It’s getting harder than ever to rent a home in Australia as one of the world’s most acute real estate shortages worsens by the day.

Less than 1% of the country’s rental properties are now available for occupancy, far fewer than even red-hot markets like Singapore. That’s sending rents soaring to eye-watering levels, deepening an already dire cost-of-living crunch and pushing thousands more Australians into homelessness.

The crisis is only set to intensify. Building pipelines are near the lowest on record and construction firms caught out by surging costs are folding by the week. At the same time, increasingly assertive “not-in-my-backyard” movements are halting new homes, just as a post-pandemic rebound in immigration means more than a million net arrivals over the next five years need somewhere to live.

While authorities are proposing limited measures, they will take years to bear fruit. Those and other solutions offered by economists and lawmakers all point to one common conclusion: Australia needs hundreds of thousands of new homes. Otherwise, one of the least affordable markets will become even more out of reach for households already among the world’s most indebted.

“Demand has never really been hotter, and people supplying property have never been more hesitant. What makes this cycle different is that people don’t want to build homes,” said Adelaide Timbrell, senior economist at Australia & New Zealand Banking Group Ltd. “And that’s putting us in this vicious spiral.”

On the supply side, the outlook is grim. The level of new building approvals is near an all-time low when adjusted for population, according to Commonwealth Bank of Australia. Meanwhile, 560 construction firms filed for insolvency in July and August alone, a third of the country’s overall number, regulatory data show.

The hangover from a pandemic-fueled boom is partly to blame, when firms agreed fixed-price contracts with customers building homes or doing up existing properties. A subsequent crunch on labor and building materials, combined with crippling inflation, means that houses are now 30% pricier to build than before the pandemic, according to Phil Dwyer, national president of Builders Collective of Australia.

“We haven’t got enough builders and we haven’t got enough people with skills to be able to deliver houses, and we’re going to end up in big, big trouble,” said Melbourne-based Dwyer.

It’s also getting harder to convince Australians they need more neighbors. At the extreme end is a standoff in Sydney coastal suburb Little Bay, where a 12-hectare swath of land has been fenced off for years as the local community fights billionaire developer Harry Triguboff’s plans to build almost 2,000 apartments.

Community group Save Little Bay describes the development as “uniquely unsuitable” for the sensitive site, which is near the ocean and two national parks, and is seeking a smaller project approval.

“High-rise developments need to be in appropriate locations, supported by mass transportation, integrated affordable housing and other public infrastructure,” spokesman Olde Lorenzen said.

Triguboff, one of Sydney’s biggest apartment developers, has faced similar fights before. He’s called for Sydney to embrace apartment living, like other major cities, and for its wealthy eastern suburbs to open up to development if supply shortfalls are to be eased. His company Meriton Properties Pty didn’t respond to questions for this story.

In Sydney, the crisis has seen rents for houses surge 16% in the past year alone, while apartments have risen 20% during the same period, according to SQM Research.

For Maryam Yaqoob, the price shock has been even bigger. The 28-year-old engineer had little choice but to leave her two-bedroom unit in Mascot when her rent leaped 60% to about A$800 ($515) a week. She downgraded to a one-bedroom unit with no air conditioning or carpet.

“I had no idea that it would be so hard for us, because ours is a double-income household,” said Yaqoob. “Wherever we went there were long queues — 50 people were lining up to see one unit and the prices were too high.”

The state government of New South Wales, home to Sydney, has called the city’s housing situation a “crisis.” Local media has been peppered with stories about full-time workers forced to live in tents and caravan parks, or students “hot bedding.” Full-time truck driver Jeffrey Lawson told Bloomberg he pays A$180 a week for a small room in a house that he shares with 14 others.

“I’d like to buy my own place to live but that’s a distant dream,” said Lawson. “I can’t get ahead of the market.”

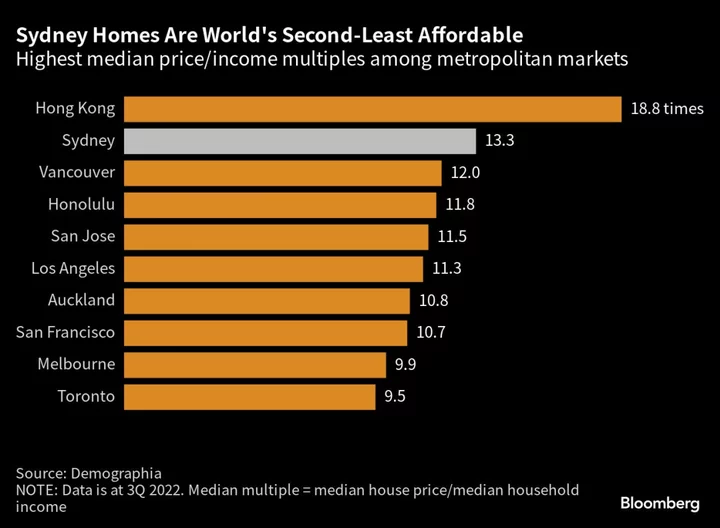

Sydney is now the second least affordable housing market in the world, only behind Hong Kong, according to Demographia. To cope with an expected influx of arrivals in coming years, New South Wales needs to build about 900,000 additional dwellings by 2041, according to government estimates.

Not all residents are anti-development. A group called YIMBY — Yes In My Back Yard — formed a branch in Sydney after its founders attended a community meeting where about 50 people opposed the building of a four-story block next to a light rail station, versus just a few supporters.

“The current planning system, it’s kind of geared towards making it easy for — and I’ll be fairly blunt about it — wealthy English speaking and usually retired residents that have more time on their hands to have their say via local council,” YIMBY spokeswoman Melissa Neighbour said in an interview.

The group advocates for more density to improve housing affordability and is campaigning for more “upzoning” or higher density development, particularly around transport.

“We are not building enough homes for our growing population and over time that can only push up house prices further,” National Australia Bank CEO Ross McEwan said in a speech in Melbourne last month, adding that he recently met a customer in the Sunshine Coast whose development was delayed by 20 years due to regulatory difficulties.

While supply and affordability have become political hot-button issues, with state and federal governments proposing measures to alleviate the situation, any real results aren’t likely anytime soon.

The New South Wales Labor government, elected this year, has given some developers the green light to build taller, denser projects, and access to a speedier planning approvals process, if they include a proportion of affordable housing.

“There is no silver bullet when it comes to addressing our housing crisis,” Rose Jackson, the state’s minister for housing, said in an emailed reply to questions. “Providing more supply in places people want to live and work, located near to the services people need is crucial.”

At a federal level, the government recently passed its key housing affordability measure through parliament after months of fighting with opposition parties. The A$10 billion Housing Australia Future Fund aims to build 30,000 new social and affordable homes over the next five years.

For some, any kind of relief can’t come soon enough. At the turn of the century, the median dwelling in Greater Sydney sold for around six-and-a-half times a mid-career teacher’s salary, according to a NSW Productivity Commission report. By 2022, this had surged to 14 times.

One such worker, Vianney Măe, has struggled to find permanent accommodation for herself and her two sons since she was evicted from her four-bedroom rental home in May last year, after asking for some electrical repairs.

“I’m a professional, I earn a good wage and I cannot afford to actually even rent a property that would house the three of us. It’s just ridiculous,” said Măe, a primary school teacher. “I’m turning 60 this year, and who would have thought at this age I’d still be struggling to find somewhere to live?”

--With assistance from Harry Brumpton and Jackie Edwards.