BEIJING (AP) — China's Belt and Road Initiative looks to become smaller and greener after a decade of big projects that boosted trade but left big debts and raised environmental concerns.

The shift comes as leaders from across the developing world descend on Beijing this week for a government-organized forum on what is known as BRI for short.

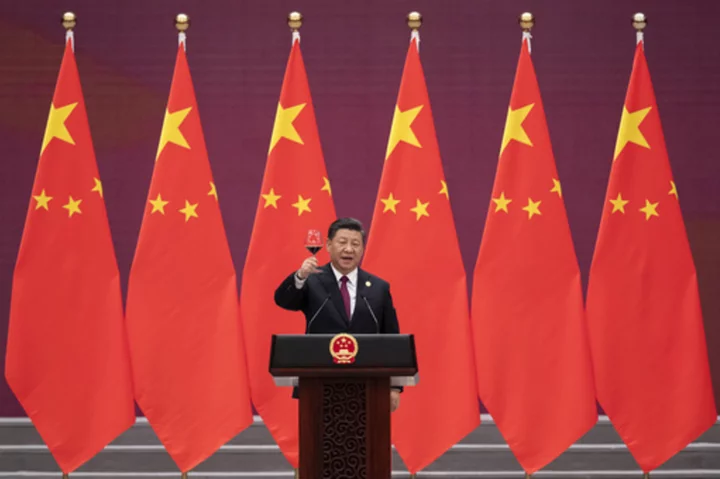

The initiative has built power plants, roads, railroads and ports around the world and deepened China’s relations with Africa, Asia, Latin America and the Mideast. It is a major part of Chinese President Xi Jinping's push for China to play a larger role in global affairs.

WHAT IS THE BRI?Called “One Belt, One Road” in Chinese, the Belt and Road Initiative started as a program for Chinese companies to build transportation, energy and other infrastructure overseas funded by Chinese development bank loans.

The stated goal was to grow trade and the economy by improving China's connections with the rest of the world in a 21st-century version of the Silk Road trading routes from China to the Middle East and onto Europe.

Xi unveiled the concept in broad terms on visits to Kazakhstan and Indonesia in 2013 and it took shape in the ensuing years, driving the construction of major projects from railroads in Kenya and Laos to power plants in Pakistan and Indonesia.

HOW BIG IS IT?A total of 152 countries have signed a BRI agreement with China, though Italy, the only western European country to do so, is expected to drop out when it comes time to renew in March of next year.

“Italy suffered a net loss," said Alessia Amighini, an analyst at the Italian think tank ISPI, as the trade deficit with China more than doubled since Italy joined in 2019.

China became a major financer of development projects under BRI, on par with the World Bank. The Chinese government says that more than 3,000 projects totaling nearly $1 trillion have been launched in BRI countries.

China filled a gap left as other lenders shifted to areas such as health and education and away from infrastructure after coming under criticism for the impact major building projects can have on the environment and local communities, said Kevin Gallagher, the director of the Boston University Global Development Policy Center.

Chinese-financed projects have faced similar criticism, from displacing populations to adding tons of climate-changing greenhouse gases to the atmosphere.

WHAT ABOUT THE DEBT TRAP?Chinese development banks provided money for the BRI projects as loans, and some governments have been unable to pay them back.

That has led to allegations by the U.S. and others that China was engaging in “debt trap” diplomacy: Making loans they knew governments would default on, allowing Chinese interests to take control of the assets. An oft-cited example is a Sri Lankan port that the government ended up leasing to a Chinese company for 99 years.

Many economists say that China did not make the bad loans intentionally. Now, having learned the hard way through defaults, China development banks are pulling back. Chinese development loans have already plummeted in recent years as the banks have become more cautious about lending and many recipient countries are less able to borrow, given their already high levels of debt.

Chinese loans have been a major contributor to the huge debt burdens that are weighing on economies in countries such as Zambia and Pakistan. Sri Lanka said last week that it had reached an agreement with the Export-Import Bank of China on key terms and principles for restructuring its debt as it tries to emerge from an economic crisis that toppled the government last year.

WHAT'S NEXT FOR BRI?Future BRI projects are likely not only to be smaller and greener but also rely more on investment by Chinese companies than on development loans to governments.

Christoph Nedopil, director of the Asia Institute at Griffith University in Australia, believes that China will still undertake some large projects, including high-visibility ones such as railways and others including oil and gas pipelines that have a revenue stream to pay back the investment.

A recent example is the launching of a Chinese high-speed railway in Indonesia with much fanfare in both countries.

On the climate front, China has pledged to stop building coal power plants overseas, though it remains involved in some, and is encouraging projects related to the green transition, Nedopil said. That ranges from wind and solar farms to factories for electric vehicle batteries, such as a huge CATL plant that has stirred environmental concerns in BRI-partner Hungary.

___

Associated Press Business Writer Colleen Barry in Milan contributed to this report.