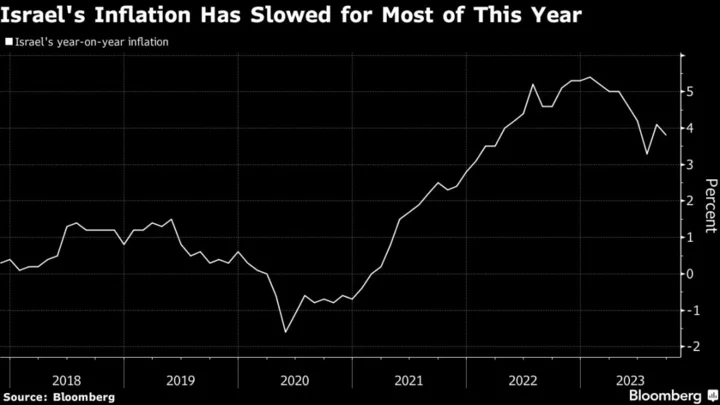

Israel’s inflation slowed for a second straight month, defying some earlier predictions of a price surge because of the war with Hamas.

Consumer prices in October rose 3.7% year-on-year and grew a monthly 0.5%, according to data published on Wednesday, matching the forecasts of economists surveyed by Bloomberg. The annual rate, which was 3.8% in September, remains above the official target range of 1%-3%.

The inflation reading provides some of the first glimpses into the economic impact of the conflict that started on Oct. 7, when Hamas militants attacked southern Israeli communities, killing 1,200 and kidnapping 240 others. More than 11,000 have been killed amid retaliatory Israeli air strikes and a ground offensive in Gaza, according to the Hamas-run Health Ministry in the territory.

The war has mainly affected the leisure and tourism sectors, with a record call-up of over 300,000 military reservists leading to worker shortages in some industries. During the fifth week of conflict, credit card purchases were still down more than 20% compared to an average week in 2023.

Inflation in October declined due to a slowdown in housing rental price hikes and a big slump in consumer demand, mainly in culture and entertainment, according to the Central Bureau of Statistics. These were counterbalanced by a sharp rise in costs for some products, like fruits, vegetables and clothing.

“Unlike previous crisis periods, when the Israeli economy demonstrated sharp rebounds, we expect a U-shaped and more gradual recovery, as it will take more time for some sectors to recover, given the effect of security issues,” Barclays Plc economists including Zalina Alborova said in a report.

On Pause

With the outlook in flux, the Bank of Israel has kept interest rates on hold as it focuses on propping up the shekel and stabilizing markets.

The Israeli currency weakened heavily in the first three weeks of the war. But it’s since recovered and is now stronger than before Oct. 7, helped in large part by the central bank selling reserves to support it.

Barclays expects the benchmark to be kept at 4.75% at this year’s last rate meeting later in November, with a quarter percentage point cut possible in January. “Labor shortages may offset disinflationary pressures from lower demand, limiting the scope for a deeper easing cycle,” the British bank’s analysts said.

A business evaluations survey for the month of October conducted by the Central Bureau of Statistics predicts a sharp deflationary effect of the war over time. Tel Aviv-based Leader Capital Markets recently lowered its inflation forecast for one year ahead to 2.6%.

“The percentage of companies in the retail trade industry that reported expectations for a decrease in prices jumped to levels that were last seen only at the peak of the coronavirus pandemic,” said Alex Zabezhinsky, an analyst at Meitav Dash Investment House Ltd.

(Updates with economist comments starting in sixth paragraph.)