ING Groep NV plans to buy back as much as €1.5 billion ($1.65 billion) worth of shares after higher interest rates helped lift profit past analysts’ expectations.

Shares of the lender rose, after first-quarter results showed interest income and provisions for loan losses came in better than analysts had expected. Net income more than tripled from a year earlier, to €1.59 billion, ING said in a statement Thursday. That compares with estimates for a profit of €1.18 billion.

European lenders are benefiting from being able to charge more for credit after central banks raised interest rates to combat record inflation, without yet seeing a spike in bad loans. That’s allowed well-capitalized lenders like ING to boost shareholder payouts by buying back stock despite the economic uncertainty.

“We had a very solid start to the year,” Tanate Phutrakul, the bank’s chief financial officer, said in an interview with Bloomberg TV. “The high interest environment has driven a strong revenue growth. But that’s also matched by relatively low risk costs in the quarter.”

The European Central Bank, which oversees lenders in the euro area, has approved the buyback plan, ING said. The repurchases will start on May 12 and are expected to end by Oct. 18, according to the bank.

ING rose 2.9% at 9:20 a.m. in Amsterdam, leaving the shares little changed this year.

BNP Paribas SA and UniCredit SpA are among European banks paying out billions of euros to shareholders by repurchasing stock. ING has made some of the fattest payouts in recent years, yet disappointed investors when it stopped short of announcing another round of stock buybacks at its previous quarterly results.

What Bloomberg Intelligence Says:

ING’s new €1.5 billion share buyback — with the prospect of more to come, given a pro forma post-repurchases CET1 of 14.4% vs. 12.5% target — is a strong commitment to shareholder returns, but 1Q’s 33% profit beat vs. consensus is low quality and unlikely to drive upgrades. A dropped commitment to a 55-56% cost-income ratio this year, 4% fees slide vs. 1Q22 (4% estimate miss) and 11% cost hike show continued earnings pressure, which will drag on net interest income upside from higher rates through 2023.

- Philip Richards, banking analyst

ING €1.5 Billion Buyback, But Costs Up 11%, Fees Drag: React

Profit a year earlier was hit by €834 million the bank had set aside to cover potential losses on its Russia-related exposure after that country’s invasion of Ukraine. This year, ING’s wholesale banking division freed up €118 million in such provisions to reflect lower Russia-related exposure and “improved macro-economic indicators.”

Unlike France’s Societe Generale SA, which exited Russia at a high cost, ING and other European lenders have taken less radical action to unwind businesses related to the country. ING has reduced its offshore exposure to Russia about 60% from the end of February last year, according to Chief Executive Officer Steven van Rijswijk. On a call with reporters, the CEO reiterated that his firm doesn’t see a future for itself in Russia.

Overall, ING added €152 million to its loan loss provisions in the quarter, well below the €405.7 million estimated in a Bloomberg survey of analysts. European banks built up additional reserves in the pandemic and kept those buffers in place when the war added to economic uncertainty.

Net interest income of €4.01 billion came in slightly better than the €3.97 billion analysts had expected. Higher interest rates more than offset pressure on mortgage margins due to rising funding costs as well as declining income from prepayment penalties, ING said.

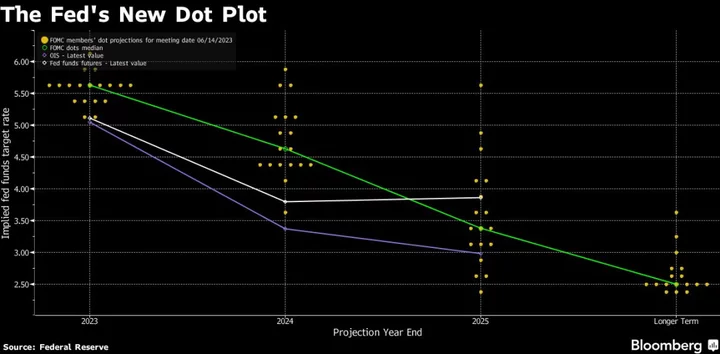

“Our house view is for interest rate hikes to come for a couple more times this year with a terminal rate of 3.75 to 4%,” Phutrakul said of the ECB’s monetary policy. “With those levels, we expect that we will continue to see strong net interest margin and see strong net interest income for the rest of the year.”

--With assistance from Cagan Koc, Dani Burger and Manus Cranny.

(Updates with shares starting in second paragraph, Russia exposure in ninth.)