s target, so views remain in the market that upward pressures on yields are building.”

Consumer prices excluding fresh food rose 3.3% from a year earlier in June, up from 3.2% in May, official data showed on Friday. Ten-year bond futures dropped 27 ticks, while the yen ended a three-day decline to rebound 0.2%.

The currency’s one-week implied volatility jumped to a four-month high on Friday, higher than levels seen before Ueda’s first policy decision at the helm of the central bank in April.

The central bank will release its updated forecasts on inflation and growth when announcing its policy decision on July 28. Ueda said this week that the BOJ has continued with monetary easing under yield-curve control with a “premise” that there is still some distance to stably hitting its inflation target.

Still, the nation’s bonds have dealt investors a loss of 0.7% this month, the worst performance only after Canada among 24 major government debt markets tracked by Bloomberg.

--With assistance from David Finnerty.

(Adds inflation data in fifth paragraph, yen’s volatility in sixth paragraph and second chart.)